|

Stock picks by the pros

|

|

June 29, 2000: 12:35 p.m. ET

Global Marine, Alza, Intel, Gannett, Compaq, VeriSign selected

|

NEW YORK (CNNfn) - Thursday's picks by market analysts and fund managers came from the technology, biotech, media, oil services and pharmaceutical sectors, with names such as Tyco, Entrust, Cisco, Broadcom, Dow Jones and Celera Genomics.

While the market decline continued into midday trading, recent guests on CNNfn commented on the stocks they are buying, and why.

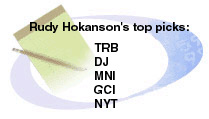

"I don't know if the word, paper, will always be after the word, news, but you're [always] going to see companies that know their communities, know how to gather news, how to disseminate information, how to advertise to local communities, how to understand the issues that surround the living of those communities," said Rudy Hokanson, media analyst, CIBC World Markets. "You're going to see the companies today maybe transformed in certain ways, but the Internet is something that we think the newspaper companies are becoming expert at, more than many people realize." "I don't know if the word, paper, will always be after the word, news, but you're [always] going to see companies that know their communities, know how to gather news, how to disseminate information, how to advertise to local communities, how to understand the issues that surround the living of those communities," said Rudy Hokanson, media analyst, CIBC World Markets. "You're going to see the companies today maybe transformed in certain ways, but the Internet is something that we think the newspaper companies are becoming expert at, more than many people realize."

"We like Tribune (TRB: Research, Estimates). We think that their acquisition of Times Mirror (TME: Research, Estimates)) was a very good acquisition, and makes them a strong player in the larger media space."

"We like Dow Jones (DJ: Research, Estimates) because of what they're doing, not only with the Wall Street Journal, but also online, electronic publishing."

"We like a small newspaper company, McClatchy (MNI: Research, Estimates), which has very attractive properties and is very good at the Internet."

"Besides Gannett Company (GCI: Research, Estimates), we find that The New York Times (NYT: Research, Estimates) in its strategy is very attractive, and the stock is priced right as far as we're concerned."

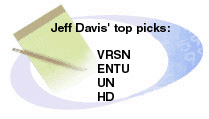

"I just love Internet security as a theme and VeriSign (VRSN: Research, Estimates) and Entrust (ENTU: Research, Estimates) are two names," said Jeff Davis, analyst, State Street Global Advisors. "I just love Internet security as a theme and VeriSign (VRSN: Research, Estimates) and Entrust (ENTU: Research, Estimates) are two names," said Jeff Davis, analyst, State Street Global Advisors.

"Unilever (UN: Research, Estimates) -- which has done nothing for years in terms of price appreciation -- may be closing in on their restructuring that has taken years to accomplish and is good management. We have a lot of respect for what they're doing even though the price hasn't been rewarding."

His final pick is Home Depot (HD: Research, Estimates). "We backed up and looked at HD. At the price where it is now, it's actually looking pretty good."

"I think the rising price of oil really acts like a tax on consumers. So in addition to the Fed raising rates, we've got less money in the consumer's pocket. Now, obviously, the gasoline prices are going up, but overall in the economy, it doesn't have a huge impact outside of this one impact on consumers, which really acts like a tax increase. So I think it has the impact of slowing the economy down a bit," said Patricia Chadwick, president of Ravengate Partners. "I think the rising price of oil really acts like a tax on consumers. So in addition to the Fed raising rates, we've got less money in the consumer's pocket. Now, obviously, the gasoline prices are going up, but overall in the economy, it doesn't have a huge impact outside of this one impact on consumers, which really acts like a tax increase. So I think it has the impact of slowing the economy down a bit," said Patricia Chadwick, president of Ravengate Partners.

"I actually like the oil service stocks. I'm not convinced that the price of oil is going to stay up. It is being run by a cartel. I think that OPEC is well aware that the United States provides its defense for it, and I don't think that there is an upward bias to much more in the price of oil. So I think that the price of oil is probably not going to go up a lot more. However, it behooves the oil companies to invest when the price is above $15 or $16 a barrel, and I think that works well for the oil services companies."

"I like Global Marine (GLM: Research, Estimates). It's an offshore driller in the Gulf, and I think that we'll see the day rates for jack-up rigs going up over the next year. And so I think you could have a huge impact on their earnings over the next 12 months. So this is a great way to play it. ALZA (AZA: Research, Estimates) is a drug distributor, and we are expecting FDA approval for a once-a-day dosage of Ritalin. Admittedly, a somewhat controversial drug, but I think that will help the drug lot. Most drug companies do very well after FDA approvals. So I think that will serve it well.

"I also think that the Tyco's (TYC: Research, Estimates) acquisition of Mallinckrodt is totally along the lines of what Tyco does so well, and that's a stock that had been under a lot of pressure. As you know, the inquiry seems to be behind them now, in terms of any financial shenanigans, which certainly was not what I believe they had done at all. So I think that is also a real opportunity for this company.

"I really think that the drive here in the economy is through productivity and through the expansion of the Internet highway, which really focuses on technology. I don't think investors can have a portfolio that doesn't have a lot of technology. But having said that, I think there are different ways you can get technology. I certainly think that Intel (INTC: Research, Estimates) is attractive. I even like the expensive ones, Cisco Systems (CSCO: Research, Estimates), EMC (EMC: Research, Estimates), Broadcom (BRCM: Research, Estimates) , all kinds of companies like that. So technology, I think, has to be a very powerful part of your portfolio. I also like financial services, because I do think interest rates are going to come down and they tend to lead the market when interest rates are coming down."

"I think there are a couple of other variables in addition to the rates, such as valuation, and I think that's one of the big reasons that this is going to continue to be a stock picker's market," said Drew Cupps, manager of the Strong Enterprise Fund of the Strong Funds group. "I think there are a couple of other variables in addition to the rates, such as valuation, and I think that's one of the big reasons that this is going to continue to be a stock picker's market," said Drew Cupps, manager of the Strong Enterprise Fund of the Strong Funds group.

"Technology is the host of the growth in the economy. And for the indices to move higher, technology's going to have to be the one leading the way. We have a growth pick and a little more of a valuation pick within technology. On the growth side, we like a company called USinternetworking (USIX: Research, Estimates). It's a leading company in the application service provider Industry, which is the way the world is going to work. It's a new way of delivering software, and USinternetworking is a leader there. We like Compaq Computer (CPQ: Research, Estimates). Compaq is in front of a

Windows 2000 upgrade; a lot of Internet appliances, information devices are going to be featured this Christmas. We think Compaq is fairly well situated to capitalize on that. I think that in an intermediate to longer-term perspective, biotechnology and within biotechnology, genomics, are probably one of the most exciting industries around. We like Celera Genomics (CRA: Research, Estimates).

-- Compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|