|

3M record 3Q tops target

|

|

October 23, 2000: 11:19 a.m. ET

Diversified manufacturer says it is on track to meet 4Q, 2001 estimates

|

NEW YORK (CNNfn) - Diversified manufacturer Minnesota Mining & Manufacturing Co. reported a record third-quarter profit Monday that edged past Wall Street forecasts.

The company, popularly known as 3M, posted earnings of $499 million, or $1.25 a share, excluding special items. Analysts surveyed by earnings tracker First Call had forecast $1.24. A year earlier, earnings from operations were $462 million, or $1.14 a share.

The St. Paul, Minn.-based company also said it expects to meet fourth-quarter and 2001 earnings estimates. The St. Paul, Minn.-based company also said it expects to meet fourth-quarter and 2001 earnings estimates.

While the company did not raise earnings guidance, many major multinational consumer products companies have been issuing warnings due to the impact of a strong dollar and the slowing of the U.S. economy.

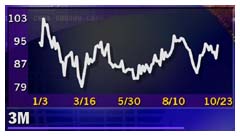

The assurances about future results helped spur investors to 3M (MMM: Research, Estimates) stock Monday. Shares of the component of the Dow Jones industrial average jumped $6 to $93.25 in morning trading Monday, lifting that blue chip measure along with it.

"3M continues to deliver solid, top-line-driven earnings growth," Chairman L.D. DeSimone said in a statement.

Analysts forecast 3M will earn $1.21 a share in the fourth quarter, up from $1.10 a year earlier, and $5.27 a share next year, up from the current forecast of $4.75 a share for this year, according to First Call, which tracks Wall Street profit estimates.

The maker of everything from Scotch tape and Post-it notes to a range of industrial products never seen by consumers took a pretax charge of about $118 million in the latest quarter, mainly for phasing out a chemical process now used to make its Scotchgard line of soil and water repellent for clothing, upholstery and carpets.

In May, 3M announced plans to stop using the process due to environmental concerns. But the company said during a conference call Monday that development of a new chemical process is going more quickly, and less expensively, than originally thought, and the company now believes consumers will not see an interruption in the availability of the product as the change in process is made next year.

The company also posted a one-time gain of $119 million from asset sales, so net income equaled the $499 million earnings from operations, up from year-earlier net income of $459 million, or $1.13 a share.

Revenue rose 6.4 percent to $4.25 billion from $4.0 billion despite currency exchange rates that reduced revenue by 3 percent. The gains were relatively broad based across the company's varied divisions.

Office and consumer products saw only a 5.3 gain in revenue to $750 million, but transportation, graphics and safety products division, its largest, saw nearly an 8 percent rise in revenue to $891 million in the quarter, and electro and communication products posted a 22 percent jump in revenue to $654 million.

For the first nine months, net income rose to $1.46 billion, or $3.64 a share, from $1.32 billion, or $3.25 a share, a year earlier, as revenue rose to $12.5 billion from $11.6 billion. The currency exchange rate reduced revenue by 2 percent, year-to-date.

|

|

|

|

|

|

3M

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|