|

Yahoo! beats Street

|

|

April 5, 2000: 6:39 p.m. ET

Web portal names DLJ's Decker as new chief financial officer

By Staff Writer David Kleinbard

|

NEW YORK (CNNfn) - The Web portal and Internet bellwether Yahoo! Inc. reported first-quarter revenue that more than doubled and earnings that more than tripled, as traffic on its network of sites grew sharply.

The Santa Clara, Calif.-based company said its first-quarter earnings, before one-time items, totaled $63.3 million, or 10 cents per diluted share, compared with $17.7 million, or 3 cents, in the year-ago quarter. Analysts surveyed by earnings tracker First Call had expected the company to earn 9 cents per share.

Yahoo! said that its first-quarter revenue rose 120 percent to $228.4 million from $103.9 million in the same period last year. Traffic on the company's Web sites averaged 625 million page views per day in March, up from an average of 465 million per day in December. During March, Yahoo!'s global audience grew to more than 145 million unique users from 120 million in December 1999.

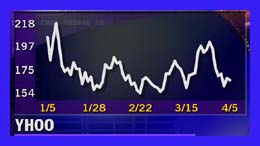

In after-hours trading, Yahoo! (YHOO: Research, Estimates) stock dipped 5-1/16 to 160-1/2, even though its results exceeded analysts' expectations.

In addition, Yahoo! named Susan Decker, global head of research at Donaldson, Lufkin & Jenrette, as its new chief financial officer, replacing Gary Valenzuela, who will retire in July.

Yahoo! extended its relationships with distribution and wireless providers during the quarter. In addition to joint ventures with Sprint, Motorola, and Palm Inc., Yahoo! recently entered wireless agreements with Bell Mobility in Canada, Siemens in Germany, Telenor in Norway, and Radiolinja in Denmark.

"Consistent with our goal to enable users to find information, connect with anybody, or buy anything, we continued to expand our media, communications, and commerce services during the quarter," said Jeff Mallett, president and chief operating officer.

Yahoo! derives its revenue by selling advertising space on its sites and by charging fees from merchants who sell goods and services over its Web properties. The company said that it enabled more than $1 billion of online transactions in the first quarter through the Yahoo! global network, which includes Yahoo! Japan. Yahoo!'s shopping sections now feature 10,500 merchants.

Tim Koogle, chairman and CEO, said that the company is shifting toward charging outside merchants a percentage of the revenue they earn from selling goods and services on Yahoo! sites, rather than charging them a fixed amount of "rent" for placement on the sites.

In addition, Yahoo! said that the average length of its advertising contracts rose to 230 days in the first quarter from 192 days in the fourth quarter of 1999.

Yahoo! Auctions, which competes with the Web auction site Ebay Inc (EBAY: Research, Estimates)., surpassed 2.5 million active daily listings, up from 1.5 million in December 1999.

Yahoo!'s operating income totaled 38 percent of revenue in the first quarter, double the percentage in the same period in 1999. The company's operating margin increased partly because its sales and marketing expense declined to 33 percent of revenue from 41 percent in last year's first quarter.

On a conference call, Yahoo!'s Valenzuela said that the company increased its expected range for future operating margins to between 32 percent and 38 percent, an increase of two percentage points from the previous range.

At Wednesday's closing price of 165-9/16, Yahoo! stock is down about 30 percent since the start of this year. However, the company still carries a market capitalization of $87 billion, more than 95 times its revenues in the past four quarters.

-- Click here to send email to David Kleinbard

|

|

|

|

|

|

Yahoo! Inc.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|