|

Funds slammed on Wall St.

|

|

April 17, 2000: 12:38 p.m. ET

After Nasdaq and Dow plunge last week, mutual funds take it on the chin

By Staff Writer Martine Costello

|

NEW YORK (CNNfn) - Wall Street's dramatic losses last week left many mutual funds with steep losses of 30 percent or more in just five trading days, according to new figures released Monday.

Popular technology mutual funds gave up an average of 28.27 percent in the week ending Friday, while midcap growth funds lost 22.32 percent and small growth slipped 21.45 percent in the same time, according to fund-tracker Morningstar.

Other big losers were communications funds, down 18.83 percent, and large growth funds, off 15.71 percent.

The Nasdaq composite index and the Dow Jones industrial average plunged to their largest point losses in history Friday. The Nasdaq plunged more than 25 percent for the week, triggering concerns about the outlook on Wall Street. The Nasdaq composite index and the Dow Jones industrial average plunged to their largest point losses in history Friday. The Nasdaq plunged more than 25 percent for the week, triggering concerns about the outlook on Wall Street.

Among the only funds that posted gains were so-called bear funds that are designed to rise when the market falls.

"The biggest theme is the biggest winners from last year were the biggest losers last week," said Russ Kinnel, an analyst at Morningstar.

Leveraged funds and leveraged Internet funds were the top losers, he said. For example, ProFunds UltraOTC Fund gave up 46.54 percent for the week, while Potomac Internet Plus lost 44.98 percent.

The losses point out that the worst thing investors can do is buy funds based on great performance, Kinnel said.

"Buying on performance would have been disastrous this year," Kinnel said. For example, Amerindo Technology Fund, which earned 249 percent last year, is down 40 percent this year.

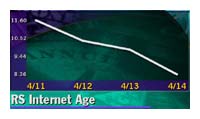

Not surprisingly, Internet funds were big losers last week. At the top of the list was RS Internet Age Fund, down 37.80 percent; followed by ING Internet Fund, off 35.73 percent; Firsthand e-Commerce Fund, down 35.71 percent; Enterprise Internet Fund, down 35.11 percent; and WWW Internet Fund, down 33.83 percent.

Check your mutual funds.

Among technology funds, the biggest loser was Seligman Communication & Information Fund, down 20.82 percent, followed by USAA Science & Technology Fund, down 18.84 percent.

In midcap growth, Alleghany Chicago Trust Talon Fund was the worst performer, down 6.20 percent for the week, followed by Berger Mid Cap Value Fund, off 5.60 percent. And in small growth, losers included Acorn Fund, down 8.79 percent, and Fasciano Fund, down 6.62 percent.

Fidelity Select Multimedia Fund was the biggest loser among communications funds, giving up 12.10 percent, followed by Gabelli Global Growth Fund, down 10.76 percent.

Click here for more mutual fund news.

Among the ten largest funds, American Century Ultra lost 16.63 percent; Janus Fund lost 15.28 percent; Janus Worldwide lost 14.17 percent; and Fidelity Magellan lost 12.34 percent.

But the news wasn't all bad last week. In fact, some categories that had been beaten down recently were among the top performers. At the top of the list were battered real estate funds, up an average of 0.38 percent. Precious metals also edged up an average of 0.12 percent.

Among international funds, Comstock Partners Capital Value Fund rose 16.15 percent, while Eaton Vance Greater India Fund gained 5.20 percent.

Kinnel said fund investors might want to sit tight instead of rushing to buy or sell shares.

"Hang tough," Kinnel said. "If you're new to investing, and you thought there was a free lunch out there, it's time to sober up. Maybe you thought Internet funds did nothing but go up."

|

|

|

|

|

|

|