NEW YORK (CNNfn) - U.S. stocks rose Friday after a report showing the economy grew at a surprisingly slow rate this summer helped signal an end to Federal Reserve interest rate hikes.

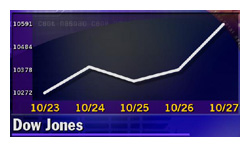

The Dow Jones industrial average advanced on strength in financial stocks and gained for a second week. The Nasdaq composite index climbed as investors bought technology blue chips such as Intel and Microsoft for a second day.

Fiber-optic shares rallied. JDS Uniphase, the big maker of fiber-optics equipment, lifted the sector after posting strong earnings. Still, the Nasdaq finished lower on the week. And weakness in biotech stocks, which came after a profit warning from Amgen, limited the index's gains.

Friday's buying came on news that U.S. gross domestic product growth slowed by more than 50 percent in the last quarter. Friday's buying came on news that U.S. gross domestic product growth slowed by more than 50 percent in the last quarter.

The cooling, economists say, increases the chances that the Fed, which raised rates six times since the summer of 1999, won't tighten credit any time soon and may even cut rates ahead.

"This is going to keep the Fed on hold," William Sullivan, economist at Morgan Stanley Dean Witter, told CNN's Street Sweep.

The Dow rose 210.50 points, or 2 percent, to 10,590.11, bringing its weekly gains to 3.5 percent. The Nasdaq climbed 6.18 to 3,278.36, but ended down 5.9 percent over the last five sessions.

The S&P 500 advanced 15.12 to 1,379.56 but fell 1.2 percent on the week.

More stocks rose than fell. Advancing issues on the New York Stock Exchange topped declining ones 1,807 to 1,025, on trading volume of 1 billion shares. Nasdaq winners topped losers 2,054 to 1,841. More than 2 billion shares changed hands. More stocks rose than fell. Advancing issues on the New York Stock Exchange topped declining ones 1,807 to 1,025, on trading volume of 1 billion shares. Nasdaq winners topped losers 2,054 to 1,841. More than 2 billion shares changed hands.

In other markets, Treasury securities edged lower. The dollar fell against the euro but gained versus the yen.

GDP softens

The U.S. economy cooled in the third quarter to a 2.7 percent annual growth rate, the slowest pace since the spring of 1999, the government reported Friday.

The slowdown in gross domestic product from 5.6 percent in the second quarter surprised analysts, who expected 3.5 percent growth. The slowdown in gross domestic product from 5.6 percent in the second quarter surprised analysts, who expected 3.5 percent growth.

Fed officials raised interest rates six times since the summer of 1999 to keep rising inflation from derailing the economy's expansion. Their job, stock investors hope, is now done.

"The FOMC is smiling, as their preferred scenario is largely unfolding," said Steven Wood, economist at Bank of America, referring to the Fed body that sets interest rates.

More news from CNNfn.com for investors:

· Kandel on AT&T

· 'Lifestyle funds' misused

· Fixed-income a safe haven?

While few economists can say exactly what the Fed's target GDP is, weak growth could prompt the first interest rate cut since 1998. Higher rates slow corporate profits. They also increase the allure of fixed-income securities, drawing money away from stocks.

Financial stocks, whose fortunes are closely tied to the economy, rose Friday. J.P. Morgan (JPM: Research, Estimates) surged $11.94 to $157, while American Express (AXP: Research, Estimates) gained $1.38 to $55.81.

General Motors (GM: Research, Estimates), another Dow member, added $3.13 to close at $60.

Microsoft (MSFT: Research, Estimates) and Intel (INTC: Research, Estimates), Dow stocks that trade on the Nasdaq, drew buyers for a second day. Microsoft, which said hackers gained access to some of its essential product secrets, rose $3.25 to $67.69.

Intel (INTC: Research, Estimates) climbed $1.69 to $46.38.

Some analysts say that the move into these tech blue chips, battered this fall, signals a bottom for the Nasdaq, which fell to its lowest levels of the year Oct. 12, at 3,074.68.

In other tech gainers, JDS Uniphase (JDSU: Research, Estimates) jumped $2.81 to $77.25 after posting earnings of 18 cents per share, more than double the year-earlier figures, and two cents better than forecasts.

The solid figures helped lift a sector hit hard Wednesday by a sales disappointment from Nortel Networks, a big buyer of fiber-optic equipment.

"It has quelled the fears that this market is not on fire," Joseph Wolf, who covers JDS Uniphase for UBS Warburg, told CNNfn's Market Call. Wolf rates the stock a "buy."

Nortel (NT: Research, Estimates), the No. 2 telecommunications equipment maker, fell $2.81 cents to $42.56. Fiber-optics stock Applied Micro Circuits (AMCC: Research, Estimates) rose $2.88 to $141.38.

Ready to rally?

The day's gains come against a backdrop of steadily losses since Labor Day. And in a sense, the market's September and early October decline anticipated the economic cooling shown in Friday's GDP numbers.

A combination of higher interest rates, expensive oil prices, and a strong dollar have caused companies including Intel, Gillette and Eastman Kodak to warn of slowing profits. Accordingly, investors knocked off billions of dollars in market value in these and other companies.

But the profit disappointments haven't ended. Amgen (AMGN: Research, Estimates) warned late Thursday that sales growth for its two biggest-selling drugs could fall short of full-year estimates.

Amgen stock lost $9.19 to $59.31, dragging other biotechs with it. Biogen (BGEN: Research, Estimates) declined $2 to $57.88 and Imunex (IMNX: Research, Estimates) lost $3.50 to $45.19.

Stocks are well of their highs for the year. The Dow is 7.8 percent lower in 2000, with the Nasdaq off 19.4 percent for the period. The S&P 500, the best performer of the three, has declined 6.1 percent this year.

Wall Street, ever paralyzed by uncertainty, faces a major puzzle ahead. With 11 days to go before the presidential election, the race remains close.

"People aren't going to take any position ahead of the elections," Christine Callies, chief U.S. investment strategist at Merrill Lynch, told CNNfn's market coverage.

Still, Callies looks for a higher market ahead.

History supports her view. After falling in September and October, stocks historically rise in November and December.

Bryan Piskorowski, market analyst at Prudential Securities, told CNNfn's market coverage that the gains will come -- but not all at once. (414K WAV) (414K AIFF).

|