NEW YORK (CNNfn) - Technology stocks fell sharply Thursday as investors dumped some of the year's best-performing shares amid concerns that lofty growth prospects don't justify sky-high prices.

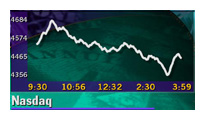

In one of the most volatile trading days on record, the Nasdaq composite index tumbled as much as 289 points before recovering somewhat to close down 186.78, or 4 percent, to 4,457.89.

The drop in the Nasdaq -- the fourth decline in as many days, left the tech-heavy index 11.6 percent below its high set March 10, past the 10 percent mark Wall Street deems a correction.

"What's driving this is techs have gone from terrific to terrible," said Alan Ackerman, investment strategist at Fahnestock & Co.

Indeed, Cisco, Qualcomm and JDS Uniphase, all up more than 65 percent in 2000, retreated Thursday, handing the Nasdaq its fifth-biggest point loss on record.

Investors seeking safety bought Treasury securities and parked funds in hard-hit industrial firms, retailers and consumer products makers.

But the Dow Jones industrial average, home to many to blue chips with stable earnings, still edged lower, as losses in Hewlett-Packard, Intel and Microsoft offset gains in Wal-Mart, Philip Morris and International Paper.

Analysts cited no one catalyst behind the tech sell-off, however traders noted that a large computer sell program had kicked in at around 3:20 p.m. ET. , followed by a buy program that wiped out some of the day's earlier losses.

In like a lamb...

Tech stocks surged in the first half of March, on expectations of strong quarterly profit reports. But in recent days some influential Wall Street strategists suggested tech shares have risen too much too fast.

"The big question making the rounds now is: How does one really judge value and are strong first-quarter earnings (expectations) already factored into technology stocks?" Ackerman said.

The Dow fell 38.47 to 10,980.25 and the broader S&P 500 shed 20.60 to 1,487.92. The Dow fell 38.47 to 10,980.25 and the broader S&P 500 shed 20.60 to 1,487.92.

"What we're seeing is this kind off continuing correction in tech stocks that began a few weeks ago," John Hughes, markets analyst at Shields & Co., told CNNfn's market coverage. "The money is leaving tech and going to what we call value stocks."

Market breadth was mixed. Advancing issues on the New York Stock Exchange topped declining ones 1,558 to 1,449, with trading volume surpassing 1.1 billion. Nasdaq losers beat winners 3,127 to 1,185 as more than 1.9 billion shares changed hands. Market breadth was mixed. Advancing issues on the New York Stock Exchange topped declining ones 1,558 to 1,449, with trading volume surpassing 1.1 billion. Nasdaq losers beat winners 3,127 to 1,185 as more than 1.9 billion shares changed hands.

In other markets, the dollar dropped against the yen and euro.

A minor setback

Even with today's losses, the Nasdaq is still up about 10 percent this year, as investors chase the economy's fastest growing companies. By comparison, the Dow is down 4 percent since January.

Larry Wachtel, market analyst at Prudential Securities, tried to keep the losses in perspective, noting that the Nasdaq rose 86 percent last year and was up 24 percent year-to-date earlier this month.

"Gimme a break," Wachtel, told CNNfn. "Where do we go from there?"

Illustrating the relatively high price of tech stocks, the Nasdaq 100 index trades at 155 times this year's earnings, Wachtel wrote in a note to clients Thursday, compared with the S&P 500, which trades at 32 times current estimates.

Still, technology companies in the S&P 500 are expected to increase profits by 26.2 percent in the first quarter, outpacing the 18.4 percent gain for the overall index, according to First Call/Thomson Financial.

But that didn't help Thursday.

Cisco Systems (CSCO: Research, Estimates) shed 2-7/16 to 73-5/8, Qualcomm (QCOM: Research, Estimates) lost 12-9/32 to 145-7/32 and JDS Uniphase (JDSU: Research, Estimates) dipped 3-1/8 to 116-1/4.

Investors sought safety in some of the year's worst performing sectors.

International Paper (IP: Research, Estimates) rose 2-5/16 to 40-1/8, Wal-Mart (WMT: Research, Estimates) climbed 1/2 to 59-1/4, Philip Morris (MO: Research, Estimates) gained 2-1/8 to 21-1/4,

Analysts ponder losses

The four-day tech slump follows cautious words from influential strategists who suggested tech shares have risen too much too fast.

Goldman Sachs strategist Abby Joseph Cohen Tuesday reduced the weight of tech stocks in her model portfolio.

And words from emerging-markets money manager Mark Mobius Wednesday didn't help. Mobius, of Templeton Funds, said a recent bout of volatility in Internet stock prices could herald the onset of a global crash in the high-flying sector.

Clark Yingst, market analyst at Prudential Securities, called some of the losses technical, with the index's downward cycle simply mimicking past trading patterns.

Looking ahead, Frank Cappiello, president of McCullough, Andrews & Cappiello, sees the Nasdaq recovering, lifted by a series of strong earnings reports next month. (464K WAV) (464K AIFF)

Among companies in the news, Seagate Technology Inc. (SEG: Research, Estimates) fell 7-1/2 to 66-1/2 after the disk-drive maker said late Wednesday it will go private in a two-stage, $20 billion deal.

And Micron Technology (MU: Research, Estimates) lost 13-1/4 to 121-1/4. The losses come despite the chipmaker's announcement late Wednesday of a 2-for-1 stock split.

Economy purrs ahead

In economic indicators, the nation's gross domestic product, the broadest measure of goods and services produced, grew at a revised 7.3 percent annual rate in the fourth quarter. And the GDP price deflator, a key inflation gauge, rose at a moderate 1.9 percent.

Peter Cardillo, director of research at Westfalia Investments, said the report bodes well for stocks investors, by showing the economy continues to strengthen without inflation.

"The good news is that we have a strong economy and there's no inflation," Cardillo said. "Investors are starting to realize the Fed may not need to be that aggressive."

Separately, the number of Americans filing new claims for unemployment benefits rose to 266,000 for the week ended March 25, from a revised 263,000 the week before, the Department of Labor said.

Click here for a look at CNNfn's hot stocks

Click here for a look a CNNfn's tech stocks

|