|

Jobs fall, Wall St. rises

|

|

August 4, 2000: 5:20 p.m. ET

A slowdown in payrolls eases rate fears, sending money into stocks

By Jake Ulick

|

NEW YORK (CNNfn) - U.S. stocks rose Friday after a government report showed the nation lost jobs in July, sparking hopes that the Federal Reserve won't hike interest rates this month.

As the major stocks indexes capped their first winning week since mid-July, investors took comfort in data showing that employers eased up on hiring workers last month. While bad for Main Street, the figures, analysts say, could keep Federal Reserve inflation-fighters from raising borrowing costs when they meet Aug. 22.

"Nothing guarantees anything with the Fed, but this comes pretty close," Greg Jones, chief economist at Briefing.com told CNNfn's Market Call. "Showing a slowdown in job growth is critical. I don't think they are going to be raising in August."

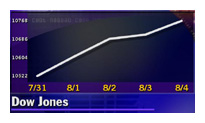

Financials stocks, ever sensitive to tighter credit, surged, handing the Dow Jones industrial average its fifth gain in five sessions. And the Nasdaq composite index jumped 27.48 points to 3,787.36, bringing its weekly advance to 3.3 percent. Financials stocks, ever sensitive to tighter credit, surged, handing the Dow Jones industrial average its fifth gain in five sessions. And the Nasdaq composite index jumped 27.48 points to 3,787.36, bringing its weekly advance to 3.3 percent.

The Dow gained 61.17 to 10,767.75, rising 2.4 percent over the last five days, as gains to financials offset losses among drug shares. The S&P 500 jumped 10.37 to 1,462.93 and is up 3 percent on the week. This is the first week since July 14 that all three indexes finished higher.

Stocks suffered in late July on concerns that earnings growth, which has surged in recent years, is going to slow. Paradoxically, the Labor Department's news that employers shed jobs last month added to those fears. Some analysts now wonder whether the slowdown in job creation foreshadows slower corporate profit growth ahead.

"The market could be saying: 'Oh no, this jobs report suggests slowness and could there be an earnings impact in the tech sector going forward,'" Clark Yingst, market analyst at Prudential Securities, said when asked about the market's midday sell-off. "The market could be saying: 'Oh no, this jobs report suggests slowness and could there be an earnings impact in the tech sector going forward,'" Clark Yingst, market analyst at Prudential Securities, said when asked about the market's midday sell-off.

In market breadth, more stocks rose than fell. Advancing issues on the New York Stock Exchange beat declining ones 1,706 to 1,102, on trading volume of 946 million shares. Nasdaq winners beat losers 2,233 to 1,692, as more than 1.4 billion shares changed hands.

Payrolls shrink

In a development cheered on Wall Street, the nation's payrolls decreased by 108,000 in July. The drop, which includes big layoffs of government census workers, was well below expectations for a 70,000 gain. Private sector job growth rose, but at a slower pace than previous reports showed.

The unemployment rate, meanwhile, held steady at 4.0 percent. Hourly earnings, a gauge of wage inflation, rose 0.4 percent -- a bit stronger than the 0.3 percent increase forecast.

The weaker-than-expected report gave investors hope that the economy is slowing under the weight of six interest rate hikes since June 1999, making further credit tightening unneeded.

"We doubt that this report unambiguously points to slower growth ahead --but it does mean no rate hike on (Aug.) 22," said Ian Shepherdson, chief U.S. economist at High Frequency Economics. "We doubt that this report unambiguously points to slower growth ahead --but it does mean no rate hike on (Aug.) 22," said Ian Shepherdson, chief U.S. economist at High Frequency Economics.

In Wall Street's logic, fewer people working could mean that spending by consumers -- who fuel most of the economy -- will slow. As labor markets loosen, employers feel less pressure to bid up wages, tempering inflation that could derail an economic expansion now in its record ninth year.

Financial stocks, which rise as interest rate fears ease, rose. J.P. Morgan (JPM: Research, Estimates) surged 8-1/4 to 143-1/4 and American Express (AXP: Research, Estimates) gained 1-15/16 to 59-15/16.

"They are clearly a proxy for interest rates," Ted Weisberg, of Seaport Securities, told CNN's Street Sweep. "The catalyst was interest rates."

The strength of financials offset weakness in drug sales. After climbing for most of the week, Merck (MRK: Research, Estimates) lost 1-13/32 to 73-13/16, and Johnson & Johnson (JNJ: Research, Estimates) dropped 7/16 to 96-9/16.

Among stocks in the news, Disney (DIS: Research, Estimates) fell 1/16 to 42-7/16 despite posting stronger-than-expected earnings. The company earned $633 million, or 30 cents a share, for its fiscal third quarter, beating forecasts of 24 cents.

Aetna (AET: Research, Estimates) rose 1-3/16 to 59-1/2 after reporting earnings of $134.0 million, or 94 cents a diluted share. That's above the 88 cents a share expected.

Cisco Systems (CSCO: Research, Estimates) rose 1-3/16 to 65-9/16 in heavy trading ahead of the company's quarterly earnings report Tuesday. More than 41 million shares changed hand, making Cisco the Nasdaq markets' most-traded stocks.

While the Dow, Nasdaq and S&P ended the week higher, the indexes are down for the year, despite a batch of strong quarterly earnings. For the April-June quarter, 89 percent, or 443, of companies in the S&P 500 beat Wall Street expectations on average by 4.3 percent, according to earnings tracker First Call. While the Dow, Nasdaq and S&P ended the week higher, the indexes are down for the year, despite a batch of strong quarterly earnings. For the April-June quarter, 89 percent, or 443, of companies in the S&P 500 beat Wall Street expectations on average by 4.3 percent, according to earnings tracker First Call.

Looking ahead, Richard Bernstein, chief quantitative strategist at Merrill Lynch, told CNNfn's In the Money the market is likely to stay in a trading range until the Fed actually cuts interest rates, something that no one expects any time soon. (230K WAV) (230K AIFF)

|

|

|

|

|

|

|