|

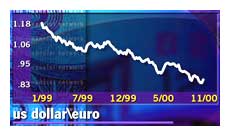

Europe mixed, euro slips

|

|

November 3, 2000: 12:36 p.m. ET

Bourses decline as European Central Bank intervenes to prop up euro

|

LONDON (CNNfn) - European bourses ended the Friday trading session mixed, with many markets losing momentum toward the close as the European Central Bank intervened for the second time in a day to prop up the ailing euro.

London's benchmark FTSE 100 index slipped 0.1 percent to 6,385.4, with oil firms BP Amoco (BP-) and Shell Transport & Trading (SHEL) leading losses, while banking stocks rose on the prospect of consolidation in the industry.

The blue-chip CAC 40 index in Paris was little changed at 6,398.92, with oil producer Total Elf Fina (PFP) among the leading decliners, while insurer Assurances Générales de France (PAGF) led gains. The blue-chip CAC 40 index in Paris was little changed at 6,398.92, with oil producer Total Elf Fina (PFP) among the leading decliners, while insurer Assurances Générales de France (PAGF) led gains.

Frankfurt's late trading Xetra Dax index climbed 39.63 points, or 0.56 percent, to 7,128.27, with chipmaker Infineon Technologies (FIFX) and electronic components firm Epcos (FEPC) among the top gainers.

Among other leading European markets, the AEX index in Amsterdam rose 0.5 percent and the SMI index in Zurich fell 0.3 percent. Milan's MIB30 inched 0.1 percent higher.

The broader FTSE Eurotop 300 index, composed of a basket of Europe's largest companies, was little changed at 1,646.74, with its oil and gas component down 2.3 percent.

Wall Street was mixed Friday at midday. The Dow Jones industrial average slipped 0.7 percent to 10,808.47, while the Nasdaq composite gained 0.5 percent to 3,448.05.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

In the currency market, the euro had a ragged day as the ECB was forced to intervene after initial efforts to maintain the euro's upward pressure failed. The euro fell to 86.32 U.S. cents in late London trade from Friday's high of 97.96 cents.

The ECB "has egg on its face," Steve Barrow, a currency economist at Bear Sterns, told CNNfn.com. "The conventional wisdom is for a central bank to buy on the upward momentum. The euro was doing well until the ECB decided to step in. It's a bad, bad day at the office."

Economist questioned the banks decision to go it alone in the international currency markets. The U.S. Federal Reserve, the Bank of England and the Bank of Japan had helped the ECB to buy euros in its first intervention in September. Economist questioned the banks decision to go it alone in the international currency markets. The U.S. Federal Reserve, the Bank of England and the Bank of Japan had helped the ECB to buy euros in its first intervention in September.

"Everyone knows that as soon as London closes tonight, the U.S. won't intervene," Barrow said. He believes the euro could slide to 80 U.S. cents.

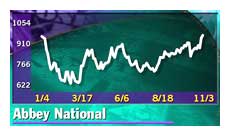

Bank merger talks lifts London

Abbey National (ANL) surged 7.3 percent after the bank confirmed it had approached Bank of Scotland (BSCT) with a view to a takeover. BoS rose 2.1 percent, after saying a deal is unlikely.

Elsewhere in the sector, mortgage bank Alliance & Leicester (AL-) gained 4.5 percent, Germany's Commerzbank (FCBK) lost 1.8 percent, and Deutsche Bank (FDTE) rose 1.5 percent. France's Société Générale (PGLE) gained 1.4 percent. Elsewhere in the sector, mortgage bank Alliance & Leicester (AL-) gained 4.5 percent, Germany's Commerzbank (FCBK) lost 1.8 percent, and Deutsche Bank (FDTE) rose 1.5 percent. France's Société Générale (PGLE) gained 1.4 percent.

Elsewhere, drug maker Schering (FSCH) was up 3.2 percent while Franco-German Aventis (PAVE) gained 1.1 percent.

Anglo-Dutch consumer goods firm Unilever (ULVR) gained 4.4 percent after reporting a 7 percent rise in third-quarter profit.

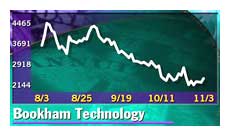

Techs, telecoms rise

Among tech shares, chip maker Infineon Technology (FIFX) climbed 3.6 percent, engineering firm Siemens (FSIE) added 1 percent, and its separately-traded electronic component unit Epcos jumped 4.8 percent.

French information technology consultant Cap Gemini (PCAP) dropped 2.1 percent.

Bookham Technology rose 7.3 percent while British chip designer ARM Holdings (ARM) climbed almost 7 percent. Network equipment maker Alcatel (PCGE) gained 2 percent in Paris while rival Marconi (MNI) added 3.2 percent. Bookham Technology rose 7.3 percent while British chip designer ARM Holdings (ARM) climbed almost 7 percent. Network equipment maker Alcatel (PCGE) gained 2 percent in Paris while rival Marconi (MNI) added 3.2 percent.

In the media sector, British Sky Broadcasting Group (BSY) rose 4.7 percent after it said subscribers are flooding to its services but its fiscal first-quarter loss widened as it spent more money on marketing its digital television services and beefed up program content.

Oil company Shell Transport & Trading (SHEL) slumped 2.4 percent after it reported profit at the low end of analysts' expectations Thursday. Rival BP Amoco dropped 3.5 percent and France's TotalFina Elf slipped 2.7 percent in Paris.

-- from staff and wire reports

|

|

|

|

|

|

|