NEW YORK (CNNfn) - U.S. stocks tanked Monday as investors ignored strong corporate earnings to focus on fears that rising interest rates will hurt company profits.

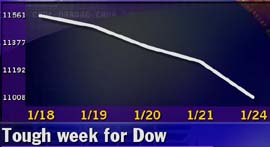

The losses sent the Dow Jones industrial average to its 10th-biggest point plunge on record and fifth straight declining session. Technology stocks, up all last week, succumbed to heavy selling as well, unable to sustain strength amid one of the most promising fourth-quarter earnings seasons in years. Trading was heavy, with the Nasdaq market posting its busiest day on record.

"Finally, you're seeing a little pressure on techs," said Peter Coolidge, senior trader at Brean Murray & Co. "Finally, interest-rate worries are spreading into techs. It's hard to get excited about the market with probable rate hikes in a week and a half."

The Federal Reserve next week is expected to begin what may be a series of interest rate increases, possibly cutting into corporate profits by making borrowing more expensive.

Still, the fourth-quarter earnings season is off to a good start. But Coolidge says the focus has shifted.

"That's looking into the past," he said. "We've got to be looking ahead to a higher interest-rate environment where profits are going to get squeezed."

Terrence Gabriel, stock market strategist at IDEA Global.com, agreed, saying the market may meet resistance once earnings season ends and rate hikes begin.

"We think longer term the risk is weighted to the downside," Gabriel said.

The Dow Jones industrials plunged 243.54 points, or 2.16 percent, to 11,008.17, its lowest level of the year and its 10th-biggest point drop on record.

The tech-heavy Nasdaq composite index, meanwhile, fell 139.32 points, or 3.29 percent, to 4,096.08. The Nasdaq's fourth-biggest point drop on record followed three consecutive record closes last week. And the broader S&P 500 lost 39.45 points, or 2.74 percent, to 1,401.91.

More stocks rose than fell. Losers on the Nasdaq beat winners 2,398 to 1,808. Declining stocks held a 2,039 to 1,026 edge on the Big Board

Volume on the Nasdaq was heavy; a record 1.98 billion shares changing hands.

In other markets, Treasury bonds rose, and the dollar gained against the yen but fell versus the euro.

Higher rates ahead?

Analysts said stocks Monday were pressured by fears the Federal Reserve will launch a series of interest rate hikes ahead to preempt inflation and cool the white-hot economy.

"The rest of the market continues to struggle with reports that continue to show the economy is too strong," said Alan Skrainka, chief market strategist at Edward Jones.

This strength has led forecasters to predict the central bank raising its main lending by a quarter percentage point next week to 5.75 percent. Many forecast another rate hike in March. A speech Monday by Federal Reserve Bank of Atlanta President Jack Guynn ignited fears of even tighter credit ahead.

"If you read the speech, he seems to imply that those hikes aren't enough," Skrainka told CNNfn's Street Sweep.

Still, earnings have been solid. With nearly a third of the S&P 500 companies reporting results, 76 percent have come in above their year-earlier figures, according to earnings tracker First Call. Of the 16 Dow components that have released earnings, 14 beat expectations and two met them.

Art Hogan, chief market analyst at Jefferies & Co., said investors should focus on this earnings strength.

"We should shrug this off and realize that this is the best fourth-quarter earnings we've seen in years," Hogan said.

Among them, Eastman Kodak Co. (EK) jumped 1-5/16 to 62-1/16 after posting better-than-expected results. The Rochester, N.Y., film and camera maker earned $403 million, or $1.27 per diluted share. Bristol-Myers Squibb (BMY), fell 2-1/2 to 58-11/16 after beating fourth-quarter estimates by 1 cent a share.

American Express Co. (AXP) rose 5/16 to 152 after posting fourth-quarter earnings in line with estimates and announcing a 3-for-1 stock split. The financial services company and Dow component reported net income of $606 million, or $1.33 per share, up from $530 million, or $1.16 per share, in the year-earlier period.

Disney (DIS), another Dow component, rose 9/16 to 33-5/16. This came before the entertainment giant after the close of trading reported first quarter earnings of 25 cents a share before one-time items, beating Wall Street estimates.

And Texas Instruments (TXN) rose 1-7/32 to 112 ahead of its earnings results reported after the close of trading Monday. The semiconductor maker ultimately earned 51 cents a share before one-time items, ahead of Wall Street projections of 47 cents a share.

P&G makes comeback

Procter & Gamble (PG) -- the maker of Tide detergent, Crest toothpaste and Pringles potato chips -- rose for the first time in days, recovering from a decline earlier in the session. The turnaround came after the consumer products maker broke off merger talks with drug makers Warner-Lambert Co. and American Home Products Corp.

P&G tumbled about 12 percent last week amid investor fears that a potential acquisition would slow the company's earnings growth.

Those fears eased Monday, with P&G gaining 3/16 to 102-7/8. Warner Lambert (WLA), still seeking a "white knight" to rescue it from Pfizer's unsolicited takeover bid, fell 4 to 88, while American Home Products (AHP) lost 5-3/8 to 42-5/8. Pfizer (PFE) dropped 11/16 to 34-3/8.

Deals for Time Warner, Amazon

Time Warner Inc (TWX), fresh from announcing a blockbuster merger with America Online Inc (AOL) earlier this month, Monday unveiled a deal with Britain's EMI Group that would create the world's second-largest record company in terms of market share.

Shares of Time Warner, the parent company of CNNfn, fell 3-1/2 to 87-5/8.

But Amazon.com (AMZN) jumped 8-1/16 to 70-1/8 after the online retailer announced Monday it will allow customers to purchase drugstore.com products directly from Amazon's site, and also will invest an additional $30 million in the e-tailer, increasing its minority stake. drugstore.com (DSCM) gained 5-7/8 to 35.

(Click here for a look at CNNfn's hot stocks)

(Click here for a look at CNNfn's tech stocks)

|