NEW YORK (CNNfn) - A hefty sell-off in Oracle sent the Nasdaq composite index tumbling to its lowest level four months Tuesday, losing more than 100 points, as investors showed concern about the pace of revenue growth in the leading technology sectors.

Analysts said there was no fundamental reason behind the selling; it comes on the heels of an analyst meeting late Monday, at which the company gave an upbeat outlook about its earnings and revenue for the next year.

The Dow Jones industrial average slowed its rally but still held gains as investors shifted money away from technology issues to blue chip stocks, placing bets that the moderating economy would still provide steady revenue growth.

Still, Wall Street had little immediate reaction to the news that the Federal Reserve's monetary policy-making body was leaving rates unchanged.

"It's not the Fed; It's all Oracle and it's taken the sector with it," said Barry Hyman, chief investment strategist with Weatherly Securities.

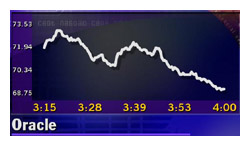

The Nasdaq composite index slump was led by Oracle, which fell $7.06 to $71.69, well off its $81.50 high of the session. The index plunged 113.06 points, or more than 3 percent, to 3,455.84. The Nasdaq composite index slump was led by Oracle, which fell $7.06 to $71.69, well off its $81.50 high of the session. The index plunged 113.06 points, or more than 3 percent, to 3,455.84.

An early rally sent the Nasdaq nearly 70 points higher after a report indicated that semiconductor sales were seeing stellar worldwide growth. But the report wasn't enough to generate a sustained tech rally. The index has now fallen for eight out of its nine last sessions.

Analysts were not overly concerned about the market's behavior, saying October tended to set the stage for a fourth-quarter rally. While it is not expected to repeat last year's stellar performance, analysts still expect the major indexes to stage a modest rally by year-end, and say the recent action is setting a bottom level from which stocks can rebound.

"It seemed to me that Wall Street analysts fired all their cannons this morning in defense of technology and look at the result," said Bill Meehan, chief market analyst at Cantor Fitzgerald. "Some of these stocks will get bailed out if they significantly beat expectations over the coming weeks but I also suspect there may be some further warnings announced. We're at significant risk of companies guiding analysts lower in terms of the fourth quarter and next year."

The Dow Jones industrial average advanced 19.61 to 10,719.74, with 18 out of 30 issues attracting buyers. The late selling spilled into the blue chip index, keeping it well off its earlier highs, when it surged nearly 150 points. The Dow Jones industrial average advanced 19.61 to 10,719.74, with 18 out of 30 issues attracting buyers. The late selling spilled into the blue chip index, keeping it well off its earlier highs, when it surged nearly 150 points.

The S&P 500 fell 9.77 to 1,426.46.

Market breadth was mixed. On the New York Stock Exchange, advancers topped decliners 1,517 to 1,342, as more than 1 billion shares changed hands. Losers outpaced winners 2,552 to 1,529 on the Nasdaq as more than 1.8 billion shares were traded.

The dollar rose against both the euro and yen. Treasury securities fell.

Oracle sends techs plunging

A late-day sell-off in Oracle sent technology stocks plunging. Oracle stock has now hit its lowest level in more than four months.

"What you have here is a revaluation of the technology sector to more reasonable levels, rather than a mass panic," said Meehan. "What you have here is a revaluation of the technology sector to more reasonable levels, rather than a mass panic," said Meehan.

Bearing the brunt of selling pressure on the Dow, IBM (IBM: Research, Estimates) fell $7.25 to $110.56. Other techs taking a beating included Microsoft (MSFT: Research, Estimates), both a Dow and Nasdaq component, falling $2.56 to $56.56, and Sun Microsystems (SUNW: Research, Estimates), tumbling $5.19 to $108.38.

An early rally was propelled by a report out Tuesday showing that worldwide sales of semiconductors jumped 53 percent to record levels in August, driven by strong growth in Asia and the Pacific and booming demand for Internet and communications devices.

Semiconductor-related issues jumped higher. Intel (INTC: Research, Estimates) gained 19 cents to $40.31, LSI Logic (LSI: Research, Estimates) rose 44 cents to $28.25, and Micron Technologies (MU: Research, Estimates) advanced 69 cents to $43.06.

"It's a pattern that's repeated virtually every day. At least today there was a reason to open higher," said Cantor Fitzgerald's Meehan. "This is not a good sign that every analyst was out pumping up their favorite tech stocks and here's the result."

Among analysts making positive comments about the tech sector, influential Goldman Sachs market strategist Abby Joseph Cohen said the backdrop for tech stocks was still favorable, with the economic deceleration setting up for a favorable new economic cycle.

But results warnings are still rolling in, with the latest coming from Xerox (XRX: Research, Estimates), which said it expects to post a third-quarter loss of 15 cents-to-20 cents a share. That's way off from the 12-cent-a-share profit forecast of analysts, according to earnings tracker First Call. But results warnings are still rolling in, with the latest coming from Xerox (XRX: Research, Estimates), which said it expects to post a third-quarter loss of 15 cents-to-20 cents a share. That's way off from the 12-cent-a-share profit forecast of analysts, according to earnings tracker First Call.

Xerox shares slumped $4.06 to $11.25. Analysts shrugged off the warning, saying it was specific to Xerox and fell in line with the copier makers' previous trend of issuing similar warnings.

The number of third-quarter results warnings has risen 25 percent from the third quarter of 1999 to a total of 257, according to First Call. The number of third-quarter results warnings has risen 25 percent from the third quarter of 1999 to a total of 257, according to First Call.

"In the earnings pre-reporting season, the companies that alarmed us so much were tech and telecom," said Art Hogan, chief market analyst at Jefferies & Co. "We still have earnings jitters and nervousness about revenue growth. I think people feel there is more value in the Dow, which has been hanging in there, so that's where the flight to quality comes in."

And John Davidson, chief investment officer at Orbitex Group of Funds, agreed, telling CNNfn's market coverage that when actual quarterly results start flowing in later this month, the markets are likely to rebound. (255K WAV) (255K AIFF)

Dow propped by industrials, aerospace

As investors sought safe havens for their money, they shifted their asset allocations and cash to blue chip stocks.

Among the key gainers were chemical maker DuPont (DD: Research, Estimates), up $2.75 to $44.38; the conglomerate 3M (MMM: Research, Estimates), $2.31 higher at $94; and the two aerospace Dow components: Boeing (BA: Research, Estimates), up $1.44 to $59.88, and United Technologies (UTX: Research, Estimates), up $2.38 to $70.63. Among the key gainers were chemical maker DuPont (DD: Research, Estimates), up $2.75 to $44.38; the conglomerate 3M (MMM: Research, Estimates), $2.31 higher at $94; and the two aerospace Dow components: Boeing (BA: Research, Estimates), up $1.44 to $59.88, and United Technologies (UTX: Research, Estimates), up $2.38 to $70.63.

No rate change, no surprise

The Federal Open Market Committee, the Fed's monetary policy-making body, left interest rates unchanged at its final scheduled interest rate meeting before the Nov. 7 presidential election.

Analysts had expected the FOMC to leave rates alone and the accompanying rhetoric also yielded no surprise, as it was still taking on an inflationary bias.

"The Federal Reserve purposely seeks not to surprise the market. And it delivered no surprise today, keeping rates steady," wrote Marc Chandler, chief currency strategist at Mellon Financial, in a note to clients. "The statement following the meeting confirmed what the market has suspected, namely that demand is moderating bringing it closer to the economy's growth potential."

This is the third straight FOMC meeting with no change to interest rate policy. Since June 1999, the FOMC has hiked interest rates six times, putting them at 6.5 percent.

"We have seen a softer tone in their write-ups. I think there is a real sense that the Fed is going to stay on the sidelines," Diane Swonk, economist with Bank One, told CNNfn's market coverage.

In the day's key economic report, new home sales for August fell 3 percent to an annual rate of 892,000, far steeper than the anticipated 0.1 percent decline. Meanwhile, the Conference Board's index of leading indicators slipped for the fourth straight month in August.

|