|

Bear funds see big gains

|

|

April 14, 2000: 7:35 p.m. ET

As the rest of Wall Street bleeds, bear market funds are on a winning streak

By Staff Writer Martine Costello

|

NEW YORK (CNNfn) - While the Dow and Nasdaq plunged Friday to their biggest point losses in history, Louis Mayberg of ProFunds may be one of the few people on Wall Street with something to smile about.

Mayberg's three bear funds, which are designed to do well when the stock market is falling, soared by as much as 20 percent on Friday and 73 percent for the week.

"It's been bloody out there," said Mayberg, president of ProFunds. "People who know about bear funds have been protecting their mutual fund and stock portfolios. It's a very easy way to hedge the market."

Bear market mutual funds have been the wallflowers of the fund business in recent years, as growth-oriented stock funds have delivered triple-digit returns. Such funds short stocks, use futures contracts, or options on futures contracts.

Short-selling is relatively new by mutual funds, allowed only because of the repeal of the so-called "short-short" rule in the Taxpayer Relief Act of 1997. The rule had prevented mutual funds from earning more than 30 percent of their profit from short sales. Short-selling is relatively new by mutual funds, allowed only because of the repeal of the so-called "short-short" rule in the Taxpayer Relief Act of 1997. The rule had prevented mutual funds from earning more than 30 percent of their profit from short sales.

In 1999, one of the best years of the best bull market in history, bear market funds were the worst performing mutual funds tracked by Morningstar, losing as much as 80 percent. Asset size remained small, as some fund analysts questioned their worth.

It wasn't until the Nasdaq started delivering record losses in recent weeks, and especially on Friday, that bear fund strategies started to pay off. It wasn't until the Nasdaq started delivering record losses in recent weeks, and especially on Friday, that bear fund strategies started to pay off.

ProFunds Ultrashort OTC Fund (USPIX), which seeks to earn twice the inverse returns of the Nasdaq 100, earned 20.91 percent on Friday, 73.38 percent in the past week and 83.30 percent in the second quarter.

"It's probably one of the best days we've had," Mayberg said.

ProFunds Bear Fund (BRPIX), which seeks to mirror the inverse performance of the S&P 500, earned 6.08 percent Friday and 12.06 percent for the week, while UltraBear Fund (URPIX), which seeks twice the inverse of the blue chip benchmark, earned 12.84 percent on Friday and 25.32 percent for the week.

Another big winner was Potomac OTC Short Fund (POTSX), which seeks to be the mirror opposite of the Nasdaq 100. It earned 10 percent on Friday, according to manager Mark Edwards. Another big winner was Potomac OTC Short Fund (POTSX), which seeks to be the mirror opposite of the Nasdaq 100. It earned 10 percent on Friday, according to manager Mark Edwards.

"This is a market where these strategies can work the best," Edwards said. "It's a way that allows investors to actively be in the market."

Check your mutual funds.

Paul McEntire, manager of the BearGuard Fund, said up until the last few days it's been hard to get investors to pay attention. But since his fund has soared 30 percent in the past month, he's seen a lot of interest in the last few days.

"It's not that we're jubilant about the market," McEntire said. "This is just a defensive investment that smooths out the long-term returns."

BearGuard Fund, tiny with just $1.2 million in assets, shorts small stocks that McEntire thinks are overvalued. The fund owns about 75 stocks, each representing about 1 percent of the portfolio. The other 25 percent of the assets are in Treasury bills.

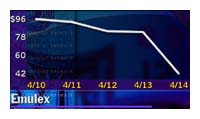

Among the top holdings are Emulex (EMLX: Research, Estimates), which traded at $10 a share a year ago before soaring to $225 on March 27. On Friday, the stock fell 41-1/4 to close at 41-11/16. Another favorite is Broadvision (BVSN: Research, Estimates), down 10-3/8 at 29-3/4. Among the top holdings are Emulex (EMLX: Research, Estimates), which traded at $10 a share a year ago before soaring to $225 on March 27. On Friday, the stock fell 41-1/4 to close at 41-11/16. Another favorite is Broadvision (BVSN: Research, Estimates), down 10-3/8 at 29-3/4.

"This is a pretty big correction," McEntire said.

But, McEntire said, keep in mind that Emulex is still up 400 percent from a year ago, even if it's only trading at around $40.

"There's no question the market got overheated," McEntire said. "It's just getting more rationally priced."

|

|

|

|

|

|

|