|

Bigger isn't always better

|

|

October 4, 2000: 10:12 a.m. ET

Smaller banks take top checking honors as large ones charge big bucks

By Michael D. Larson

|

NEW YORK (Bankrate) - When it comes to banking, bigger isn't better. In fact, the nation's largest financial institutions seem good at only one thing -- proving that by putting their heads together and working really hard, they can design some of the worst checking accounts in the country.

The latest semiannual Checking Account Pricing Study from Bankrate.com shows that the two largest banks in the country by assets, Bank of America Corp. (BAC: Research, Estimates) and Citigroup Inc. (C: Research, Estimates), have 10 of the top 20 worst accounts.

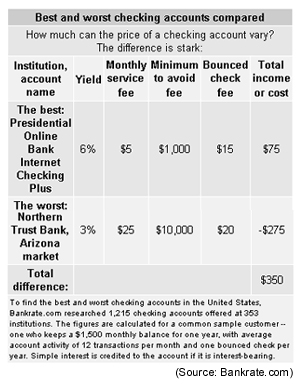

They offer bad deals in San Francisco, San Diego, Miami and Washington, among other places, that can cost a typical customer as much as $268 in fees and charges over the course of just one year. An account from Northern Trust Bank, the nation's 32nd-largest institution, takes the "top" spot on the worst list. Its Anchor Checking costs account holders who can't maintain a hefty minimum balance almost $300 a year.

And the winner is ...

On the other hand, there are still some financial institutions that remember how to treat regular customers, rather than just those whose names can be found on the side of college library buildings. One such company, tiny State-Investors Bank of Metairie, La., offers the best brick-and-mortar account in the country. Internet banks are even nicer. In Bankrate.com's combined list of the best online and offline accounts, Web-based ones took every spot in the top 20 except the one belonging to State-Investors. On the other hand, there are still some financial institutions that remember how to treat regular customers, rather than just those whose names can be found on the side of college library buildings. One such company, tiny State-Investors Bank of Metairie, La., offers the best brick-and-mortar account in the country. Internet banks are even nicer. In Bankrate.com's combined list of the best online and offline accounts, Web-based ones took every spot in the top 20 except the one belonging to State-Investors.

"The best accounts continue to be those offered by Internet institutions," says Greg McBride, a Bankrate.com financial analyst. "Better still was the fact that half of the best Internet accounts were truly free -- no monthly service fee and no per-item fees regardless of the balance maintained."

The rankings stem from a semiannual study conducted by Bankrate.com researchers. They survey the largest banks and thrifts in the top 35 U.S. markets, as well as Internet institutions, to gather data on more than 1,200 accounts. Using that information, they compile lists of the best and worst accounts available in specific geographic markets and a "best overall" list that includes Web banks. The rankings are based on how much money consumers would earn or have to pay out over the course of a year assuming they kept $1,500 in their accounts, performed 12 transactions per month and bounced one check. Simple interest is credited to the accounts that bear interest.

Banking giants offer worst accounts

Bank of America and Citibank fared so poorly because their products have high monthly service fees, per-transaction charges and NSF fees that more than consume any interest earned off their piddling yields. For example, Bank of America's "Prima Checking" pays a yield of just 0.4 percent, but requires consumers to keep an obscene $10,000 on deposit to avoid a monthly service fee of $22.

A bank official counters that the $10,000 can be made up of combined balances taken from 24 different Bank of America products, including savings accounts and certificates of deposit. Prima customers get free online banking and bill payment, free unlimited travelers checks and other benefits with the account, too. As for people who don't have as much money to keep on deposit, spokeswoman Ashleigh Adams says they can choose from one of Bank of America's five other checking accounts, each of which is tailored to a different type of customer.

"This may not be the perfect account for one person, but it does work for other people," says Adams. "It just depends on the type of relationship the customer has with the bank. It's whether or not it provides value for the people."

Northern Trust, based in Chicago, takes the cake, though. Its Arizona market account yields 3 percent, but requires a $10,000 minimum balance to avoid a $25 monthly service fee. Customers don't even get their checks back. A typical customer would pay $275 over the course of a year to keep the account open.

Industry representatives counter that people can choose from a wide variety of accounts not only among separate banks but within individual institutions. Customers who don't have enough money to meet the demanding minimums required on brick-and-mortar interest accounts can get cheaper, non-interest bearing or express accounts with much lower minimums and fees, says John Hall, a spokesman for the American Bankers Association in Washington.

"The ultimate advice to consumers is, 'Shop around,' and that includes shopping your own institution. Often there's a cheaper account tailored for your specific need," he says. "They offer a lot more and the services are kind of on an 'a la carte' pricing strategy because they have a huge array of new and innovative products now."

Champion of brick-and-mortar banking

On the positive side of things, Bankrate.com found a new brick-and-mortar champion in State-Investors. The four-branch thrift's "Sunburst Checking" account would earn the typical customer $47.50 over the course of a year, thanks to its 4.5 percent yield. The New Orleans-market account carries no monthly fee, requires only $1 to open and charges below-average NSF fees of $20.

"It was a promotion we started just after July 4th to just get some cheap funds in here," says Jerry Plough, head of savings for the thrift. "We're still trying to build core deposits. It's still big to us and not only the other smaller banks in New Orleans but elsewhere.

"Customer support and customer relations, it's still a huge thing down here."

Still, Internet banks are far and away a consumer's best bet. In the combined online and offline rankings, Presidential Online Bank nabbed the top spot with its Internet Checking Plus account. It pays a 6 percent yield, requires just $1,000 to avoid a monthly service fee (which is only $5 anyway) and has NSF fees of $15. Direct deposit is required, but a typical customer could earn $75 a year by banking with the Bethesda, Md.-based company.

On the whole, the study shows that just because a financial institution has its name on every street corner, it's not necessarily the best place to bank. The most consumer-friendly accounts can often be found at smaller banks and those that do business over the Internet.

"Conspicuous in their absence from the Best Deals are the largest institutions, with large branch and ATM networks and extensive regional footprints. Not so among the 20 Worst Deals," McBride says. "Better-than-average yields and low minimum balance requirements on accounts offered by smaller local or regional thrifts are common trademarks of those making the Best Deals list."

- by Bankrate.com for CNNfn.com

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|