|

Pfizer expected to prevail

|

|

January 31, 2000: 2:24 p.m. ET

Analysts say W-L, Pfizer deal likely, but barriers remain as court date looms

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - After a high-stakes, three-month takeover battle, Warner-Lambert Co. is expected to grudgingly agree to an unfriendly buyout by rival drug maker Pfizer Inc. fairly soon - although several big issues still need to be resolved, according to pharmaceutical industry analysts.

While the negotiations between the companies reportedly have been rocky and another rival suitor could still emerge, analysts say that Pfizer (PFE: Research, Estimates) appears to be firmly in the driver's seat after Procter & Gamble Co. (PG: Research, Estimates), a potential "white knight" suitor for Warner-Lambert (WLA: Research, Estimates), dropped out of the bidding last week.

Now, analysts say, it may be in the best interests of both Warner-Lambert and Pfizer to reach a deal before a Delaware court begins hearing arguments in the takeover battle Feb. 14. The combination of Pfizer, maker of male impotence remedy Viagra among other successful drugs, and Warner-Lambert, whose crown jewel is blockbuster cholesterol treatment Lipitor, would create the world's second biggest drug maker after the new company formed by British-based Glaxo Wellcome and SmithKline Beecham.

"The most likely outcome will be a deal," Steven Gerber, pharmaceuticals analyst at CIBC World Markets, said Monday. Warner-Lambert's "one major effort to find a white knight appears to have failed; we do not believe there are any other apparent potential bidders out there."

But analysts say that a couple tricky issues must be resolved - how much Pfizer will pay, and what kind of compensation American Home Products Corp. (AHP: Research, Estimates) -- which has signed a $56 million merger deal with Warner-Lambert -- will receive in exchange for walking away.

Pfizer's bid stands at 2.5 of its shares for each share of Warner-Lambert, valuing the total deal at about $76 billion. Analysts say that the final bid is likely to be somewhat higher than 2.5 Pfizer shares, but is unlikely to go as high as 3 Pfizer shares - the figure Warner-Lambert reportedly is seeking.

"I think that if they were to raise it, it would be a nominal amount," Gerber said.

New York-based Pfizer has said that an acquisition of Warner, of Morris Plains, N.J., would add to earnings, meaning that it has little room to maneuver in raising its bid, observers say. Also, now that Procter & Gamble, the Cincinnati-based maker of Tide and Pampers, has bowed out, Pfizer likely won't face a bidding war, they say.

"I just don't know who can compete with Pfizer -- it's a pretty tall order," said Tom Burnett, president of institutional research service Merger Insight.

Madison, N.J.-based American Home would receive $1.8 billion in break-up fees and could seek other compensation for its Warner-Lambert stock options if the Warner deal falls apart. According to a published report earlier this month, American Home may be interested in obtaining the rights to certain Warner-Lambert or Pfizer products in lieu of stock options.

These are not easy issues to resolve, said Neil Sweig, an analyst at Ryan, Beck & Co. While he thinks Pfizer eventually will win out, the battle could draw on for weeks longer, he cautions.

"I would say that the ability to come to a written agreement where Pfizer takes over Warner-Lambert by Feb. 14, has no greater chances than 50-50, he said. "They're arguing, it seems, about so many different areas -- the price is not high enough, which positions will be salvaged, how many jobs will be cut. These are issues that require days if not weeks of conversation."

However, he said, both companies may want to settle the matter before the Delaware Chancery Court trial is set to begin. The trial centers on control of cholesterol drug Lipitor, which is manufactured by Warner and co-marketed with Pfizer. Warner-Lambert wants full control of the drug, charging that Pfizer violated terms of their joint marketing pact in crafting its takeover bid.

"We're dealing with the courts, and lots of unfortunate mistakes come in trying to divine what the courts will do," Sweig said. "Both companies are facing something only a few weeks away; it could be good or bad for either."

The Lipitor agreement is complicated - I can see arguments on both sides," said Burnett, of Merger Insight.

But, he notes, if Pfizer loses in court it is likely to then launch a hostile effort to vote out the Warner-Lambert board - a move that Warner shareholders likely will go along with, he said.

Influential Warner-Lambert shareholders, meanwhile, including the California Public Employees' Retirement System (CalPERS), have urged Warner-Lambert to avoid costly litigation if possible.

"I think shareholders of all the parties seem to be pressing very intently for a settlement," Gerber said.

Neither Pfizer nor Warner-Lambert responded for requests for comment Monday. A spokesman for American Home reiterated the company's position that it its standing by the deal with Warner-Lambert.

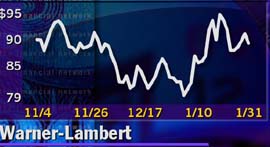

Pfizer launched its unsolicited bid for Warner-Lambert just hours after Warner and American Home agreed to merge Nov. 4, creating a new company called AmericanWarner. The AHP deal originally was worth about $72 billion in stock, but its value has tumbled to about $56 billion as American Home's share price has been hit amid uncertainty about the deal's fate and continuing litigation over the "fen-phen" diet drug combination.

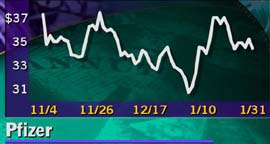

Meanwhile, Pfizer's bid has dropped only modestly over the past three months, from $82 billion to about $76 billion.

Warner-Lambert management prefers the "merger of equals" plan with American Home, but the widening disparity between the two offers led Warner-Lambert shareholders to clamor for the company to consider Pfizer's rival bid.

Warner acquiesced Jan. 13, saying it would open talks with Pfizer along with exploring other strategic alternatives. Procter & Gamble then stepped into the fray, launching three-way talks with Warner and American Home, but backed off a week ago after its shareholders sold off their stock out of concern that such a deal would slow Procter & Gamble's earnings growth.

In afternoon trading Monday, Warner-Lambert shares fell 15/16 to 90-3/16; Pfizer slipped 11/16 to 34-1/2 and American Home added 3/16 to 44-7/16.

|

|

|

|

|

|

|