NEW YORK (CNNfn) - Treasury bonds ended moderately lower Wednesday, giving back gains from an early session rally as a rebound in U.S. technology stocks weighed the market.

The performance of equities greatly impacted bonds for the second consecutive session. Early in the day, investors continued to flee stocks for the relative safety of government maturities on the heels of Tuesday's stock turmoil.

But the equity markets stabilized, with the tech-heavy Nasdaq composite index advancing over three percent in late afternoon trade.

"Stocks are doing better; that has taken a little bit of froth out of the (bond) market," said Don Galante, head of Treasury trading at Fuji Securities.

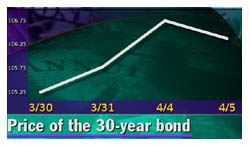

Shortly before 3 p.m. ET, the 30-year Treasury bond fell 12/32 of a point to 106-12/32. Its yield, which moves in the opposite direction to its price, rose to 5.79 percent from 5.77 percent Tuesday. Ten-year Treasury notes dipped 1/32 to 104-15/32, their yield unchanged from 5.89 percent Tuesday.

Along with the flight to quality from stocks,  reports of buying by a large hedge fund and a central bank lifted prices early in the session. reports of buying by a large hedge fund and a central bank lifted prices early in the session.

Intermediate securities, such as five- and ten-year notes, outperformed other maturities throughout the session, despite the Nasdaq's upward momentum. These issues do not appear to be as sensitive to changes in monetary policy as shorter-dated securities.

Tightening still ahead

Remarks by two Federal Reserve officials rekindled some interest rate jitters. Speaking at a White House conference on the 'new economy,' Fed chief Alan Greenspan again signaled his intention of raising rates in a gradual manner. Separately, Boston Fed President Cathy Minehan noted the economy is growing at an unsustainable pace.

With a booming economy fueled by strong consumer demand, the Fed has actively pursued a higher interest rate policy. The central bank has boosted short-term rates five times since June, each time by a quarter-point.

But the economic continues to sizzle, largely due to robust gains in the equities market, the so-called "wealth effect." If stocks were to enter a period of sustained selling pressure, consumer demand would weaken and the Fed's tightening cycle would be successful.

Due to the current stock volatility, the May fed funds contract, seen as a proxy for where interest rates are headed, is no longer pricing in the probability of a half-point rate hike at the next monetary policy meeting in May.

Most analysts expect the central bank to tighten by a quarter-point in May. Michelle Girard, Treasury market strategist at Prudential Securities, told CNNfn's market coverage it would be "premature" to forecast no action from the Fed at that time. (462K WAV) (462K AIFF)

Kathy Jones, director of futures research at Prudential Securities, expects at least one more tightening from the Fed. Looking ahead, she is optimistic about the market, telling CNN's Before Hours Treasury yields may decline.

(237K WAV) (237K AIFF)

But in the near-term, the market will be on the defensive ahead of Friday's key March employment report. Analysts surveyed by Briefing.com forecast a robust gain of 375,000 in non-farm payrolls against 43,000 in February, and the unemployment rate to drop to 4 percent from an already low 4.1 percent in February.

(Click here for a look at Briefing.com's economic calendar.)

Dollar stabilizes

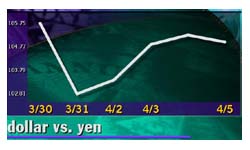

The dollar was steady against the major currencies Wednesday. Analysts said the U.S. currency also took its cues from the equities market.

"This morning, the currency markets were just as nervous as the rest of the financial markets," said Alex Beuzelin, senior market analyst at Ruesch International. "As the stock market stabilized, so did the U.S. currency."

Shortly before 3 p.m. ET, the dollar fell slightly against the yen, trading at 104.89 yen, down from 105.23 yen Tuesday. Meanwhile, the euro changed hands at 96.28 cents, up from 96.11 cents Tuesday, a 0.2 percent loss in the dollar's value.

|