|

3Com to restructure

|

|

March 20, 2000: 10:02 p.m. ET

Company announces plans to revamp with release of quarterly earnings report

By Staff Writer David Kleinbard

|

NEW YORK (CNNfn) - 3Com Corp. reported Monday that its fiscal third-quarter earnings rose 9 percent, topping Wall Street estimates, as the company announced a broad reorganization and job cuts amid declining sales in its core analog modem and networking equipment businesses.

Not including a $680 million investment gain, Santa Clara, Calif.-based 3Com reported fiscal third-quarter net income of $94 million, or 27 cents per share, up from $89.6 million, or 24 cents, in the same period last year. Sales of $1.4 billion were flat with the same period a year ago.

Analysts had expected 3Com (COMS: Research, Estimates) to post a fiscal third-quarter profit of 25 cents per share, 1 cent above last year.

A 'transformation' at 3Com

3Com said it would quit the analog modems business, selling the unit to a new company it will form with Accton Technology Corp. of Malaysia and Singapore's NatSteel Electronics. The sale represents a huge reversal for 3Com, which paid about $6.6 billion to buy modem maker U.S. Robotics in 1997. The new company will continue to sell U.S. Robotics modems, one of 3Com's best-known brand names.

Also as part of what company officials called its "transformation," 3Com said it would exit the high-end local area network (LAN) switch business by discontinuing its CoreBuilder product line. 3Com faced stiff competition in that area from other networking giants, such as Cisco Systems (CSCO: Research, Estimates) and Lucent Technologies (LU: Research, Estimates).

"We're focusing on markets where we have established a leadership position," Eric Benhamou, 3Com's chairman and chief executive officer, said in a statement. "We're transitioning out of businesses that are no longer strategic to 3Com's future."

As part of the reorganization, said 3Com spokesman Mark Plungy, the company will cut up to 1,000 jobs, but details of the workforce reduction are "still to come." 3Com will also transfer an additional 1,700 employees to the affiliate companies it is forming with Accton and NatSteel, he added.

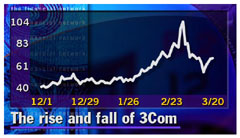

Shares of 3Com rose 9/16 to 68-9/16 Monday on the Nasdaq stock market. The shares climbed to 69-1/2 in after-hours trade following the earnings release and restructuring announcement, which came after the closing bell.

Stiff competition taking its toll

The financial results 3Com released Monday show that the company is being bruised by competitors Cisco, Lucent, and Nortel in sales of high-end networking equipment to corporations and that its consumer-oriented analog modem and network interface card lines are sliding.

Sales of personal connectivity products, which include network interface cards, analog and broadband modems, and home networking products, fell 15 percent from the same period last year. Sales of corporate networking products, such as switches and hubs, dropped 7 percent from the year-ago quarter to $591 million.

On the other hand, sales of Palm handheld computing devices, considered the main bright spot in 3Com's business, soared 116 percent to $272.3 million.

Earlier this month, 3Com sold 5 percent of its Palm Inc. (PALM: Research, Estimates) handheld computer division in an initial public offering. It expects to spin off its remaining 95 percent stake in Palm to 3Com shareholders during its first fiscal quarter ending Sept. 1, one quarter earlier than it had previously planned.

At current share prices, 3Com's holdings in Palm are worth about $29 billion, while 3Com itself has a market value of only $23 billion. In other words, the market is assigning a negative value to 3Com without Palm, even though 3Com's other businesses are profitable and it holds nearly $3 billion in cash.

"Investors are asking if the emperor has clothes," David Jones, a technology analyst at the brokerage Edward Jones, said on CNNfn television. "Once they spin off Palm, they are stuck with businesses that are low-growth and low-margin. Investors want to know what this company is going to do for an encore."

After reaching an intraday high of 165 on their first day of trading, Palm shares have dropped like a rock to 55-1/4 on Monday. After reaching an intraday high of 165 on their first day of trading, Palm shares have dropped like a rock to 55-1/4 on Monday.

3Com now plans to focus on broadband cable and DSL modems, LAN telephony products, wireless LANs and wide area networks, and home networking products. 3Com's sales of products in those segments rose a combined 25 percent in the third quarter from the second quarter.

3Com said it will steer its high-end LAN switching customers to Extreme Networks (EXTR: Research, Estimates). Extreme, based in Santa Clara, Calif., will employ more than 200 3Com sales, engineering, and marketing staff members.

Separately, 3Com said that it will make a $20 million investment in Washington, D.C.-based CAIS Internet (CAIS: Research, Estimates) to enhance its offerings of broadband Internet access at hotels and airports that have contracted with CAIS.

"Our alliance with CAIS will make it easy for travelers to get access to the information they need while on the road," 3Com's Benhamou said.

-- Click here to send e-mail to David Kleinbard

|

|

|

|

|

|

3Com Corp.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|