|

Home building rebounds

|

|

January 19, 2000: 10:37 a.m. ET

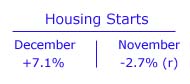

December new housing starts jump 7.1% to 1.71M annual rate

|

NEW YORK (CNNfn) - U.S. home builders broke new ground at the fastest pace in nine months in December, finishing off the best year in the home-building market since 1986, the government reported Wednesday.

The Commerce Department said housing starts jumped 7.1 percent to a 1.71 million annual rate last month, countering a revised 2.7 percent decline to a 1.59-million rate the month before. Analysts polled by Briefing.com had expected starts to stay almost level at a 1.6-million rate.

For the year, new home construction rang in at 1.66 million units, the highest annual rate since ground was broken on 1.81 million new units in the boom real estate market of the mid-1980s. Housing starts reflect the number of new projects started on single- and multiple-family units.

"In the short-term, these data will reinforce the impression that the housing market is proving resilient in the face of higher mortgage rates," said Ian Shepherdson, chief U.S. economist with High Frequency Economics. However, "it will not last, because the current trend in home sales is not high enough to support this rate of house building in the medium-term."

Higher rates knocking on the door?

Today's report is the latest piece of economic data indicating the economy is growing at a rapid clip, despite three inflation-dousing interest rate increases from the Federal Reserve last year and rates in the government debt market rising to near three-year highs. Bond yields are directly linked to what banks charge their customers for mortgages.

The Federal Open Market Committee, the policy- setting arm of the Fed, will have this and many other reports to pore over when they gather for their first policy meeting of the year Feb. 1-2. The central bank is expected to raise rates by another quarter point to keep potential inflation pressures in check.

"The FOMC is counting on further weakness

in housing to help slow the economy, but this resilience will add to the pressure to push rates higher," said Steven Wood, an economist with Banc of America Securities in San Francisco.

While mortgage rates that already are significantly higher than year-ago levels should slow housing activity in 2000, "robust labor markets, rising incomes and stellar capital gains will support housing activity at a relatively high level," Wood said.

Mortgage rates keep rising

The rate on the 30-year mortgage averaged around 7.6 percent last month, according to mortgage buyer Freddie Mac, almost a point higher than the 6.7 percent average recorded a year earlier. Last week the rate climbed to 8.18 percent, the highest in more than 2-1/2 years, as yields on government bonds surged at roughly the same clip.

Yields on government bonds and the rates banks charge for mortgages coincide because banks typically borrow from the government debt market to partially finance their lending. The more expensive it is for them to borrow, the higher the rate they charge their clients for mortgages.

Still, consumers don't seem to mind paying a little more to finance a new home, with rising equity prices boosting the net worth of Americans by almost 18 percent in the boom 1990s, according to a Fed study released Tuesday.

|

|

|

|

|

|

|