|

Shy on savings in your 50s?

|

|

August 28, 2000: 9:14 a.m. ET

Although hard, playing catch-up near retirement has a silver lining or two

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - At 50, Barbara Tom Jowell was staring at a poorly funded future. Newly divorced from a man who declared bankruptcy, the Midland, Texas housewife was not receiving alimony and hadn't worked for 25 years. She did have $200,000 from an inheritance, $50,000 in home equity, volunteer experience at fund-raisers and a whole lot of fear.

"I was panicked," said Jowell, now 62. "My mind was locked in shock."

She knew she had to find work. But beyond that, like a lot of Americans in their 50s and 60s whose savings come up short, she had to do three things: save aggressively, cut expenses and delay retirement.

Today, after working more than a decade as a fund-raising consultant and seminar leader, Jowell has turned her $200,000 into $700,000, saving and investing at least a quarter of her income every year.

"I've been very, very careful and very diligent," she said. Jowell's been lucky, too, given that she has enjoyed the fruits of a prolonged bull market.

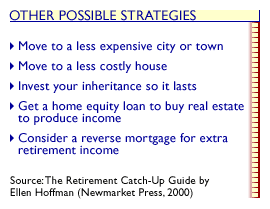

But she hasn't just relied on Wall Street. She also moved to a less expensive home, built up two businesses and plans to work at least another five years before retiring.

Cook up more dollars, but don't eat

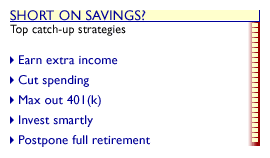

There's no magic bullet when it comes to playing catch-up, experts say. Maximizing your 401(k) contributions, while essential, is not enough.

Beyond that, there are five things you should consider doing: Earn more, save more, spend less, invest smartly and adjust your expectations about when, where and how you retire. Beyond that, there are five things you should consider doing: Earn more, save more, spend less, invest smartly and adjust your expectations about when, where and how you retire.

Like being on a sugar-free diet at Hershey Park, none of these options may sound very appealing. But within each are some creative solutions that may be easier than you think. And some even come with a silver lining.

That may be good news for the 49 percent of U.S. workers age 55 or older who have saved less than $150,000 for retirement, according to the 2000 Retirement Confidence Survey by the American Savings Education Council.

Do more with what you've got

For starters, experts say, take a hard look at your cash flow.

"There's always surplus in there somewhere," said Burlingame, Calif.-based CFP Barbara Steinmetz. "A latte everyday is an IRA."

Next, if you haven't already, commit to maxing out your 401(k). Coupled with any employer matches, "that's a sizeable chunk of one's income," said Sun Prairie, Wis.-based certified financial planner Terry Balding.

For those who teach or work for a nonprofit or government agency, your 403(b) or 457 plan allows you to contribute more than the annual maximum for a few years prior to retirement if you failed to max out in prior years.

Whatever you do, Balding cautioned, "take on no new debt during this time."

"It's time to be more of an accumulator than a conspicuous consumer," Steinmetz said. "It's time to be more of an accumulator than a conspicuous consumer," Steinmetz said.

On the bright side, she added, if you've spent much of your adult life raising a family and putting your kids through college, chances are this is the largest income period in your life.

But if the college years are not over, "it's not the end of the world to have your kids enter a work-study program or take out a loan," she said.

Get aggressive

After finding more money to invest, the next step is to reassess how it should be invested.

"If the numbers aren't working, reach for more investment return," said Boca Raton, Fla.-based CFP Mari Adam. "This is a very powerful tool at your disposal."

Click here for three sure-fire portfolios.

Consider this, said Debra Neiman, a certified financial planner based in Wakefield, Mass. If you have a fixed annuity or bond paying 4 percent and inflation is running at 2 percent, you're only netting 2 percent. If inflation goes any higher, "You run the risk that you'll lose purchasing power," she said.

Neiman and Adam recommend you reduce your bond investments, guaranteed income contracts (GICs) or conservative fund holdings like Vanguard Wellington if they make up a sizeable portion of your retirement money. "You want to push yourself up the scale. You're talking about exponential function," Adam said.

That means increasing your exposure to equities, and adopting a more aggressive investment strategy ... but not a foolish one. That means increasing your exposure to equities, and adopting a more aggressive investment strategy ... but not a foolish one.

"Don't go beyond your risk tolerance," Steinmetz cautioned.

And don't be unrealistic about potential returns, Balding added. To downsize overly bullish expectations and to make clients feel better about the returns they do get, he reminds them that the average annual return on large-cap stocks over a 40-year period is 10 percent; for small-cap stocks it is 12 percent.

Show me more money

Of course, the more you make, the more you have to save. That's why planners suggest you consider a second job or some freelance projects to bring in extra income. If you're married and have a non-working spouse, he or she might consider getting a job as well.

Whatever you choose, put the added income toward your long-term savings. Sit down with an accountant or planner to see where it makes the most sense to put your money, such as in a Roth IRA and a brokerage account. You can contribute up to $2,000 a year in after-tax dollars to a Roth if your adjusted gross income is less than $95,000 as a single person or $150,000 as a couple. When you're ready to retire, your Roth distributions will be tax-free.

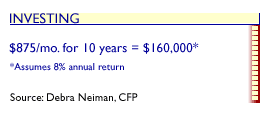

An extra $10,000 a year invested over 10 years on a monthly or weekly basis can really add up, the planners said.

There's an added benefit as well. Taking on outside projects may "plant the seed of something you can do in retirement," Adam said. And that option has both psychological and financial benefits.

For a lot of people, work equals self-worth. "When (work) ceases, it's difficult on the psyche," Neiman said. For a lot of people, work equals self-worth. "When (work) ceases, it's difficult on the psyche," Neiman said.

Steinmetz put it more bluntly: If all you're planning to do is play golf until you can't see the ball, "you're on a crash course."

Jowell, for one, is not rushing her retirement. She loves her work, she said. "I'm not a bridge player. I have to have something to do everyday."

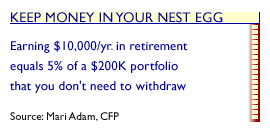

Financially, extra income during retirement means your nest egg can continue to accrue. If you make $10,000 a year, that's a 5 percent yield on a $200,000 portfolio that you don't have to withdraw. "It takes a big amount of money to produce that," Adam said.

Plus, you'll be in good company if you keep your foot in the work world. Twenty-three percent of Baby Boomers surveyed by AARP said they expected to work at least part-time during retirement for the income, and more than a third said they would do so because they enjoyed working.

Consider a new job altogether

Sometimes, if you're near retirement and need more money, it may be worthwhile to get a higher paying job, especially if you're paid below-market rates and think you may work a few years beyond your original retirement date, Adam said.

A lot of people stay at a job because they've got a pension coming to them. "But look at what you're giving up in pension benefits, if any," she said. "Don't stay for a bad pension."

If you do take a new job, you may not qualify to participate in a 401(k) for as much as a year. If that's the case, Adam said, put $10,500 - the maximum allowable contribution to a 401(k) in 2000 -- in a brokerage retirement account for that period. You don't get the contribution deducted from your gross income, but your money will only be taxed at the capital gains rate, which is probably less than the income tax rate you will pay on money taken from your retirement plan.

A dose of reality and optimism

However you choose to save, don't waste time on the "couldas, shouldas or wouldas," Steinmetz said. There are plenty of good reasons why your nest egg is lacking, and many have to do with your accomplishments and obligations in life, such as building a business, raising a family, helping your parents or owning a home.

Click here for more from CNNfn.com's special report The Road to Riches.

No one will tell you playing catch-up is easy, but few things in life are. Consider all the other constraints on your time and actions that you have handled successfully up until this point.

Consider this, too, Steinmetz said. When it comes to saving, "It's never too late to start. Don't give up."

|

|

|

|

|

|

|