|

Job growth drops sharply

|

|

August 4, 2000: 11:27 a.m. ET

A softer-than-expected jobs number raises expectations rate hike unlikely

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - The U.S. economy shed jobs at the sharpest rate in nearly a decade last month as an increase in hiring by private companies failed to offset a drop in census-related work, the government reported Friday.

U.S. stock markets were cheered by the report, which was taken as further indication that the Federal Reserve will not raise interest rates at its Aug. 22 meeting.

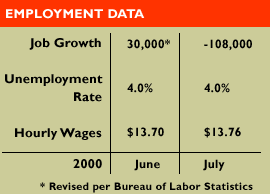

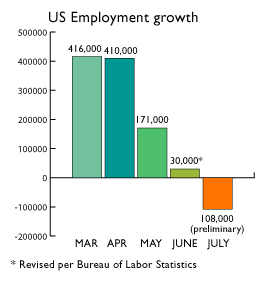

Overall, U.S. employment declined by 108,000 positions in July, countering the 70,000 new positions expected by economists and the revised 30,000 jobs created a month before. It was the biggest monthly job drop since 1991. Excluding the census positions, some 182,000 jobs were added in July.

Private sector employment gained 138,000 jobs in July, but that was below the average monthly growth of 182,000 jobs that private employers added during the first half of the year. Private sector employment gained 138,000 jobs in July, but that was below the average monthly growth of 182,000 jobs that private employers added during the first half of the year.

The department also reported average hourly earnings, a closely watched measure of potential inflationary pressures, rose by 6 cents, or 0.4 percent, to $13.76 a hour, a penny above the forecast, which had called for 0.3 percent growth in the period. The unemployment rate held steady for a third straight month at 4 percent, also in line with analysts' estimates.

Will the Fed steer clear of attention ahead of the November election?

Analysts and investors interpreted the numbers as another sign that the U.S. economy is slowing, reducing the need for the Federal Reserve to raise interest rates at its policy meeting. U.S. stock markets opened higher after the report while bonds recovered from earlier losses.

"Nothing guarantees anything with the Fed, but I think it comes pretty close," Greg Jones, chief economist at Briefing.com, told CNNfn's Market Call program Friday. "We've probably seen the end of the cycle. Seeing the slowdown in job growth was critical. The tight labor market was the key why the Fed was raising rates in the first place. They were concerned of the possibility that wages would rise and push up inflation. That hasn't happened, and now we're seeing job growth slow. That's just really what the Fed wanted to see." "Nothing guarantees anything with the Fed, but I think it comes pretty close," Greg Jones, chief economist at Briefing.com, told CNNfn's Market Call program Friday. "We've probably seen the end of the cycle. Seeing the slowdown in job growth was critical. The tight labor market was the key why the Fed was raising rates in the first place. They were concerned of the possibility that wages would rise and push up inflation. That hasn't happened, and now we're seeing job growth slow. That's just really what the Fed wanted to see."

Anthony Chan, chief economist, BancOne Investment Advisors, agreed that the report contains enough signs of a slowdown in the economy to make another rate hike by the Fed on Aug. 22 unlikely. Anthony Chan, chief economist, BancOne Investment Advisors, agreed that the report contains enough signs of a slowdown in the economy to make another rate hike by the Fed on Aug. 22 unlikely.

"This is a report that represents judgment day for the Federal Reserve," Chan told CNNfn's Before Hours program. "When you look at it over a three-month period, it does suggest the economy is slowing." (318KB WAV) (318KB AIFF)

There were some pockets of unexpected growth in the jobs report, such as a 64,000 increase in manufacturing jobs that was much higher than expected.

"We doubt that this report unambiguously points to slower growth ahead -- but it does mean no rate hike on the 22nd," said Ian Shepherdson, Chief U.S. Economist for High Frequency Economics.

|

|

|

|

|

|

Department of Labor

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|