|

Same-store sales mixed

|

|

April 6, 2000: 12:36 p.m. ET

Late Easter pushes sales into April; higher-end stores fare better overall

|

NEW YORK (CNNfn) - Sales among the nation's largest chain stores were mixed to lower in March from a year earlier as a late Easter prompted consumers to put off buying their holiday-related candy and gifts until April. Upscale clothing chains, however, continued to post strong monthly sales.

Companies including Wal-Mart Stores Inc. (WMT: Research, Estimates), Limited (LTD: Research, Estimates), Kmart Corp. (KM: Research, Estimates), Target (TGT: Research, Estimates) and J.C. Penney (JCP: Research, Estimates) posted mixed revenue growth in March -- a month traditionally strong as consumers start shopping for the Easter holiday and begin stocking up on new spring fashions. Companies including Wal-Mart Stores Inc. (WMT: Research, Estimates), Limited (LTD: Research, Estimates), Kmart Corp. (KM: Research, Estimates), Target (TGT: Research, Estimates) and J.C. Penney (JCP: Research, Estimates) posted mixed revenue growth in March -- a month traditionally strong as consumers start shopping for the Easter holiday and begin stocking up on new spring fashions.

The numbers, typically released individually by consumer goods and apparel chain stores on the first Thursday of each month, partially countered figures from the U.S. Commerce Department showing strong sales a month before. That provided some evidence to analysts that rising short-term interest rates may be starting to damp consumers' penchant to spend.

"Retailers involved in home furnishings, appliances and other goods didn't fare as well in March, which may be partially due to actions from the Fed," Michael Exstein, retail analyst with Credit Suisse First Boston, told CNNfn's Before Hours. As for apparel sales, "fashion will dictate that apparel sales continue to be strong," he said. (550KB WAV) (550KB AIFF)

Easter bunny arrives late

Easter falls three weeks later this year, on April 23, delaying purchases of spring fashions, home décor items and holiday-related purchases such as toys, candy and clothing, analysts and retailers said. At the same time, overall same-store retail sales still managed to climb 3.6 percent in March from a year ago, according to monthly figures compiled by check acceptance company TeleCheck Services Inc., released earlier in the week.

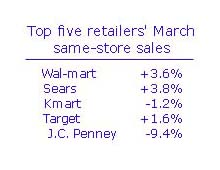

Among discount retailers, sales at stores open at least a year gained 3.6 percent at Wal-Mart, the nation's biggest chain, while No. 3 U.S. retailer Kmart saw its same-store sales decline 1.2 percent. Target, the fourth-biggest chain store in the country, said sales fell 3.6 percent, while J.C. Penney's sales plunged 9.4 percent. The Limited apparel chain showed a gain of 4 percent on the month. Among discount retailers, sales at stores open at least a year gained 3.6 percent at Wal-Mart, the nation's biggest chain, while No. 3 U.S. retailer Kmart saw its same-store sales decline 1.2 percent. Target, the fourth-biggest chain store in the country, said sales fell 3.6 percent, while J.C. Penney's sales plunged 9.4 percent. The Limited apparel chain showed a gain of 4 percent on the month.

As for higher-end apparel sellers, women's specialty retailer Talbot's (TLB: Research, Estimates) said its same-store sales jumped 19.9 percent in the month, added in part by an aggressive marketing push aimed at attracting older, upper-middle class women. Nordstrom (JWN: Research, Estimates)'s same-store sales gained 5.8 percent, while sales at specialty home furnishings store Pier 1 Imports (PIR: Research, Estimates) advanced 12.4 percent.

"Apparel overall is showing a mixed picture," said Dana Telsey, a retail analyst with Bear Stearns. "There's been a lot of pressure on the apparel side, particularly among specialty retailers, to keep prices down but we think that situation will improve as the year goes on."

Gap sales hit the skids

At Gap Inc. (GPS: Research, Estimates), the No. 1 clothing chain, sales plunged 11 percent. Sales fell among all its units, including at domestic and international Gap stores and at its Banana Republic and Old Navy stores. At the same time, the company said Wednesday that chief operating officer John Wilson resigned.

Intimate Brands Inc. (IBI: Research, Estimates), which runs the Victoria's Secret lingerie chain, had a sales gain of 1 percent, while May Department Stores Co. (MAY: Research, Estimates) sales fell 4.3 percent. Same-store sales at Dillards Inc. (DDS: Research, Estimates) declined 10 percent on the month while sales at Consolidated Stores (CNS: Research, Estimates) rose 3.3 percent.

Sears (S: Research, Estimates), the country's second-largest retailer, reported an increase in same-store sales Tuesday and said its fiscal first-quarter earnings will set a record. Sears said its earnings will come in between 62 cents and 67 cents a diluted share, above the 46 cents a share analysts polled by First Call Corp. had expected.

As long as we continue to have low unemployment strong consumer confidence and strong wage gains, we see no slowdown," Telsey said.

In a separate economic report, the Commerce Department said wholesale inventories rose for a 13th straight month in February, while sales slipped for the first time in seven months.

Wholesale inventories, items such as new cars on dealer lots, rose 0.7 percent in February after gaining a revised 0.6 percent in January. Sales, meantime, declined 0.2 percent in February, the first decline since a 0.3 percent drop in July 1999.

|

|

|

|

|

|

|