|

Stock picks by the pros

|

|

July 3, 2000: 1:54 p.m. ET

Oracle, Nokia, Petsmart, Raytheon, Catellus, EMC and SVI win mention

|

NEW YORK (CNNfn) - As the third quarter gets under way, sector and market analysts came up with a mix of some big-cap and small-cap names for investors to look out for, such as Oracle, Petsmart, AIMCO, Nokia and SVI.

While stocks on the Dow and the Nasdaq edged higher in Monday's shorter session, a day before the Independence Day holiday, recent guests on CNNfn commented on the stocks they are buying, and why.

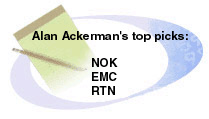

"Stay with the big stocks with the big backlog and big trend of earnings and with management that have been there before," said Alan Ackerman, market strategist, Fahnestock & Company. "Stay with the big stocks with the big backlog and big trend of earnings and with management that have been there before," said Alan Ackerman, market strategist, Fahnestock & Company.

"Nokia (NOK: Research, Estimates), love that one. That's the key player in the wireless industry. I think that there's a stock that can move sharply higher. And by year end I'm looking for the stock to be up another 17-to-20 points."

"EMC (EMC: Research, Estimates) is the big Kahuna in the data storage business. Clearly that company has been growing at a 40 percent rate on top line and 30 percent bottom line. It split a number of times. That's a core holding as far as I'm concerned."

His final pick is Raytheon (RTN.A: Research, Estimates) "This stock is down 70 percent from its high. It's in a very slow period now. The strength of democracy, this independence that we enjoy so well today and tomorrow is really due to the fact that the United States was always defense ready. And I think when the election is over we're going to see more money going into defense. This had been a defense dividend but I think that is passed."

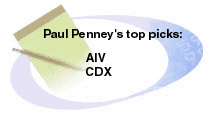

"We generally feel that the supply/demand fundamentals in the real estate sector have never been stronger," said Paul Penney, real estate housing specialist, Robertson Stephens. "For instance, on the office side, there's still a lot of growth left and there's large embedded rent growth in the sector because the leases are typically 5 to 15 years. So today's market rents are still way below today's lease rents." "We generally feel that the supply/demand fundamentals in the real estate sector have never been stronger," said Paul Penney, real estate housing specialist, Robertson Stephens. "For instance, on the office side, there's still a lot of growth left and there's large embedded rent growth in the sector because the leases are typically 5 to 15 years. So today's market rents are still way below today's lease rents."

"REITs over the past 18 months have been focusing on repurchasing their own shares and at this point, they are poised to do so. Also, with a slowing economy, specifically a rising interest rate environment, we see that bodes really well on the apartment side of the business where it becomes more and more pricey to buy a home. So renting an apartment bodes well for the apartment owners."

"AIMCO (AIV: Research, Estimates) is one of the largest owners and operators of Class B apartments. And these are -- with 90 to 95 percent of the construction activity taking place in the Class A sector -- we think they are poised to really excel. They have a national diversified asset base with no more than 5 percent of their NOI coming from one potential city."

He also said that he likes Catellus (CDX: Research, Estimates), which is not a REIT, but an operating company. "They are the largest non-government owner of land in California. They control Pacific Commons, a large development in the Silicon Bay area, and Mission Bay, a development right here in the South of Market Area in San Francisco."

"The business-to-business model is promising, but again, I underline for the quality players like the Ariba (ARBA: Research, Estimates), Commerce One (CMRC: Research, Estimates), and i2 Technologies (ITWO: Research, Estimates). But the field is getting so crowded that competition as a result is becoming so severe that only a handful of companies, relatively speaking, can make it. The vast bulk of the B2B companies that are lurking in the shadows, trying to get a piece of the action - I'm not too optimistic on their future," said Ulric Weil, technology analyst Friedman, Billings, Ramsey & Company. "The business-to-business model is promising, but again, I underline for the quality players like the Ariba (ARBA: Research, Estimates), Commerce One (CMRC: Research, Estimates), and i2 Technologies (ITWO: Research, Estimates). But the field is getting so crowded that competition as a result is becoming so severe that only a handful of companies, relatively speaking, can make it. The vast bulk of the B2B companies that are lurking in the shadows, trying to get a piece of the action - I'm not too optimistic on their future," said Ulric Weil, technology analyst Friedman, Billings, Ramsey & Company.

"I'm positive on Oracle (ORCL: Research, Estimates)," Weil said. "It's one of the leading high-quality companies in a dominant position on the Internet as well in the database arena. And that's what it takes to be successful in the kind of tech market we are in. Dominance in a market niche, defensible territory, excellent management -- all those goodies."

"I think wireless is the future. It's the killer application of the future. Today a few hundred million are using wireless phones, particularly in Europe. But you know in not more than two or three years, a billion people will be using wireless phones -- in Africa as well, and Asia of course, here in the U.S.," said Weil. "Needless to say, that is a huge market that will benefit not only the wireless companies directly that provide the service, like Vodafone AirTouch (VOD: Research, Estimates), but also the semiconductor companies that provide the grist for the mill, if you will. Every one of those handsets you know has to have a semiconductor chip inside to function, and a billion handsets take a lot of chips. So the semiconductor industry, which has been on a roll already, should continue to do well in the emerging age of the wireless Internet."

"It's been struggle, but I am really optimistic about the second half, particularly now that we're going into the summertime, the summer rally is about upon us here," said Ray Dirks, senior analyst at Dirks & Co. "It's been struggle, but I am really optimistic about the second half, particularly now that we're going into the summertime, the summer rally is about upon us here," said Ray Dirks, senior analyst at Dirks & Co.

"The financials I think are going to be all right. They had a pretty decent move here, particularly the insurance stocks a couple of months ago. Then they backed off. But I think the financial are going to do all right, now that it appears that the Fed may not raise rates rest of the year," Dirks said. "I'm looking to recommend substantial diversification for the individual investor, if he can afford to buy 20 different stocks it's better than buying two different stocks. So diversification above all. But small caps have the upside potential that the big caps do not necessarily have."

"You can buy small caps in the tech area as well as the large caps," he continued. "And, for example, one stock I like is Take-Two interactive Software (TTWO: Research, Estimates). I think Petsmart (PETM: Research, Estimates) has been a company that's been on a downtrend for a long time. And the stock is down to $3. It was in the high 20s at one point. And they have over 2 billion in sales. It's the No. 1 pet retailer in U.S. And their earnings are going to be about 30-or-40 cents this year, going up perhaps to 55 cents next year. So it's a very low multiple. When you look at small caps, another thing to try to do is to buy low multiple small caps. SVI (SVI: Research, Estimates) is a stock took a big hit Friday. It was 7 down to 5. Now I like to buy small caps after they've dropped rather than before they drop."

--compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|