|

Europe ends in red

|

|

April 5, 2000: 1:05 p.m. ET

Paris, Frankfurt fall more than 2.5%, London also falls in extended trading

|

LONDON (CNNfn) - European stock markets closed lower Wednesday, only marginally recovering earlier losses, as many technology, media and telecom shares lost further ground, mirroring the slides on Wall Street. "Old economy" stocks didn't fair any better in the general sell off.

Paris and Frankfurt closed down more than 2.5 percent, while London, which started trading 45 minutes before its usual closing time due to technical problems, was last trading down more than 2 percent.

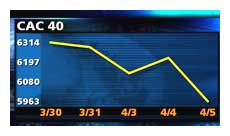

In Paris, the benchmark CAC 40 index plunged 185 points, or 2.9 percent, to 6,036.94. In Frankfurt, the Xetra Dax sank 192.03 points, or 2.6 percent, to 7,330.77, while Zurich's SMI fell 1.5 percent to 7,490.4.

In London, the benchmark FTSE 100 index was down 47.70 points, or 0.7 percent, at 6,379.3. Technical problems, the second this week, forced the London Stock Exchange to extend trading by two hours to a closing time of 5:30 p.m. GMT or 12:30 p.m. ET. In London, the benchmark FTSE 100 index was down 47.70 points, or 0.7 percent, at 6,379.3. Technical problems, the second this week, forced the London Stock Exchange to extend trading by two hours to a closing time of 5:30 p.m. GMT or 12:30 p.m. ET.

The FTSE Eurotop 300 index, comprised of the leading stocks across Europe, fell 2.7 percent, recording losses on all but one of its sector sub-indexes. The worst performer was the aerospace and defense sector, down 6 percent.

Wall Street bounced around Wednesday morning, continuing this week's shakiness, leaving the Dow Jones industrial average solidly lower and the Nasdaq composite index flat as midday approached. The Nasdaq rose just 6.20 to 4,155.09. The Dow fell 93.69 to 11,071.15, adding to the 57.09 drop from Tuesday. The S&P 500 shed 7.22 to 1,485.24.

In Frankfurt

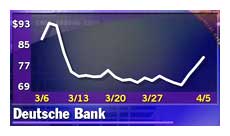

Dresdner Bank (FDRB) shocked the market Wednesday, announcing that its management board decided unanimously to abandon its planned merger with Deutsche Bank (FDBK), ending a tie-up that would have created the world's largest bank. Dresdner shares rose 4.2 percent, while Deutsche gained 4.1 percent. Insurer Allianz (FALV), which would have bought Deutsche's asset management business and taken a share in the combined personal banking unit, dropped 13.9 percent. Dresdner Bank (FDRB) shocked the market Wednesday, announcing that its management board decided unanimously to abandon its planned merger with Deutsche Bank (FDBK), ending a tie-up that would have created the world's largest bank. Dresdner shares rose 4.2 percent, while Deutsche gained 4.1 percent. Insurer Allianz (FALV), which would have bought Deutsche's asset management business and taken a share in the combined personal banking unit, dropped 13.9 percent.

Other German banks rose on speculation that they may become takeover targets. HypoVereinsbank (HVM) rose 1.4 percent, while Commerzbank (FCBK) rose 1 percent.

Shares of German electronics and engineering group Siemens (FSIE) slipped 2.95 percent after the company said it and privately held Robert Bosch would offer  9.1 billion ($8.7 billion) for Mannesmann's industrial unit Atecs, topping an earlier bid by Thyssen Krupp (FTKA). Thyssen fell 1 percent. 9.1 billion ($8.7 billion) for Mannesmann's industrial unit Atecs, topping an earlier bid by Thyssen Krupp (FTKA). Thyssen fell 1 percent.

In Paris

France Telecom (PFTE) fell 6.2 percent, wiping out an earlier gain, after the Financial Times newspaper reported that the leading French telephone company is eyeing a bid for British mobile-phone service provider Orange, owned by Mannesmann (FMMN). The German company was recently bought by the U.K.'s mobile-phone market leader Vodafone AirTouch (VOD).

Canal Plus (PAN) shares fell 11.4 percent, while defense electronics group Thomson-CSF (PHO) led decliners with a drop of 12.6 percent. Electronic data network operator Equant (PEQU) fell 5.6 percent, and computer consultant Cap Gemini (PCAP) slid 9 percent.

Among financial-services stocks, which had been among the market's best performers earlier this week, Société Générale (PGLE) fell 4.8 percent and insurer AXA (PCS) fell 5.3 percent.

In London

Power utility Scottish & Southern Energy (SSE) led the decliners, falling 20 percent, Internet service provider Freeserve (FRE) slumped 8 percent, and hand-held computer maker Psion (PON) fell 5.4 percent.

Dutch Newconomy NV, an economic network of Internet companies, said Wednesday it postponed its planned listing of shares in Amsterdam because of growing volatility on world stock markets.

Currency news

In the currency market, the euro rose against the dollar to $0.9655 from $0.9602 in late New York trading, after European Central Bank President Wim Duisenberg told Italy's Corriere della Sera newspaper that the European currency isn't weak at current levels, but is set to rebound as European growth continues. He said the central bank must stay on the lookout for inflation pressures.

--From staff and wire reports

|

|

|

|

|

|

|