|

More, better 401(k)s

|

|

September 20, 2000: 6:01 a.m. ET

Tight labor market helps shorten waiting periods for eligibility

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - Maybe you don't have headhunters hounding you, and that voodoo that you do won't double your salary at a new job. But you still might benefit from some of the financial plums bestowed on job seekers by the tight labor market.

Key among them is a trend toward reduced waiting periods for 401(k) eligibility, something that recent government policy changes have encouraged. That means you may not have to sit on the sidelines for six months to a year in a new job while more tenured colleagues boast about how much they're saving and how great the tax break is.

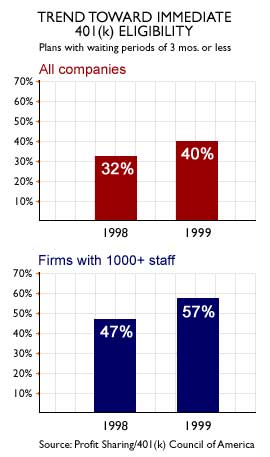

In 1999, 40 percent of companies let their employees join their 401(k) plans within three months of hiring, up from 32 percent in 1998, according to a survey by the Profit Sharing/401(k) Council of America (PSCA). The jump is even bigger among larger companies, 57 percent of which let workers join within the first three months, up from 47 percent the year before.

Nowhere to go but up

PSCA President David Wray and other 401(k) experts expect those percentages to increase as more companies seek to meet marketplace demands.

"The war for talent is driving people to make their benefits programs more attractive," said Tom Rossi, a defined-contribution-plan consultant with human resources research firm Watson Wyatt Worldwide.

Indeed, Wray said, "Employers are looking ahead. They want to find out what people want before they walk in the door."

All for one, one for all

And one thing job applicants are requesting more and more, experts say, is faster access to a company's 401(k).

But it's not something that can be negotiated on an individual basis. But it's not something that can be negotiated on an individual basis.

No matter how desirable you are as a candidate, a company can't make an exception just for you, said Peter Starr, a managing director with Cerulli Associates, a Boston-based financial services research firm. That's because the waiting period for a 401(k) is something that must be written into the plan.

"Everyone has to be treated the same," Wray said. But the plan can be amended at any time and, he added, "eligibility is not a big expense."

Unless, that is, the company has high turnover among new employees. Firms with a busy revolving door "will never have immediate eligibility. Somebody has to pay for opening and closing all those accounts," Wray said.

Match that

Expense also becomes a factor if a matching contribution is involved. The trend among companies is to make employees eligible for matches as soon as they join the 401(k) plan.

But companies concerned about retaining employees will have a longer vesting schedule for their matches, since vesting and eligibility for plan participation are two separate issues.

So even if you're granted immediate eligibility into a 401(k) plan - which generally means you can start contributing the first day of a month within the first three months of your hire - if you leave the company before a certain period of time you will forfeit some or all of your matches.

Tight labor market or no, "companies are extremely reluctant to change their vesting schedules," Wray said.

A little cash for your troubles

But they may be willing to cut you a deal if their waiting period is too long for your needs.

Let's say you want to close the deal on a new job, but you must wait one year before you can participate in the 401(k). That may give you pause, especially if you're well into your peak earning years.

After all, if you change jobs five to seven times in a 30-year career, that's potentially five to seven years - or up to 23 percent of your working life - when you're not eligible for a tax-qualified, employer-sponsored retirement plan.

If you're a solid candidate and a good negotiator, you might consider asking for a one-time sign-in bonus or a slightly higher salary to offset the loss, Rossi said.

"That's not an unrealistic tactic," especially if you're in hot demand, added Richard Applegate, a registered investment adviser for company retirement plans.

Figure into your calculations the amount of the match you'd miss out on for that period, plus what you will lose in taxes by not being able to deduct your contributions from your gross income, said Ted Benna, president of the 401(k) Association.

Make the most of your year

If you do secure a deal, don't just take the money and splurge. Use it to keep up your retirement investments until you can open your 401(k) account, experts say.

If you qualify for a deductible IRA, use it for that first, Benna said. If not, then try for a Roth IRA if your salary doesn't disqualify you.

Or, as a third resort, invest the money in stocks or funds along with regular biweekly or monthly automatic deductions from your bank account.

Whatever you do, Benna said, you want "to make sure you don't lose the savings habit."

|

|

|

|

|

|

|