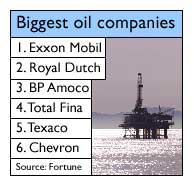

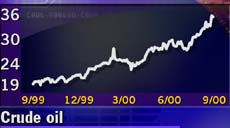

NEW YORK (CNNfn) - The world's biggest energy companies can't seem to catch a break. Oil prices jumped almost three-fold in a year. And profits at many of the integrated oil companies are expected to nearly double in the current quarter.

But stocks like Chevron, Texaco, and BP Amoco have all lost value over the last 52 weeks -- a period when all the major U.S. stock indexes rose. Some analysts now see opportunities among these inexpensive energy companies, many of which will show earnings growth this year to rival any tech firm.

"This is the time to be buying integrated oils," said Kate Warne, oil and energy analyst at Edward Jones.

It's about time. Shares of Texaco (TX: Research, Estimates), the nation's No. 2 oil producer, are down 5 percent in the last 52 weeks, a period when the price of a barrel of crude oil jumped to its highest levels in 10 years. Chevron (CHV: Research, Estimates) stock is down 16 percent in a year. BP Amoco (BP: Research, Estimates): off 4 percent.

Only Exxon Mobil (XOM: Research, Estimates) is higher, up 12 percent in a period when the S&P 500 made a 10 percent advance. Only Exxon Mobil (XOM: Research, Estimates) is higher, up 12 percent in a period when the S&P 500 made a 10 percent advance.

"It's not surprising that even though the major integrated oils are making money hand-over-foot, the market hasn't paid much attention," Warne said.

Companies likes Texaco, Chevron and Exxon Mobil explore and produce oil, making money as the commodity's price rises. But they also buy oil while purchasing futures contracts as a hedge against price increases. They are involved, to various degrees, along the entire oil production process from finding it to selling it at the pump. This diversification means fewer direct ties to oil prices. And diversification insulates these stocks from dramatic gains and losses in the commodity's price.

"Relative to some of the other companies they don't have the earnings leverage," Steve Curbow, who follows the oil industry for Independence Investment Associates, said of the large integrated companies.

As oil prices rise, the companies that simply drill and explore for the commodity stand to profit most. Every dollar change in the price of a barrel translates almost directly to earnings per share. Investors have made this translation.

Oil explorer Apache Corp. (APE: Research, Estimates) jumped 40 percent in the last 52 weeks. Rival Global Marine (GLM: Research, Estimates) is 70 percent higher in the period. Oil explorer Apache Corp. (APE: Research, Estimates) jumped 40 percent in the last 52 weeks. Rival Global Marine (GLM: Research, Estimates) is 70 percent higher in the period.

"These oil stocks that have huge runs, oil exploration, oil services, I think you sell them now and they pull back and stay down for years with the price of oil," Scott Bleier, investment strategist at Prime Charter LTD, told CNNfn's Market Call.

That said, many now think it's time for the large integrated oil companies to outperform. In a way, they already have, with stocks like BP Amoco and Atlantic Richfield (ARC: Research, Estimates) beginning to climb in late July. At the same time, the hard-charging exploration stocks have fallen from their highs in early September.

"The companies that have the biggest leverage suffer the most," Independence Investment Associates' Curbow said.

Ed Maran, oil analyst at A.G. Edwards, notes that the integrated oil companies, which pay dividends, typically attract conservative investors. Conversely, the smallest players tend to draw the most speculative investors, who bid up stocks ahead of the expected price surge.

Click here for a look at the entire sector

Hawks Industries (HAWK: Research, Estimates), the owner of several oil and gas producing properties, is up more than 450 percent in a year.

That's a far cry from giants like Exxon Mobil, a relatively inexpensive stock. The world's biggest oil producer is expected to earn $4.38 a share this year. Trading at about $85, Exxon has a price-to-earnings ratio of about 19.

Explaining the underperformance, Edward Jones' Maran believes the market is taking a long-term view of the big oil firms, pricing them on an outlook for oil at $18-to-$19 a barrel. Forecasting prices next year in the $25 range, Maran sees a piece of market inefficiency to exploit.

Maran likes BP Amoco (BP: Research, Estimates), for its long-term outlook and its diversification with natural gas. He says the company's presence in China and India create opportunities.

Edward Jones' Warne sees oil prices staying above $30 though year-end, with the average price in 2001 dipping to $23. She forecasts more crude supply on the market as world demand eases.

Warne's top pick is Exxon Mobil. She also likes BP Amoco and Royal Dutch Petroleum (RD: Research, Estimates). Warne's top pick is Exxon Mobil. She also likes BP Amoco and Royal Dutch Petroleum (RD: Research, Estimates).

Click here for a look at commodity prices

At this time last year oil prices were under $20 a barrel. Though off their lowest levels, prices were still weakened by light demand from Asian countries recovering from recession. Prices have climbed steadily since then as overseas economies improve and concerns about limited supply grow. Some fret that a cold winter could further pressure prices as consumers and business require more heating fuel.

With oil surging above $37 a barrel, Vice President Al Gore urged President Clinton Thursday to tap into the nation's strategic oil reserves in a bid to force down prices. Late Friday afternoon, the president agreed to release some of the reserves.

Before prices fall, the companies themselves will be posting some extraordinary results. Consider Exxon Mobil. The world's largest oil producer is expected to earn $1.14 per share in the quarter ended in September. That's up 84 percent from the 62 cents earned in the year-ago period. In the same quarter Intel (INTC: Research, Estimates), the world's biggest chip maker, is seen growing its profit by 46 percent. And Intel is a much more expensive stocks.

Still, not everyone is bullish on big oil.

"While the companies are enjoying record profitability, we would expects that to decline going forward and we'd expect it's as good as it gets," Mathew Warburton, oil analyst at UBS Warburg, told CNNfn's Market Call. "While the companies are enjoying record profitability, we would expects that to decline going forward and we'd expect it's as good as it gets," Mathew Warburton, oil analyst at UBS Warburg, told CNNfn's Market Call.

Warburton downgraded Exxon Mobil (XOM: Research, Estimates) last week.

In a note to clients Thursday, Abby Joseph Cohen, the influential Goldman Sachs strategist, took a more balanced view of on the sector.

"We are currently advising a moderate overweight, with an emphasis on oil services and a small number of integrated producers," Cohen wrote.

She said Goldman's crude team forecasts an average price per barrel of $23.50 next year, a price that some analysts says bodes well for the largest and most diversified of the oil producers.

* Disclaimer

|