LONDON (CNNfn) - Asian equity markets made modest gains Wednesday as a rebound in U.S. blue-chip stocks helped to calm investor concerns in the region after sharp sell-offs in the previous session.

The benchmark Nikkei 225 index in Tokyo closed up 129 points, or 0.67 percent, at 19,519.55, as investors' attention turned to some of the stocks that have lagged in recent sessions, at the expense of bellwether tech companies.

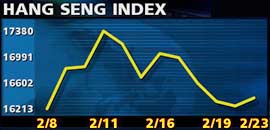

In Hong Kong, gains in property and telecom shares sent the Hang Seng index up 0.75 percent to close at 16,376.79, while Singapore's Straits Times index was the best performer among the region's major exchanges, ending up 1.5 percent at 2,137.70 as bank stocks enjoyed firm demand.

Asia's advance followed a rebound in U.S. blue chips that sent the Dow Jones industrial average up 85 points to close at 10,304.34, breaking three straight sessions of losses. The broader S&P 500 added 6 points to end at 1,352.17 while the Nasdaq lost almost 30 points, ending at 4,382.12.

In the currency markets, the yen gained a little ground against the dollar, rising to 110.55 from 110.82 in late New York trading Tuesday.

In Tokyo, some of the market's recently overlooked shares attracted attention, leaving technology stocks that have underpinned the Nikkei in 2000 to nurse losses. Tire maker Bridgestone rose 2.2 percent and Fuji Photo climbed 2 percent after both shares were added to the Standard & Poor's Global 100 stock index.

Nissan Motor recovered from its slide Tuesday to rise 5.5 percent. Financial stocks also staged a mild recovery, with Sakura Bank the best performer with a 4.4 percent gain.

Sony Corp. dropped 1.1 percent, the day after the consumer electronics company's stock set an intraday high. Rival Matsushita gained 1.2 percent after beating expectations with its third-quarter earnings.

Hong Kong shrugged off the political tensions between China and Taiwan that had pulled the market back Tuesday. The property sector recovered some of the ground lost in recent sessions when concern about higher interest rates had emerged. Cheung Kong (Holdings) rose 4.5 percent and developer Great Eagle Holdings gained almost 4 percent ahead.

China Telecom recovered part of the loss it posted Tuesday with a 1.7 percent advance. Cellular operator SmarTone rose more than 1.4 percent while Hutchison Whampoa gained 2.5 percent. China Telecom recovered part of the loss it posted Tuesday with a 1.7 percent advance. Cellular operator SmarTone rose more than 1.4 percent while Hutchison Whampoa gained 2.5 percent.

The market was held back by a 4 percent slump in takeover target Hong Kong Telecom while banking heavyweight HSBC Holdings ended narrowly lower.

In Singapore, DBS Group was the best performer, rising 7.6 percent as the region's largest bank rebounded from a loss of 8 percent over the previous three sessions. Auto distributor Cycle & Carriage rose 3.1 percent after confirming plans to bid for a stake in Indonesian auto manufacturer PT Astra.

Smaller markets were broadly higher, with only Taipei's Weighted index losing ground, closing off almost 1 percent at 9,642.26 as tensions between Taiwan and China persisted.

The Kospi index in Seoul was the region's best performer, closing up 3.6 percent at 880.67, buoyed by the exchange's plan to extend trading hours and introduce other measures to improve liquidity.

Financial shares helped lift the All Ordinaries in Sydney to end a modest 0.36 percent higher at 3,112.50, though commodity shares fell back.

Thailand's Set index rose 3.6 percent, regaining some of the ground lost in its 7 percent slide Tuesday as retail investors dumped stock amid fears about the country's economic recovery.

The PHS Composite in Manila closed 1.6 percent higher at 1,828.93 while the JSX index in Jakarta added just 1 point to close at 584.43 and the KLSE Composite in Kuala Lumpur was 0.8 percent ahead at 1,009.21.

Mumbai's BSE 30 posted the weakest performance in the region, tumbling 4.1 percent to end at 5,642.46 amid speculation India's securities regulators might intervene to limit institutional share holdings.

-- from staff and wire reports

|