|

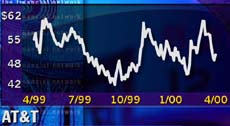

AT&T readies wireless IPO

|

|

April 22, 2000: 8:30 a.m. ET

In record-setting offering, Ma Bell to issue much-awaited tracking stock

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - It's Ma Bell meets Wall Street.

More than a century after building the nation's first long-distance telephone network, AT&T this week is cutting the cord, spinning off its wireless communications unit in a record $10.4 billion initial public offering.

The country's No. 1 long-distance provider plans to sell a 10 percent stake in AT&T Wireless.

And analysts are nothing less than giddy over the prospects for the unit, whose strong name recognition and proven profitability could lead to a solid first-day pop.

"It's going to be a barnburner," said Jeffrey Hirshkorn, senior market analyst at IPO.com.

In an IPO market that has become more selective and less speculative this month, AT&T (T: Research, Estimates)'s tracking stock couldn't be better timed. In an IPO market that has become more selective and less speculative this month, AT&T (T: Research, Estimates)'s tracking stock couldn't be better timed.

"Given the skittishness I would imagine a lot of investors would welcome this," said Corey Ostman, analyst at Alert! IPO, referring to the market volatility that all but brought IPO offerings to a halt in April.

Look Ma -- Earnings!

With 12 million subscribers, AT&T Wireless earned $748 million in 1998, according to IPO.com, and had about $5.5 billion in revenues for the nine months ended Sept. 30, 1999.

Fundamentals like these make the offering an IPO blue chip, reminiscent of last year's debuts of United Parcel Service (UPS: Research, Estimates) and Goldman Sachs (GS: Research, Estimates).

Speaking of Goldman, the investment bank along with Merrill Lynch & Co. (MER: Research, Estimates) and Salomon Smith Barney leads a fleet of Wall Street's biggest banks and brokers underwriting the massive deal.

"With 360 million shares you have to (have a huge sales force)," Ostman said.

The $10.4 billion size of AT&T Wireless easily tops the previous IPO record: United Parcel Service's $5.5 billion offering last November. But it's not just size that matters.

The offering is probably the most closely watch deal since early March, when 3Com (COMS: Research, Estimates) spun off Palm Inc. (PALM: Research, Estimates), the world's No. 1 provider of handheld computer devices.

Trading under the ticker symbol AWE, the shares are expected to price in the $26-$32 a share range Wednesday.

"You can't not like it," said Irv DeGraw, research director at WorldFinanceNet.com. He calls the shares a solid long-term investment.

"This is the kind of stock you buy and put away and in four or five years you'll be very happy," DeGraw said.

AT&T Wireless, based in Redmond, Wash., has at its core a digital wireless network. It encompasses all the company's wireless networks, operations, cell sites, retail operations, wireless customer facilities and customer location assets, as well.

A tracking stock like AWE is a special type of stock issued by a publicly held company to track the value of one particular business segment. In this case, AT&T executives said they chose to float a tracking stock to help that unit realize its full potential.

"We believe that issuing a tracking stock will help the AT&T Wireless Group raise capital, which can be used for investments and acquisitions in this fast-growing and quickly evolving field," the New York-based company said in a statement sent to shareholders in February.

While the IPO will overshadow all other deals this week, it won't be the only debut. Still, analysts predict that many of the 15 offerings on the calendar will be pushed ahead as underwriters wait for IPO demand to increase.

Virologic (VLGC), a biotechnology company, plans to sell 5 million shares priced in the $14 to $16 range. In one of the larger deals, Birch Telecom (BRCH) plans to offer 12.5 million shares in the $15 to $17 range.

|

|

|

|

|

|

|