|

Chase buying J.P. Morgan

|

|

September 13, 2000: 2:46 p.m. ET

Stock deal valued by firms at $33B joins two of banking's biggest names

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - Chase Manhattan Corp. is buying J.P. Morgan & Co. in a stock deal that unites two of the nation's biggest banks and continues to reshape the rapidly consolidating financial services industry.

The new company will be called J.P. Morgan Chase & Co., keeping two of the most established names in U.S. banking. However, the retail banking operations will retain the Chase Manhattan name, and Chase will fill most of the positions on the board of the combined company.

|

|

VIDEO

|

|

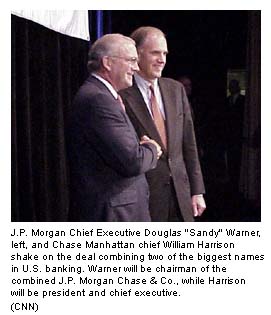

William Harrison, CEO, Chase Manhattan, and Douglas Warner, CEO, J.P. Morgan, chat with CNNfn about the merger.

William Harrison, CEO, Chase Manhattan, and Douglas Warner, CEO, J.P. Morgan, chat with CNNfn about the merger.

|

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

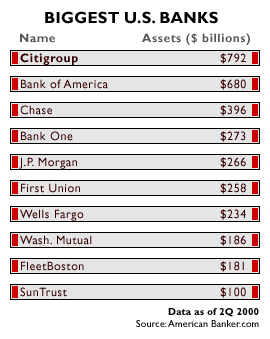

The combined company would have $660 billion in assets, which keeps it as the third-largest bank holding company in the country, the same as Chase's current ranking. The two companies had combined 1999 net income of about $7.5 billion on revenue of about $31 billion.

Under the deal, Morgan (JPM: Research, Estimates) shareholders are to receive 3.7 shares of Chase (CMB: Research, Estimates) stock for each of their shares. Based on Tuesday's New York Stock Exchange closing prices, the companies said the deal is valued at $207 a share, or about $33 billion, a 16.7 percent premium over Morgan's regular-hours close of $177.75.

The details of the deal sent Morgan shares lower Wednesday, as the anticipation of a higher price disappeared. In early afternoon trading Morgan was down $6.75 at $178.75, while Chase shares fell $2.75 to $50.06. The lower prices brought the value of the deal down to about $29.4 billion, and the premium for Morgan shareholders to about 3 percent. The details of the deal sent Morgan shares lower Wednesday, as the anticipation of a higher price disappeared. In early afternoon trading Morgan was down $6.75 at $178.75, while Chase shares fell $2.75 to $50.06. The lower prices brought the value of the deal down to about $29.4 billion, and the premium for Morgan shareholders to about 3 percent.

The combined company will retain J.P. Morgan Chief Executive Douglas Warner as chairman and Chase Chairman William Harrison as president and chief executive, the companies said in announcing the deal Wednesday morning.

Financial buzz to continue?

J.P. Morgan's history: colorful and powerful

There has been speculation in recent weeks that other institutions, such as Germany's Deutsche Bank, might by eyeing a bid for Morgan, but that opportunity likely vanished with the announcement of this deal.

The German bank will not make a counter-offer, a banking industry source said in Frankfurt Wednesday morning, according to Reuters. Hostile bids are extremely rare in the banking business.

"This is the kind of market where everyone is talking to everyone else," Warner told CNNfn's Ahead of the Curve program Wednesday. "The only conversation we had that is important today is the one that Bill (Harrison) described to you, and we're very pleased about it.

"From here on we're joined at the hip and we are very excited about that prospect," he added.

The deal also likely ends Chase's pursuit of a major investment banking house or securities firm. A bid for a company such as Merrill Lynch & Co. (MER: Research, Estimates) has long been the center of rumor and speculation of Chase's desires. Harrison said that he wouldn't rule out fill-in acquisitions, but the Morgan deal gives the company what it was seeking going forward. The deal also likely ends Chase's pursuit of a major investment banking house or securities firm. A bid for a company such as Merrill Lynch & Co. (MER: Research, Estimates) has long been the center of rumor and speculation of Chase's desires. Harrison said that he wouldn't rule out fill-in acquisitions, but the Morgan deal gives the company what it was seeking going forward.

"I think there will be less than a less than handful of end-game winners in this space. This gives us platform to be one of those winners," Harrison told analysts. "I don't have to answer questions half dozen times a day -- 'When are you going to do a big deal?' This is it."

Chase has made two smaller acquisitions in the last year, buying West Coast investment firm Hambrecht & Quist Group for $1.35 billion in cash in a deal announced almost exactly a year ago, and paying $7.7 billion in cash and stock for British investment house Robert Fleming Holdings in a deal announced in April.

The companies say they expect the deal to close in the first quarter of next year and to not add to Chase's earnings per share until the second year after completion.

Chip Dickson, banking analyst at Lehman Brothers, told CNNfn's Before Hours Wednesday that he expects to see a 10-to-20 cent a share hit on earnings next year. Analysts surveyed by First Call forecast that Chase would make $4.45 a share next year, up from the forecasted profit of $4 in 2000. Chip Dickson, banking analyst at Lehman Brothers, told CNNfn's Before Hours Wednesday that he expects to see a 10-to-20 cent a share hit on earnings next year. Analysts surveyed by First Call forecast that Chase would make $4.45 a share next year, up from the forecasted profit of $4 in 2000.

Dickson said the deal should be a good one for Chase, despite the somewhat lofty price.

"What the deal does is it gives Chase greater position or stronger positions in the secular growth areas of the financial services business, in terms of capital markets, investment banking," he said.

Merrill Lynch's Judah Kraushaar, considered one of Wall Street's leading banking analysts, said that while fears of the short-term earnings hit may depress prices in the short run, Chase's share price can be expected to gain on the deal. He reiterated a "buy" rating on the stock.

"This deal should finally resolve long running investor concerns that CMB would be force to pay an exorbitant price to enter the equities business either by acquisition or internal investment," he said Wednesday.

But others analysts said that the combination of the two entrenched organizations will be difficult, and that they believe that the current share prices will be difficult to support once the speculation on future mergers is removed.

"Chase paid top dollar and this is going create substantial strains on Chase," Charles Peabody, analyst with Mitchell Securities, told CNNfn's In the Money program Wednesday. "There's tremendous execution risk going forward. I think it's going to be a very difficult cultural fit."

Andy Collins, the banking and brokerage analyst at ING Barings, downgraded both companies' shares due to integration problems, although he kept Chase with a buy rating rather than his previous strong buy recommendation.

Companies see a new emphasis on growth

The two companies anticipate merger-related costs of $2.8 billion before taxes, and annual savings of $1.5 billion, with about a third coming from real estate, a third from systems integration, and a third from reduced staffing.

The companies also foresee about $400 million in incremental revenue growth. That growth is more important to the deal than the cost savings, Warner and Harrison said in their interview on CNNfn Wednesday.

"That (emphasis on growth) is new," Warner said. "We've been building. We've been transforming. We've been made profitable. But growing is the challenge now, and this is the best way in my judgment by far to grow our business." (396KB WAV) (396KB AIFF) "That (emphasis on growth) is new," Warner said. "We've been building. We've been transforming. We've been made profitable. But growing is the challenge now, and this is the best way in my judgment by far to grow our business." (396KB WAV) (396KB AIFF)

Company officials said the growth will come from being able to offer Morgan's broader range of products to Chase's much larger client base.

"Combined, we stand ready to accelerate far beyond what either of us could expect alone or for that matter, with any other partner," Warner told analysts.

Latest in string of deals in sector

The merger, if successful, would be the latest in the financial services industry. Just last week, competitor Citigroup Inc. (C: Research, Estimates) agreed to buy Associates First Capital Corp. (AFS: Research, Estimates), the nation's largest consumer finance company, for about $31 billion in stock.

Last month, Credit Suisse Group agreed to pay $11.5 billion in cash and stock for Donaldson, Lufkin & Jenrette Inc. (DLJ: Research, Estimates). That deal followed Swiss bank UBS AG's agreement to buy Paine Webber Group Inc. (PWJ: Research, Estimates) for about $11 billion.

Warner and Harrison told CNNfn talks with Chase have been going on in earnest for two-to-three weeks.

"We took some of our most senior people, including Sandy and I, and have worked very hard over the last two or three weeks and very quickly determined that this was great for our shareholders and here we are today," Harrison said. The two banks acted as their own advisers on the deal.

Morgan, founded in the mid-19th century, has long been a major participant in international finance. It helped finance U.S. Steel, General Electric Co. and American Telephone & Telegraph (now AT&T Corp.), among other major corporations. It also made a then-daring 10 million pound loan to the besieged government of France during the Franco-Prussian War in 1870.

J.P. Morgan has tried to remake itself as more of an investment bank than a commercial bank in recent years. But analysts said that despite its reputation and abilities, it did not have the size to remain independent in the current environment.

"J.P. Morgan had a fairly strong independent streak," said Mitchell Securities' Peabody. "In the last two-to-three years, they decided they were going to try to get their brand name out there to and leverage that into a business stream of revenue that would have allowed them to remain independent. It didn't work. Their second goal: If you can't do it internally, let's command an extreme premium for that brand name. And they did that. Chase paid top dollar."

Chase also has sought to move further into investment banking, with somewhat limited success, which created pressure on it to make a major acquisition. But it has been strong in corporate as well consumer banking in the New York area. The consumer banking operations will be virtually unaffected by the proposed Morgan combination, other than being less important in the overall scheme of the company.

Harrison said that presence at the retail banking level is an important contributor to the company, even if it is not a natural fit with the greater emphasis on wholesale banking and investment banking services.

"We like the diversity of earnings the consumer business gives this broad-base platform," he said.

The current Chase is the child of three New York banks that combined over the last decade -- Chemical Bank, which purchased Chase Manhattan in 1996 but kept the better-known Chase Manhattan name, and Manufacturers Hanover, which Chemical bought in 1991.

Chase's Harrison said that the company's experience in those last two big deals leaves it in good shape to complete this one without any significant problems.

"It (integration of merged businesses) is an art, it's not a science," Harrison told analysts. "But we think we're pretty good artists because we've been through a lot of them.

"Give us credit for being good merger integrators," he added later in the presentation.

One key to the integration, Harrison said, is that the companies have already selected the top 40-to-50 executives to lead the combined firms, and what positions they will fill.

"This is not the way most mergers are done," Harrison said. "But it enables you to go into day one with commitment of new management teams. If you go into day one without this, you go in with people on the defensive, and it takes you six months or a year to recover."

The full roster was not identified, although the Wall Street Journal has reported that most of the positions are going to Chase executives. One move that is already known is Peter Hancock, who had been J.P. Morgan's chief financial officer, resigned from the company late Friday. Other top executive departures are expected soon.

"I think that they'll have to cut some heads at J.P. Morgan," said Collins of ING Barings. "That's not particularly good for the franchise. I'm not too happy to see it."

-- Click here to send e-mail to Chris Isidore

|

|

|

J.P. Morgan's history: colorful and powerful - Sept. 13, 2000

Financial buzz to continue? - Sept. 13, 2000

J.P. Morgan stock jumps on acquisition speculation - Sept. 6, 2000

Dresdner in talks to buy Wasserstein Perella - Sept. 12, 2000

Citigroup buys Associates - Sept. 6, 2000

Credit Suisse to buy DLJ for $11.5B - Aug. 30, 2000

UBS to buy PaineWebber - July 12, 2000

After PaineWebber, what is next? - July 12, 2000

Citigroup, Chase beat forecasts - July 19, 2000

J.P. Morgan beats 2Q forecasts - July 13, 2000

Chase to buy Fleming for $7.7 billion - Apr. 11, 2000

Chase to buy Hambrecht & Quist for $1.35B - Sept. 28, 1999

Chasing Merrill Lynch - Mar. 19, 1999

|

|

|

|

Chase

J.P. Morgan

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|