|

Dow back above 10,000

|

|

February 28, 2000: 5:40 p.m. ET

Blue chips finds buyers while Nasdaq takes a pause

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - The Dow Jones industrial average rose Monday, breaking the 10,000 barrier as investors snapped up financial and drug stocks cheapened by last week's sell off.

But the Nasdaq composite index edged lower after money moved out of large technology stocks such as Cisco Systems, Intel and Oracle that have helped push the high-flying index to 11 record closes this year.

The Dow Jones industrial average rose 176.53 points, or nearly 2 percent, to 10,038.65 only one trading session after the index closed below 10,000 for the first time since April.

With the index of 30-blue chip stocks now off 12.6 percent this year, analysts said some bargain hunting was inevitable.

"I think the performance gap between the new-economy and old-economy stocks is like a rubber band; it seems to be snapping the other way," Alan Skrainka, chief market strategist at Edward Jones, told CNN's Street Sweep. "The new economy sounds very exciting, but you're still going to need food, medicine and electricity to survive."

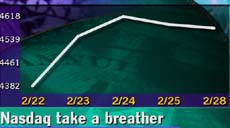

Many of the so-called new-economy tech stocks that power the Nasdaq fell Monday, pushing the index down 12.63 points to 4,577.87.

Still, the Nasdaq is up 12.5 percent this year and is only 40 points off its record set Thursday.

Despite the day's losses, analysts expect the Nasdaq to keep outperforming the Dow in the months ahead as investors stick with the technology companies expected to lead the economy's growth.

"It's too soon to call it a meaningful trend," Hugh Johnson, chief investment officer at First Albany, told Street Sweep.  , referring to the Dow's gains. , referring to the Dow's gains.

The broader S&P 500, meanwhile, rose 14.69 points to 1,348.05.

Still, more stocks fell than gained. Losing shares beat winners 1,518 to 1,447 on the New York Stock Exchange, where trading volume rose above 1 billion shares. Nasdaq decliners topped advancers 2,179 to 2,061. More than 1.8 billion shares changed hands.

In currency markets, the dollar jumped against the euro, which fell to a lifetime low overnight. The U.S. currency, meanwhile, dipped against the yen. Treasury securities fell.

Unloved Dow finds suitors

The Dow's gain was paced by three financial stocks hit hard in last week's sell-off. American Express (AXP: Research, Estimates) surged 7-7/8 to 132-5/8 while J.P. Morgan (JPM: Research, Estimates) advanced 7/8 to 108-3/4.

And Citigroup (C: Research, Estimates) climbed 1-3/8 to 49-3/8. Citigroup said co-chairman and co-chief executive John Reed will retire as of the company's annual meeting in April. Sanford Weill, the former head of Travelers Group, will assume both titles.

Dow drug makers Johnson & Johnson (JNJ: Research, Estimates) jumped 3/4 to 72-3/4 while Merck (MRK: Research, Estimates) rose 1-3/8 to 61-9/16.

The Nasdaq's drop, meanwhile, was paced by losses in some of its biggest movers. Cisco Systems (CSCO: Research, Estimates) shed 2-3/16 to 130-9/16, Intel (INTC: Research, Estimates) dipped 7/8 to 112-3/8 and Oracle (ORCL: Research, Estimates) dropped 2 to 68-5/8.

Despite the Dow's rally, Al Goldman, chief market strategist for A.G. Edwards, told CNNfn he sees the Nasdaq maintaining its leadership in the months ahead. (385K WAV) (385K AIFF).

Analysts Monday also question the Dow's resilience in the face of expected Federal Reserve interest-rate hikes.

"I'm afraid we're not out the woods yet with our friends at the Fed," said Alfred Kugel, senior investment strategist at Stein Roe Farnham.

The Fed has tightened credit four times since June, boosting its main lending rate to 5.75 percent.

In economic indicators, personal income rose 0.7 percent in January, while spending gained 0.5 percent, the Commerce Department said. Both figures were in line with forecasts compiled by Briefing.com.

The gains gives Federal Reserve inflation fighters one more reason to hike interest rates when they meet next month -- a move investors fear could hurt corporate profits by raising borrowing costs.

Stein Roe Farnham's Kugel doesn't see many of the old-economy value stocks rising appreciably until the Fed finishes raising rates sometime this summer.

The day's deals

NiSource Inc. (NI: Research, Estimates) fell 2-9/16 to 13 after the energy company agreed to acquire Columbia Energy Group for $6 billion cash and stock. Columbia (CG: Research, Estimates) rose 2-5/16 to59-3/8.

British electricity and gas producer PowerGen (PWG: Research, Estimates) dropped 15/16 to 27-9/16 after agreeing to acquire Kentucky-based LG&E Energy (LGE: Research, Estimates) in a deal valued at $5.4 billion in cash and assumed debt. LG&E rose 6-1/8 to 21-7/8.

Arch Communications Group (APGR: Research, Estimates) soared 2-3/8 to 14 after announcing a wireless alliance with America Online (AOL: Research, Estimates). The pact, terms of which were not disclosed, will allow AOL members to gain access to Arch's interactive messaging capabilities.

America Online, which agreed last month to buy Time Warner, the parent of CNNfn, rose 15/16 to 60-9/16. More than 25 million shares changed hands, making the world's largest Internet service provider the NYSE's most actively traded stock.

Click here for a look at CNNfn's hot stocks.

Click here for a look at CNNfn's tech stocks.

|

|

|

|

|

|

|