|

Wall Street takes a break

|

|

August 25, 2000: 4:54 p.m. ET

Light volume, little news leaves stocks drifting; Dow up, Nasdaq down

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - U.S. stocks fluttered between positive and negative territory all day Friday, with little impetus to gain momentum on one of the lightest trading days of the year.

Investors dug up selected stock bargains, but money was just being moved on corporate news, or to sectors, such as technology, which investors bet could weather any economic hiccups.

"There's nothing terribly significant driving the market," said David Katz, chief investment officer at Matrix Asset Advisors. "There are no overriding trends; there are a few company-related phenomena but, even then, it's not significant."

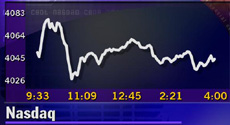

The Nasdaq fell for the first time in five sessions, losing 10.60 to end the day at 4,042.68. Still, the index gained 2.8 percent this week and is just 27 points shy of its breakeven point for the year. The Nasdaq fell for the first time in five sessions, losing 10.60 to end the day at 4,042.68. Still, the index gained 2.8 percent this week and is just 27 points shy of its breakeven point for the year.

The Dow Jones industrial average rose 9.89 to 11,192.63, gaining 1.3 percent for the week. The S&P 500 shed 1.85 to 1,506.46 but was still up 1 percent this week.

"There's no conviction for a sustained move but there's just an ongoing rotation," said Larry Rice, chief strategist at Josephthal & Co. "Everyone knows now that (interest) rates aren't going to go up for awhile so it's just a recycling of the same money." "There's no conviction for a sustained move but there's just an ongoing rotation," said Larry Rice, chief strategist at Josephthal & Co. "Everyone knows now that (interest) rates aren't going to go up for awhile so it's just a recycling of the same money."

In the coming week, investors will keep a close eye on the influx of economic data due to hit the market, but analysts expect no surprises.

Market breadth was narrowly positive. On the New York Stock Exchange, advancers nudged out decliners, 1,425 to 1,332, as more than 674 million shares changed hands. On the Nasdaq, winners outpaced losers, 2,131 to 1,758, as more than 1.2 billion shares were traded.

It was the lightest trading day on the New York Stock Exchange this year and the 10th-lightest day on the Nasdaq this year.

In currencies, the dollar was down against the euro but up versus the yen. Treasurys were mixed.

IBM boosts Dow

Technology stocks were mixed as investors sought out specific companies in the sector that will continue to show decent revenue growth in a slowing economy.

Leading the Dow's rise, IBM (IBM: Research, Estimates) gained 4-5/16 to 129-1/8. Analysts cited IBM as a company that would continue to attract investor interest due to its good valuation.

On the Nasdaq, WorldCom (WCOM: Research, Estimates) gained 1-1/8 to 36-1/16 but Oracle (ORCL: Research, Estimates) shed 1/16 to 84-5/8, Sun Microsystems (SUNW: Research, Estimates) lost 3 to 124-3/4 and Qualcomm (QCOM: Research, Estimates) slid 1-3/4 to 58-7/8. On the Nasdaq, WorldCom (WCOM: Research, Estimates) gained 1-1/8 to 36-1/16 but Oracle (ORCL: Research, Estimates) shed 1/16 to 84-5/8, Sun Microsystems (SUNW: Research, Estimates) lost 3 to 124-3/4 and Qualcomm (QCOM: Research, Estimates) slid 1-3/4 to 58-7/8.

"It's light, and people are looking for anything to do," said Bill Meehan, chief market analyst at Cantor Fitzgerald. "I think you'll continue to see money move into the tech group because that's where all the performance has been."

And Linda Jay, floor trader at RPM Specialists, told CNNfn that the market could setting itself up for a fall rally. (408K AIFF) (408K WAV)

In the day's news, Coca-Cola (KO: Research, Estimates) fell 1-5/16 to 56 after Salomon Smith Barney lowered second-half volume growth estimates for the soft drink maker to 4.5 percent from 5.5 percent. Still, the analysts left their earnings estimates unchanged.

More news from CNNfn.com for investors:

· Making your nest egg last

· Kandel on the 'boomers'

· Special Report: The Road to Riches

Eyes on Emulex

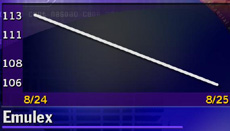

Stocks soured in late morning, led by telecommunications equipment maker Emulex (EMLX: Research, Estimates) after a press release -- later described as a hoax -- was distributed over the Internet. The release, which the company says falsely stated that it would restate earnings and that its  CEO was resigning, send Emulex shares tumbling by as much as 60 percent until Nasdaq halted trading. CEO was resigning, send Emulex shares tumbling by as much as 60 percent until Nasdaq halted trading.

When trading resumed at 1:30 p.m. ET, Emulex shares recovered most of the loss; for the day, it was down 7-5/16 to 105-3/4.

"People were rattled by Emulex because if it's that easy, is it going to happen more and that took some of the steam out of the Nasdaq," said Josephthal's Rice.

Economy sees smooth sailing, for now

The U.S. economy grew at a 5.3 percent annual rate in the second quarter, the Commerce Department said Friday, above the 5.2 percent estimated a month ago but a bit weaker than Wall Street forecasts. The price deflator, a key measure of inflation, edged up to 2.6 percent, a shade above economists' estimates.

Also on the economic front, Federal Reserve Chairman Alan Greenspan made no specific comments about interest rates when he kicked off an annual meeting of world central bankers in Jackson Hole, Wyo. Greenspan did say that high rates of productivity growth that have helped boost the U.S. economy's performance and hold down inflation show few signs of tapering off.

"There might have been a little interpretation into the comment where he (Greenspan) says productivity will slow at some point, causing the market to not have the catalyst to go (significantly) higher today," said Barry Hyman, chief market strategist at Ehrenkrantz King Nussbaum.

Razorfish gets sliced

Razorfish (RAZF: Research, Estimates) fell 7/8 to 13-11/16 after the Internet consulting firm said that Mike Pehl, company president, will resign. Analysts at Deutsche Banc Alex. Brown downgraded the firm to "buy" from "strong buy."

Sycamore Networks (SCMR: Research, Estimates), a maker of equipment used in fiber-optic networks, fell 7-3/16 to 150-13/16.

The company reported results for its initial fourth quarter as a public company that topped expectations. The company earned 8 cents per share, excluding special charges. That was 2 cents a share better than the forecast of analysts and improves on the loss of 4 cents a share in the year-earlier period.

|

|

|

|

|

|

|