|

IPO Focus: Top IPOs of the year

|

|

August 27, 2000: 8:06 a.m. ET

Networking IPOs are year's hottest so far; 'old economy' up, dot.coms falter

By Staff Writer Luisa Beltran

|

NEW YORK (CNNfn) - Investors looking to score big in this year's go-go IPO market have thus far found a wide range of new issues to their liking. Companies ranging from 'old economy' retailers to highly technical computer networking firms have waltzed onto Wall Street to find investors playing a welcoming tune.

But while networking and infrastructure deals soared, Internet-related deals, such as e-tailers and business-to-business companies -- the stalwarts of last year's new issues market -- have floundered as investors began looking past their Internet sizzle for more concrete factors, such as revenues, products and earnings.

So far this year, 359 IPOs have raised $84.5 billion, nearly double the amount raised by last year's new issues. By Aug. 25 last year, 336 IPOs had raised just $45.7 billion, according to data from CommScan, a New York-based investment banking research firm.

The new issues market's momentum is expected to continue straight through the fourth quarter with roughly 280 deals in the pipeline that are expected to raise another $37.268 billion, CommScan said.

"It's a good market and rolling right along," said John Fitzgibbon, editor of WorldFinanceNet.com. "We've gotten out of the grips of dot.com insanity and moved on to other deals. This underscores the resiliency of the IPO market."

Networking

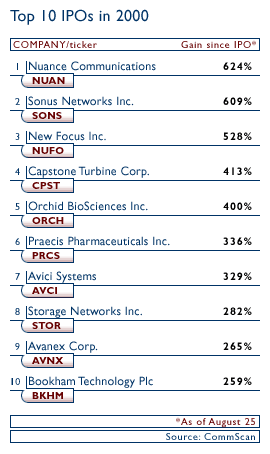

The networking sector continued to show its dominance this year, ranking as the IPO market's hottest industry through the first eight months.

Simply put, networks are the way computers send and receive data with each other. Such companies often toss around highly technical terms as bandwidth, backbone and fiber optics, but that clearly has not fazed savvy investors.

"Networking is the single largest area of growth in this economy," said Ben Holmes, president of IPOpros.com. "Everything is connected at some point. If you believe the networked world is growing then you have to bet on these networking plays."

Sonus Networks emerged as one of the year's hottest networking deal and is running neck and neck with Nuance Communications for the year's top prize. Sonus has climbed nearly 600 percent since going public on May 25, when it priced 5 million shares at $23 each, above the target range of $19 to $21, via underwriters led by Goldman Sachs. Its shares closed Friday at 163.

Westford, Mass.-based Sonus Networks (SONS: Research, Estimates) offers voice infrastructure products to communications service providers such as long-distance carriers, local exchange carriers and Internet service providers as a means to speed network traffic. The technology lets customers deliver voice services over packet-based networks.

Investors jumped on the Sonus deal because it marked a transformation in how traditional copper phone lines are now being upgraded, analysts said. Packet-based networks are an alternative to traditional circuit-switched telephone networks that have been in use since before the advent of the Internet but cannot handle high volumes of online traffic.

"In the past, the phone network was mostly for voice -- with the line open all the time between two callers -- but now everything, voice included, is being reduced to packets of data," said Steve Harmon, chief executive of Internet investment firm Zero Gravity Group (e-harmon.com).

Voice interface software

Nuance Communications, the year's other hot deal, is a combination of infrastructure and telecommunications. On April 12, the company sold 4.5 million shares at $17 each via underwriters led by Goldman Sachs.

Nuance (NUAN: Research, Estimates) shares have since risen over 600 percent to a Friday close of 123-1/8. The Menlo Park, Calif.-based company develops voice interface software for computer networks allowing businesses to automate such information as stock quotes, home banking and travel planning.

Where heavyweights such as International Business Machines (IBM: Research, Estimates) and Lucent Technologies (LUC: Research, Estimates) have failed, Nuance successfully offers voice services software that lets users speak over the Internet to contact a corporation, Harmon said.

"Very few have been successful," Harmon said. "Nuance is really defining voice interface."

Only Lernout & Hauspie Speech Products (LHSP: Research, Estimates) has achieved a measure of success in the voice interface software business, Harmon said.

Nuance's technology is based on 10 years of research by SRI International, which held a 10 percent stake in the deal while Cisco Systems took a nearly 8 percent stake.

Best first day

WebMethods Inc. generated the year's strongest first-day performance thus far, gaining 505.5 percent in its debut. WebMethods (WEBM: Research, Estimates) sold 4.1 million shares at $35 each via underwriters Morgan Stanley Dean Witter on Feb. 11.

Fairfax, Va.-based WebMethods develops infrastructure software and services that let companies achieve business-to-business integration, allowing them to work more closely with customers, partners and suppliers.

While WebMethods may be the year's top gainer, it didn't produce the strongest first day of all time. That title still goes to VA Linux (LNUX: Research, Estimates), which rose 697.5 percent in its December debut.

Telecom

Telecoms seemed to display split personalities this year. Infrastructure deals, or anything connected with fiber optics, emerged as the closest thing to a sure bet in the market. However, service providers took a hit after the 10.6 billion offering from AT&T Wireless in April.

On April 26, AT&T Wireless priced 360 million shares at $29.50 per share, the middle of its expected pricing range via underwriters led by Goldman Sachs, Merrill Lynch and Salomon Smith Barney. However, AT&T Wireless has consistently traded below its offer price and has fallen nearly 20 percent since its debut.

Before the AT&T Wireless (AWE: Research, Estimates) deal in April, service providers such as Alamosa PCS Holdings -- which went public in February -- usually managed a strong first day and sustained a good aftermarket performance. But such deals are now floundering, analysts said.

"AT&T Wireless was the bullet," said Corey Ostman, co-chief executive of Alert-IPO.com. "The service providers used to do well."

Alamosa PCS Holdings (APCS: Research, Estimates), a Sprint affiliate, sold 10.7 million shares at $17 each in February and the deal soared 66 percent in its first day. The company reached a year high of 43-5/8 in March, fell to 13 in June and is now trading in the 20s.

"Wireless stock valuations haven't been very good this year," said analyst Sean Butson of Legg Mason.

Wireless stocks exploded in 1999 but shares have traded relatively flat in 2000 affecting wireless new issues, Butson said.

"The performance of stocks after their IPOs has not been very large," he said.

The biotech boom

Biotechnology deals rebounded this year, producing one of the strongest sectors in the new issues market. So far nearly 50 biotech companies have completed their IPOs on the Nasdaq, raising $4.7 billion.

Globally, 71 biotech deals raised $5.9 billion, far outpacing the 21 deals in 1999 that raised $915 million, according to data from BioCentury Publications Inc., a Belmont, Calif.-based information services company targeting the biotech and pharmaceutical industry.

The success of the genome project caused biotech shares to soar and forced the IPO market to take notice. The year's hottest deal came from Orchid BioSciences Inc. (ORCH: Research, Estimates), a genome deal, which raised $48 million after selling 6 million shares at $8 each. Orchid closed its first day up 2 at 10 but has blossomed since. Through Friday, Orchid has more than quadrupled its offer price, gaining 400 percent.

"You can expect more biotech coming into play," WorldFinanceNet.com's Fitzgibbon said. "Biotechs have done well in the broad market. It's one of the better performing sectors of the market and when that happens you start looking for IPOs."

Death of the dot.com

Internet deals were all the rage in 1999, but their fortunes dwindled when investors became more discerning, looking beyond the buzz to whether companies actually had products, revenue and a sustainable business model. E-tailers took a particularly hard hit in 2000 with the most notorious deal from Pets.com.

The online retailer has fallen over 90 percent since its February IPO and emerged as nearly the worst performing new issue this year, according to CommScan.

On Feb. 11, Pets.com (IPET: Research, Estimates) sold 7.5 million shares at $11 each. The deal traded flat and then died in the aftermarket, trading Friday at 15/16.

The e-tailer of pet supplies received much attention with its campy advertising campaign, which features the popular sock puppet. The company also bought pricey spots in the Super Bowl.

"This is an example of a pretty good brand name," Ostman said. "It just wasn't interesting."

Another notoriously bad deal came from Buy.com (BUYX: Research, Estimates) which actually produced a strong first day, climbing 93 percent, on Feb. 8 after selling 14 million shares at $13 each via underwriters led by Merrill Lynch. However, the company couldn't sustain the gain, and has fallen nearly 80 percent in the aftermarket, and is trading at 2-11/16.

The 'old economy' rebirth

The failure of e-tailers, such as Pets.com, caused many investors to reconsider investing in anything Internet without looking at fundamentals such as revenue and losses -- a notion that led to a flurry of successes for 'old economy' stocks such as Krispy Kreme Doughnuts Inc. and Metlife Inc.

On April 5, the doughnut giant launched its IPO selling 3 million shares at $21 each, surging nearly 50 percent in its first day and has since gained nearly 280 percent.

The Winston-Salem, N.C.-based company has been selling doughnuts since 1937. Krispy Kreme (KREM: Research, Estimates) sells nearly 20 different types of doughnuts primarily in stores in the South and Southwestern states. On Aug. 24, the company reported that profits had tripled and that sales had surged nearly 40 percent.

However, many analysts continue to downplay the company's prospects.

"What's the growth capacity for doughnuts?" said analyst Angelish Kumar, of 123Jump.com. "The market for Krispy Kreme is tremendously overvalued. As far as where they are going to be in five years, a doughnut is a doughnut. It's not like we are feeding news over cell phones."

However, Zero Gravity's Harmon said the company's growth is based on a good franchise, positive income and a strong brand. "As long as they are making good sales, who cares?" he said. "There are lines out the door for these things. The proof is in the doughnut."

Another strong 'old economy' stock, Metlife Inc. also began trading in 2000 as a demutualized life insurance company. Another huge deal, the Metlife (MET: Research, Estimates) IPO raised $2.88 billion after selling 202 million shares at $14.25 each. The deal gained just 5 percent on its first day but has since surged over 60 percent.

"It was a big float so you can't expect moonshots out of these," Fitzgibbon said. "But there is always room for quality deals."

|

|

|

|

|

|

|