|

U.S. taps oil reserve

|

|

September 22, 2000: 3:49 p.m. ET

Energy Secretary Richardson says U.S. to release 30 million barrels

|

NEW YORK (CNNfn) - President Clinton Friday authorized the release of 30 million barrels of crude oil from the Strategic Petroleum Reserve, marking the first time the U.S. has dipped into its reserves in nine years.

The move is aimed at lowering crude oil prices, which currently are at a 10-year high, and assuring Americans they will have enough energy to heat their homes.

However, industry experts are concerned that an infusion of crude oil may have little or no impact unless refiners, already stretched to their limits, can produce more heating oil. However, industry experts are concerned that an infusion of crude oil may have little or no impact unless refiners, already stretched to their limits, can produce more heating oil.

"We have worked with refiners to help them with transportation, with numerous other logistical initiatives so that they can get more product into the market," Energy Secretary Bill Richardson said. "I will be meeting next week with refiners, with petroleum executives, with many others -- heating oil suppliers, to ensure that we get this product reserve into the market."

Meanwhile, the U.S. Energy Department said that all 30 million barrels planned for release will be delivered by Nov. 1.

The department said it would ask for bids on Monday, with companies required to submit their bids by Friday. Awards of the crude oil will be made on Oct. 2 following negotiations with the highest bidders, the department said.

Click here for a look an outlook on oil industry stocks.

Analysts applauded the move, saying it would likely lower home heating bills $3-to-$5 a month while insuring the nation has more reserve oil in the long run to help keep prices stable.

"This is really pulling out the big guns. If you think about it, this is working at the margin with a very large volume, so it's going to have a very pronounced price effect," George Beranek, an oil industry analyst with Petroleum Finance Co., said.

Beranek said the deal to release the reserves is actually a "swap" deal in which winning bidders must agree to return the borrowed crude, plus a bonus percentage added to that, in 2001, when markets are expected to be less tight.

"Ultimately you will end up with a larger SPR," Beranek said.

On Friday oil prices fell ahead of the news, down $1.32 at $32.68 a barrel on the New York Mercantile Exchange.

Richardson made the announcement during a late Friday afternoon press conference.

"This is the right time to do this," Richardson said, citing the need to make sure the U.S. has enough heating oil to last the winter. He acknowledged an increase in oil production by the Organization of Petroleum Exporting Countries, but said "tremendous demand" for oil has muted the benefits of that increase.

Richardson said releasing 30 million barrels of oil into the market will likely add an additional 3 million-to-5 million barrels of heating oil this winter, and will also keep diesel truck drivers working.

"The supply boost will likely benefit everyone who drives a car," he said.

The decision comes a day after crude prices tumbled sharply on U.S. Vice President and Democratic presidential hopeful Al Gore's call for Clinton to release oil from the SPR to help ease the fuel and heating oil price pinch. Gore proposed that batches of five million barrels be released to help rebuild private oil inventories, which are near 24-year lows.

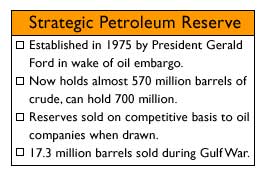

The 571-million-barrel reserve was used only once before, during the 1990-1991 Gulf War, when Iraq and Kuwait stopped pumping oil.

Congress set up the stockpile -- stored in underground salt caverns along the Gulf of Mexico -- after the Arab oil embargo.

Richardson said home heating oil inventories were 19 percent lower than a year ago nationwide, and 65 percent lower in New England, where people rely heavily on oil to heat their homes. Oil stocks have been tight for months despite some increased worldwide production by the OPEC oil cartel.

Gore's Republican opponent, Gov. George W. Bush of Texas, immediately criticized the release, saying the government reserve is "meant for a national emergency, a national war, a major disruption of supply," and not to influence the market.

OPEC member Saudi Arabia also criticized the move, calling Clinton's action "an election ploy requested by Al Gore."

Beranek said he didn't think Clinton's decision would affect ongoing talks with OPEC members on ways to achieve a more long-standing oil price reduction.

"OPEC has tried and has had many opportunities try to bring the price down," Beranek said. "At this point most OPEC member countries don't have much spare capacity. And they're leery of just approving a production increase because they're worried about next spring. What happens when all this oil is lying around and the demand goes down?"

What impact will it have?

Other analysts remain skeptical that a modest injection of government-owned oil into the market will have a serious impact on prices. Some have said it probably would have little more than a psychological effect as a signal from the government that it is willing to intervene.

American refineries use about 14 million barrels of oil a day and the country consumes 18.6 million barrels of oil products daily.

The president of the Organization of Petroleum Exporting Countries said Friday that any drawing down of U.S. reserves would cause only a temporary dip in world oil prices.

"Prices will fall, but the effect will be temporary," Ali Rodriguez, who is Venezuela's oil minister as well as OPEC's president, said in a televised interview.

He said the world market needs so-called sweet crude to ease shortages of products such as gasoline, while the U.S. strategic reserve mainly consists of solid crude.

-- from staff and wire reports

|

|

|

|

|

|

|