NEW YORK (CNNfn) - Treasury securities ended the week sharply lower Friday, with yields at their highest levels in nearly three months after a stronger-than-expected April employment report added to the unease about higher interest rates.

In the currency markets, the euro rebounded against the dollar, rising above the 89-cent level on the heels of its lifetime low set Thursday. Rumors that the European Central Bank (ECB) may buy euros to boost the currency continue to provide support.

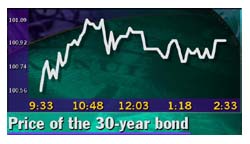

Shortly after 3 p.m. ET, the 30-year Treasury bond fell 20/32 of a point in price to 100-21/32. The yield, which moves inversely to its price, rose to 6.20 percent from 6.18 percent late Thursday. Shortly after 3 p.m. ET, the 30-year Treasury bond fell 20/32 of a point in price to 100-21/32. The yield, which moves inversely to its price, rose to 6.20 percent from 6.18 percent late Thursday.

The 10-year note, now considered by many to be the market benchmark, dropped 16/32 to 99-30/32, its yield rising to 6.50 percent from 6.46 percent.

Analysts said the April employment report was bearish for the Treasury  market, and supports the case for the Federal Reserve to hike rates by a half-percentage point at its next meeting on May 16. market, and supports the case for the Federal Reserve to hike rates by a half-percentage point at its next meeting on May 16.

The U.S. economy created 340,000 jobs in April, below a revised 458,000 in March, according to the Bureau of Labor Statistics. The unemployment rate fell to 3.9 percent, a 30-year low, from 4.1 percent the previous month, and average hourly earnings, a measure of inflation, rose 0.4 percent.

Both the unemployment rate and the wage data were stronger than consensus estimates. Analysts surveyed by Briefing.com forecast the number of jobs created to have increased by 325,000 workers, and also forecast the unemployment rate to fall only to 4 percent.

"We're right back in a bear market mode, waiting for the Fed to tighten," said Mike McGlone, analyst at IBJ Lanston Futures.

A trader at an investment firm said he saw very little buying. "There's no rush to buy with the Fed being active hiking rates," he said.

Judging by the June fed funds futures contract, which gages market expectations for where rates will go, market participants now anticipate an 80 percent chance of a half-percentage point hike.

The Fed had increased short-term interest rates five times since June, but its effort to curb inflation in a gradual manner has had little impact. Recent economic reports reveal signs suggesting inflation may be accelerating.

Investors are now looking ahead to the next key inflation reports, the producer and consumer price reports. Michael Boss, bond futures trader at IBJ Lanston Futures, expressed caution about the data, warning CNN's Before Hours that inflation-way investors should prepared for more surprises. (359K WAV) (359K AIFF)

The producer price index (PPI) is slated for release May 12, and the consumer price report on May 16. Along with the PPI, the Treasury's quarterly refunding auctions are scheduled for next week. The department will sell $12 billion of new five-year notes and $8 billion in 10-year notes.

(Click here for a look at Briefing.com's economic calendar.)

Euro rebounds vs. dollar

The euro recovered slightly against the dollar, rising above the 90-cent level. Analysts said it was bolstered by speculation the ECB may buy euros to prop the beleaguered currency. On Thursday, the single currency hit a record low of 88.45 cents.

The euro was also helped by comments from ECB President Wim Duisenberg, who said in a press release Friday the central bank was closely watching the currency.

Shortly before 3 p.m. ET, the euro traded at 89.76 cents, up from 89.12 cents Thursday, a 0.7 percent loss in the dollar's value. Meanwhile, the dollar rose slightly to 108.39 yen from 108.07 yen Thursday.

|