NEW YORK (CNNfn) - U.S. stocks entered November on a sour note Wednesday, showing signs of weakness, just one session after triple-digit gains, led by selling in the financial and telecom sectors.

The Nasdaq composite index was dragged lower after WorldCom issued an earnings and revenue warning, sending the telecom company 20 percent lower.

"WorldCom was the second-biggest harmful stock on the Nasdaq 100 and we had some profit taking after a reasonably nice day yesterday (Tuesday)," said Phil Orlando, chief investment officer at Value Line Asset Management. "The only thing I'd point to as a catalyst for selling today was the strength we saw yesterday." "WorldCom was the second-biggest harmful stock on the Nasdaq 100 and we had some profit taking after a reasonably nice day yesterday (Tuesday)," said Phil Orlando, chief investment officer at Value Line Asset Management. "The only thing I'd point to as a catalyst for selling today was the strength we saw yesterday."

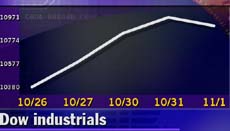

Following three sessions of triple-digit gains and ending a four-session winning streak, the Dow Jones industrial average slipped on weakness in financial stocks after Goldman Sachs cut its earnings outlook for several brokerage houses. Selling in drug issues, Procter & Gamble, and AT&T also contributed to the Dow's decline.

The Dow slipped 71.67 to 10,899.47, and the S&P 500 fell 8.18 to close at 1,421.22. The Nasdaq lost 36.23 points, or more than 1 percent, to end Wednesday at 3,333.40.

Analysts said the selling was not unexpected as it came on the heels of sharp gains. They also noted that the selling was not a sign of panic, as evidenced by the narrow market breadth. Analysts said the selling was not unexpected as it came on the heels of sharp gains. They also noted that the selling was not a sign of panic, as evidenced by the narrow market breadth.

"I think the fundamentals show that we're going to work higher over the next two or three months," said Orlando. "It was reasonable to expect that we'd get some profit taking."

Market breadth was negative. Decliners beat advancers 1,464 to 1,417, on the New York Stock Exchange as more than1.1 billion shares were traded. On the Nasdaq, losers topped winners 2,107 to 1,828, as more than 2 billion shares changed hands.

Treasurys edged higher. The dollar fell against the euro and yen.

WorldCom drags Nasdaq down

Just when investors thought it was safe to go back into the tech arena, concerns about WorldCom and Altera sent them scurrying away.

"We have a lot of difficulty with the telecom service sector," said Joseph Battipaglia, chief investment strategist at Gruntal & Co. "It looks like the bad news is localized in that company and that sector. We're at a point where most of the major shocks have been had and the market action today, after the gains over the last few days, is very constructive."

WorldCom (WCOM: Research, Estimates) tumbled 20 percent to a new 52-week low, down $4.81 to $18.94, after it lowered its earnings and revenue guidance for the fourth quarter and for 2001. WorldCom said it expects fourth-quarter earnings of 34-to-37 cents a diluted share, while analysts were forecasting 49 cents. The company also announced a major restructuring of its businesses into two publicly traded issues. WorldCom (WCOM: Research, Estimates) tumbled 20 percent to a new 52-week low, down $4.81 to $18.94, after it lowered its earnings and revenue guidance for the fourth quarter and for 2001. WorldCom said it expects fourth-quarter earnings of 34-to-37 cents a diluted share, while analysts were forecasting 49 cents. The company also announced a major restructuring of its businesses into two publicly traded issues.

"There just doesn't seem to be a lot of direction. A lot of us expected more of a sell-off this morning, especially with the news about WorldCom," Linda Jay, NYSE floor trader with RPM Specialists, told CNNfn's Market Call. "I think the general consensus is more bullish than bearish."

Jim Waggoner, market and technology strategist at Sands Brothers & Co., told CNNfn's Market Call that tech stocks should rally once a series of market uncertainties clear up. (356K WAV) (356K AIFF).

Altera (ALTR: Research, Estimates) skidded $8.38 to $32.56 after WR Hambrecht analyst Jim Liang lowered his rating to "neutral" from "strong buy," cut his 2001 earnings estimate to $1.51 a share from $1.55, and cut his 12-month price target on the shares to $45 from $75.

Liang also lowered his rating on Xilinx (XLNX: Research, Estimates) to "neutral" from "buy" due to an anticipated inventory correction in the March 2001 quarter for programmable logic device (PLD) chip makers. Xilinx shares slipped $5 to $67.44.

More news from CNNfn.com for investors:

· Stocks: the reign of value?

· Hail to the Dow

· Health funds enjoy boom

Dow taken down by financials, drugs

Financial issues took a hit after Goldman Sachs lowered its earnings estimates on brokerage houses Merrill Lynch, Morgan Stanley Dean Witter and Lehman Brothers. The report spilled into the entire sector.

Hurting the Dow, Citigroup (C: Research, Estimates) shed 94 cents to $51.69, and American Express (AXP: Research, Estimates) slipped $1.63 to $58.38.

Drug stocks didn't fare much better. Johnson & Johnson (JNJ: Research, Estimates) dropped $1.13 to $91 and Merck (MRK: Research, Estimates) fell 16 cents to $89.75. Drug stocks didn't fare much better. Johnson & Johnson (JNJ: Research, Estimates) dropped $1.13 to $91 and Merck (MRK: Research, Estimates) fell 16 cents to $89.75.

Procter & Gamble (PG: Research, Estimates) slid for its second straight session, losing $2.44 to $69, and AT&T (T: Research, Estimates) fell $1.38 to $21.88 in the wake of the WorldCom news.

Economy and election eyed

After six interest rate hikes since June 1999, most of the incoming economic data have been pointing to a slowing economy, helping calm skittish investors.

In the day's economic news, the National Association of Purchasing Management said its index of manufacturing activity fell for a third month in October. The NAPM index slid to 48.3, below forecasts of 49.5 and September's 49.9.

"Overall there's nothing here that is going to get investors too upset," said Michael Lyons, senior trader with Morgan Stanley Dean Witter. "There's money going into the market and they're taking advantage of any weakness at this point."

Investors were also considering the national presidential election, which takes place in six days. The latest CNN/USA Today/Gallup three-day tracking poll shows Texas Gov. George W. Bush's lead over Vice President Al Gore holding at 3 percentage points, 47-44.

"Overlying everything, you've got the election and there's a lot of uncertainty," said Alan Kral, senior vice president at Trevor Stewart Burton.

|