|

IBM beats Street in 1Q

|

|

April 18, 2000: 5:54 p.m. ET

But stock slips after-hours as company posts 5% decline in revenue

|

NEW YORK (CNNfn) - International Business Machines Corp. reported a 3 percent increase in first-quarter profit Tuesday, easily beating Wall Street estimates, but revenue fell as big corporate customers delayed computer purchases because of lingering Y2K-related worries.

The world's leading computer company earned $1.52 billion, or 83 cents a share, in the three months ended in March, up from $1.47 billion, or 78 cents per share, a year ago. The results beat the 78-cent per share First Call consensus estimate. However, revenue fell 5 percent to $19.3 billion from $20.3 billion in the year-earlier quarter.

Hardware revenue dropped 12 percent to $7.7 billion, as sales of personal computers and other products declined. Revenue from IBM Global Services totaled $7.6 billion, flat over the year-earlier period amid the sale of the IBM Global Network last year to AT&T Corp. (T: Research, Estimates) and a severe year-over-year drop in Y2K-related service revenue. Software revenue was flat at $2.9 billion.

"The first quarter was a difficult transitional quarter," Chief Financial Officer John Joyce said in a conference call with analysts. But "our business portfolio is improved and the pipeline of opportunity has started to build."

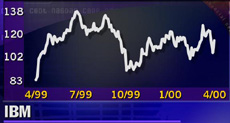

Armonk, N.Y.-based IBM, a component of the Dow Jones industrial average, released its results after the market closed. Prior to the news, IBM (IBM: Research, Estimates) shares closed up 3-1/4 to 115-1/8 on the New York Stock Exchange. After the results were released, the stock slipped to 112 in after-hours trading.

In addition to Y2K-related concerns, the company said "unanticipated significant shortfall" in its hard disk drive business hurt revenues. Restructuring programs also cut into revenues, but helped boost profitability, Joyce said.

Weakness in the hard disk drive unit also is expected to stretch into the second quarter, "but we do see revenues building through the year," Joyce said.

Y2K 'is behind us'

IBM, like other computer manufacturers, has been hurt by weakness in corporate spending on new computers in the first few months after the Year 2000 date change.

Saying that he agreed with some industry analysts' assessments that the company is a "second-half story," Joyce said the company anticipates posting double-digit revenue and earnings growth in the third and fourth quarters of the year.

The company said service contract business rose toward the end of the quarter.

"For all practical purposes, Y2K is behind us," Joyce said. He said analysts should not change their profit estimates for the full year.

During the quarter, IBM bought back about $2.1 billion worth of its common shares, reducing the number of basic common shares outstanding to 1.78 billion from 1.82 billion in the same quarter last year. By reducing the number of shares outstanding, a company can boost earnings per share.

In a statement, IBM Chairman Louis Gerstner said the company faced a number of issues in the first quarter, but looking forward, IBM expected its financial results to improve as the year unfolds.

"This was a transitional quarter, as we expected, with Y2K lockdowns continuing until late in the quarter in many of our large enterprise accounts," he said. "In addition, a series of previously announced actions -- which are improving our business structure over the long term -- hurt our revenues in the first quarter. Nevertheless, we had good earnings per share, improving results in our server business, and strong performance in such growth areas as e-business services, database and Web application software, and custom chips.

"Looking forward, we continue to believe that 2000 will be a good year for IBM," Gerstner said.

(Click here for the latest earnings news.)

|

|

|

|

|

|

IBM

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|