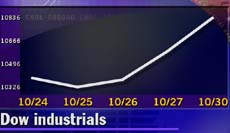

NEW YORK (CNNfn) - The Dow Jones industrial average rallied to a four-week high Monday, jumping more than 200 points, as investors poured money into the blue chip index.

Nervous investors dumped technology stocks, sending the Nasdaq composite index plunging in a Cisco Systems-led sell-off after Lehman Brothers cut its price target for the tech leader, citing slower growth in capital spending.

"You really have a two-tier market with tech stocks going down and everything else going up," said Alfred Kugel, senior investment strategist at Sein Roe & Farnam. "Part of this is because valuations in technology stocks got overdone this year and, at the same time, the Dow hadn't performed and now they look cheap."

The Dow extended its run to three straight sessions of gains, surging 245.15 points, or more than 2 percent, to 10,835.77. The blue chip index has gained more than 500 points over the past three sessions. The Dow extended its run to three straight sessions of gains, surging 245.15 points, or more than 2 percent, to 10,835.77. The blue chip index has gained more than 500 points over the past three sessions.

The Nasdaq slid 87.02, or more than 2 percent, to 3,191.34, while the S&P 500 advanced 19.07 to 1,398.65.

With equity mutual funds facing the end of their tax year Tuesday, some of the selling is also offsetting some of the large capital gains that fund managers had taken earlier in the year, said analysts.

"They're now looking at a situation where their shareholders are going to see the fund is down for the year but they're going to have to pay taxes on large gains," explained Kugel. "The managers are selling tech stocks that they might have bought at higher prices to realize losses and offset the gains."

Market breadth was mixed. Advancers topped decliners on the New York Stock Exchange 1,888 to 1,012, as more than 1.1 billion shares were traded. On the Nasdaq, losers beat winners 2,230 to 1,763, as more than 1.7 billion shares changed hands.

Treasurys were mostly lower. The dollar was unchanged against the euro but gained versus the yen.

Broad rally boosts Dow

Investors rotated money away from technology into financial and cyclical issues on the Dow. American Express (AXP: Research, Estimates) gained $2.63 to $58.44 and Citigroup (C: Research, Estimates) jumped $1.31 to $51.56.

Other Dow advancers were Caterpillar (CAT: Research, Estimates) jumping $2.06 to $34.94, Dupont (DD: Research, Estimates) gaining $2.69 to $45, and 3M (MMM: Research, Estimates) rising $1.50 to $95.

The buying was quite broad on the Dow, with only four out of the 30 issues showing marginal losses.

On the Nasdaq, Cisco (CSCO: Research, Estimates) tumbled $2.63 to $48.06 after Lehman Brothers cut its 12-month price target to $60-to-$65 from $90, due to concern about capital expenditure spending.

"Clearly there are signs that we are going to see a much less rosy picture in capital investment, and we're certainly in a bear market in technology," said Bill Meehan, chief market analyst at Cantor Fitzgerald. "I would expect many investors still have not been able to pare back their exposure to technology to the degree that many would like to."

Other techs also fell. Oracle (ORCL: Research, Estimates) slumped $2.56 cents to $31.53, while Qualcomm (QCOM: Research, Estimates) shed $6.75 to $68.13. Other techs also fell. Oracle (ORCL: Research, Estimates) slumped $2.56 cents to $31.53, while Qualcomm (QCOM: Research, Estimates) shed $6.75 to $68.13.

Qualcomm owns 9 percent of beleaguered satellite telecommunications firm Globestar (GSTRF: Research, Estimates), which tumbled $3.63 to $2.38 after it missed analysts' expectations for its third quarter by 10 cents to post a $1-a-share loss.

"It's more of the same. The rallies continue to be extremely narrow and it's a safe type of market," said Larry Rice, chief strategist at Josephthal & Co. "The buying in the Dow is broad because it's not a risk taker's market, as you can see by Nasdaq."

And Marc Klee, technology manager for John Hancock Funds, told CNNfn's In the Money that the technology stock sell-off may be overdone. (242K WAV) (242 AIFF).

More news from CNNfn.com for investors:

· Making up for lost time

· Investing for the future

· Want better returns?

Economic data pointed to little change in the inflationary picture. Consumer spending rose 0.8 percent in the United States last month while personal income jumped 1.1 percent, the government said Monday -- both above Wall Street forecasts.

The savings rate stood at negative 0.1 percent. Consumer spending is watched closely by investors and policy makers since it fuels about two-thirds of the U.S. economy.

Primedia acquiring About.com

With the flow of quarterly results diminishing, some Internet deals emerged.

Primedia (PRM: Research, Estimates) agreed to acquire About.com (BOUT: Research, Estimates) for $690 million in stock in a move that would combine a traditional magazine publisher with an Internet portal.

Primedia shares fell $3.81 to $11.44 while About.com shares rose 31 cents to $24.19.

Terra Networks (TRRA: Research, Estimates) gained $3.44 to $22.56 after shareholders of U.S. Web portal Lycos overwhelmingly approved their company's $4.6 billion merger with Spanish Internet service provider Terra Networks Friday, ending months of speculation about the completion of the deal.

Microsoft (MSFT: Research, Estimates) advanced $1.38 to $69.06. Microsoft and News Corp. (NWS: Research, Estimates) are in discussions that may result in the software maker investing more than $1 billion in the media firm's Sky Global Networks unit, according to a published report Monday. Microsoft (MSFT: Research, Estimates) advanced $1.38 to $69.06. Microsoft and News Corp. (NWS: Research, Estimates) are in discussions that may result in the software maker investing more than $1 billion in the media firm's Sky Global Networks unit, according to a published report Monday.

In the day's corporate results, Union Carbide (UK: Research, Estimates), which is being acquired by Dow Chemical (DOW: Research, Estimates), gained $4.19 to $40.94 after saying its third-quarter profit fell 62 percent, due to rising costs of energy and raw materials, although the company exceeded Wall Street's recently lowered earnings forecasts for the quarter.

Dow shares jumped $3.13 to $30.56.

|