|

Fed seen holding the line

|

|

August 22, 2000: 1:47 p.m. ET

Evidence of slowing growth, tame inflation means no rate hike: analysts

By Staff Writer John Chartier

|

NEW YORK (CNNfn) - Signs of slowing economic growth along with little evidence of any inflationary pressures are widely expected to convince Federal Reserve policy makers to hold the line on interest rates when their meeting wraps up later Tuesday.

Where analysts were hopeful, but unconvinced, two months ago that signs of a slowing economy were here to stay and that growth would finally ease back from its recent breakneck pace, now they have little doubt.

Will the Federal Reserve's policy setting board, the Federal Open Market Committee, raise interest rates at the conclusion of their one-day meeting Tuesday?

In a word - no.

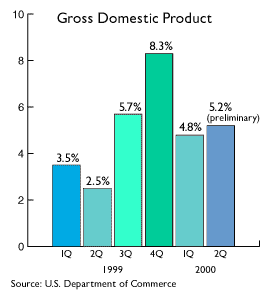

Now well into its 10th and record year of uninterrupted expansion, the U.S. economy is finally showing real signs of easing off in the wake of six rate increases implemented by the Fed's policy making arm in the past year.

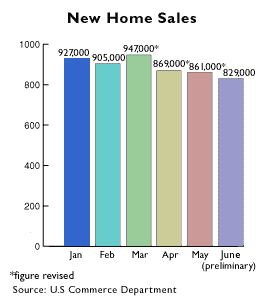

Consumers are spending less -- not just because the interest rates on their credit cards are higher but also because they are reaching a saturation point for new homes, cars, appliances and other goods following 10 years of unprecedented growth, according to analysts.

A smile on Greenspan's face

And other factors such as a tight labor market and more stringent lending standards at the nation's banks for both consumers and businesses all have put a smile on Fed Chairman Alan Greenspan's face, making a seventh rate increase highly unlikely, experts say.

At least this time around.

"There's a pretty firm consensus out there that the Fed is going to do nothing," said Wayne Ayers, chief economist at Fleet Boston Financial Corp. "On balance, when you look at the labor market data, I think it's all pretty much sending the message that this slowdown is not a head-fake like we had in '99. I think the Fed can safely bide its time now." "There's a pretty firm consensus out there that the Fed is going to do nothing," said Wayne Ayers, chief economist at Fleet Boston Financial Corp. "On balance, when you look at the labor market data, I think it's all pretty much sending the message that this slowdown is not a head-fake like we had in '99. I think the Fed can safely bide its time now."

One wild card in the FOMC's take on the economy could be oil. Oil prices have been a concern for the Fed because, as the winter season approaches, demand for home heating oil revs up. If prices remain high, that will curb consumer spending even more, experts said. So the question becomes: Does a rate hike make sense?

Yet there are some who would argue that gushing oil prices, which hit a 10-year high last week, along with strong consumer confidence, steady retail sales and some strengthening in manufacturing output in certain areas of the country could elicit another quarter-point rate increase anyway - a way for the Fed to ensure that its growth-slowing brakes aren't wearing down.

A quarter-point insurance move?

"There is that argument. As the election season heats up, some think the Fed should take another insurance policy, another 25 basis point (one-quarter percentage point) increase to make sure the soft landing is here to stay," Ayers said. "But I think it's probably very unlikely."

Additionally Ayers believes oil prices will start to come back down into the mid-to-high $20-per-barrel range as the Organization of Petroleum Exporting Countries (OPEC) realizes it's not in the cartel's best interests to plunge the global economy into a recession. Additionally Ayers believes oil prices will start to come back down into the mid-to-high $20-per-barrel range as the Organization of Petroleum Exporting Countries (OPEC) realizes it's not in the cartel's best interests to plunge the global economy into a recession.

In May, the FOMC raised its benchmark interest rate, the fed funds rate, by a half-point to 6.5 percent, the highest in nine years. But amid increasing signs of a slowdown, the Committee left rates alone in June, saying that rapid advances in productivity have helped companies keep costs in line. But policy makers still were concerned about inflationary tendencies.

Although most analysts and investors now have ruled out an August rate increase, some are not as whole-heartedly convinced.

The unemployment rate has crept up slightly, indicating that businesses have all the workers they need right now. Yet in reality, demand for high-tech jobs remains frenzied, as evidenced by the way companies are lobbying Congress to make it easier to import engineers and other talent from overseas, said Warren Bailey, an economics professor at Cornell University.

Other signs of strength?

Bailey points out that housing prices, particularly on the East and West coasts, remain extremely high, pointing to continued demand for housing.

He also notes that unemployment figures can be misleading because a drop in non-professional jobs that boosts the rate masks the fact that both Silicon Alley - New York City's tech community - and Silicon Valley in California, still are hungry for talent.

"Each business cycle is different. We can't compare this to some expansion that occurred in 1964," Bailey said. "We literally don't have enough data." "Each business cycle is different. We can't compare this to some expansion that occurred in 1964," Bailey said. "We literally don't have enough data."

He points to the recent struggle between labor and management at Verizon Communications (VZ: Research, Estimates), the largest local U.S. phone service provider, where a labor strike that appeared ready to conclude after more than two weeks reflected an obvious economic shift from "old economy" to "new economy" employees with different types of highly specialized skills.

With demand for such specialized employees remaining strong, he suggests, Fed officials may look at that as a reason to raise interest rates.

Bailey said another interest rate increase could hurt middle and lower middle class families, where the difference between an $800-a-month mortgage and a $1,200-a-month mortgage means a great deal. Like it or not, then, he believes the Fed's decision will be as much political as economic.

That aside, most of the actual hard-core numbers coming from Washington point toward a definitive slowdown, particularly on the labor front.

Unemployment up

The economy shed 108,000 jobs in July, countering the 70,000 new positions economists expected and the revised 30,000 jobs created a month before. That's the sharpest rate in nearly a decade. Private sector employment gained 138,000 jobs for the month, well below the 182,000 jobs added during the first half of the year.

While bad news for people out of a job, it is a good sign that the labor market is tight enough at the moment and that another rate increase is not necessary, according to economists. The latest report bolsters Greenspan's view that rapid productivity advances have helped to keep companies' costs down, said Mark Wanshel, an economist at J.P. Morgan. While bad news for people out of a job, it is a good sign that the labor market is tight enough at the moment and that another rate increase is not necessary, according to economists. The latest report bolsters Greenspan's view that rapid productivity advances have helped to keep companies' costs down, said Mark Wanshel, an economist at J.P. Morgan.

"I'm not sure I necessarily go along with him forever, but for right now the evidence is that's a supportable view, or one that is certainly not contradicted," " Wanshel said. "He certainly seems disinclined to raise interest rates."

Other signs that the economy is downshifting are apparent as well.

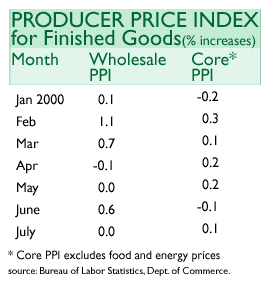

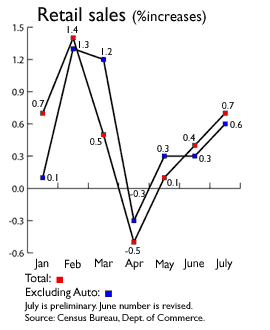

Although retail sales have continued to slow, they did increase at a faster-than-expected pace in July, the government said last week. But wholesale prices remained flat, which has helped keep inflation in check.

Retailers: adjusting to slower pace

And that number was reinforced in recent weeks as a number of retailers, such as Gap Inc. (GPS: Research, Estimates), Lands' End (LE: Research, Estimates) and Federated Department Stores (FD: Research, Estimates) posted lower-than-expected sales and profit warnings for their second quarters.

More than a dozen retailers issued profit warnings for the second quarter. Most remain optimistic about the upcoming holiday season, but many analysts believe they are adjusting to a slower pace of consumer spending driven by mounting debt and high oil prices. More than a dozen retailers issued profit warnings for the second quarter. Most remain optimistic about the upcoming holiday season, but many analysts believe they are adjusting to a slower pace of consumer spending driven by mounting debt and high oil prices.

However, the retail numbers still leave some wondering whether another rate hike could loom in the future even if the Fed does nothing Tuesday.

"My personal opinion is that probably the policy (of leaving rates alone), is about right for now," Wanshel said. "But there are people who think we have not totally brought demand in line with supply and that further tightening will be needed."

While waiting to see how retail sales react in the second half of the year, Fed watchers also have an eye on rising European inflation and the dollar's strength against the euro.

Looking overseas

Euro-zone inflation remained at 2.4 percent in July, about what analysts had expected, but higher than the European Central Bank's 2 percent ceiling target. That, combined with the weak euro, is fueling speculation that Europe's central bank could raise interest rates at its Aug. 31 meeting.

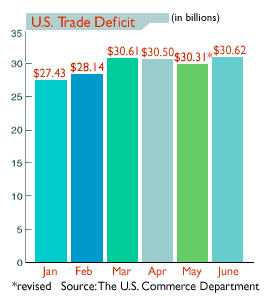

Meanwhile, the U.S. trade deficit shot to a record high of $30.62 billion in June because of rising oil prices, the government reported Friday. But the strength of U.S. exports bolstered the view of analysts who believe a rate hike is unlikely. Meanwhile, the U.S. trade deficit shot to a record high of $30.62 billion in June because of rising oil prices, the government reported Friday. But the strength of U.S. exports bolstered the view of analysts who believe a rate hike is unlikely.

"The real surprise is the strength in exports," Jay Bryson, global economist for First Union, told CNNfn.com Friday. "These sharp increases in computer-related exports corroborate recent U.S. industrial-production data that show marked strength in high-tech industries."

Fed watchers also have their eyes on the U.S. markets. Falling stock prices temper consumer spending, which would be good news for the Fed.

"Possibly we could see a little bit of profit taking because investors had been anticipating that when the Fed does meet next week that they won't raise interest rates," Sam Stovall, senior investment strategist for Standard & Poor's, told CNNfn's "Street Sweep" Friday. "And I think that's pretty much been built into stock prices, because financials have been the best performing group since the Fed last met in May and raised interest rates."

What does the future hold?

Looking beyond Tuesday's meeting, some economists believe the Fed is through tightening and actually could begin to ease off interest rates by the second half of 2001.

"I think the Fed is on hold tomorrow and for the foreseeable future. We've actually been proponents of the view for quite a while that the economy was going to moderate, and it was important for the Fed to be patient," Gerald Cohen, a senior economist at Merrill Lynch, told CNNfn's Before Hours program Monday. "And one of the dangers was if the Fed kept raising rates, that they would slow the economy a lot more than they would want. So we think that there are enough signs of moderation that the Fed will remain on hold, and we think that signs of moderation will continue. So we think the Fed will be on hold through the end of this year and into early next year."

|

|

|

|

|

|

U.S. Federal Reserve

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|