|

HP misses 4Q forecasts

|

|

November 13, 2000: 3:33 p.m. ET

Cancels PwC Consulting talks; blames currency, expenses for shortfall

|

NEW YORK (CNNfn) - Hewlett-Packard Co. reported earnings Monday that came in well below Wall Street forecasts, triggering a sharp drop in its stock and sparking a temporary sell-off in an already nervous market.

The world's No. 3 computer maker also said it ended talks with the accounting firm of PricewaterhouseCoopers about buying its consulting business. The world's No. 3 computer maker also said it ended talks with the accounting firm of PricewaterhouseCoopers about buying its consulting business.

The Palo Alto, Calif.-based company reported profit of 41 cents a diluted share excluding extraordinary items for its fourth quarter, ended Oct. 31, up from 36 cents a share a year earlier but below the 51-cent average forecast of analysts surveyed by First Call, which tracks estimates on Wall Street.

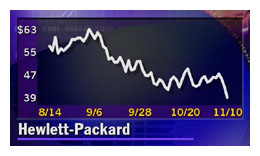

The news sent Hewlett-Packard (HWP: Research, Estimates) stock down $5.75 to $33.37, a drop of about 15 percent, in afternoon trading. HP, one of 30 stocks in the Dow industrials, is now 57 percent below its 52-week high of $78.

Personal computer stocks tumbled last Friday after Dell Computer (DELL: Research, Estimates) executives said they expect Dell's revenue growth in the coming year to be much lower than it has been historically. That forecast caused Dell to decline 19 percent on Friday, while HP lost almost 9 percent.

Shift to low-end products

In its report, HP said sales rose 17 percent to $13.3 billion, a bigger rise than most analysts had forecast. But profits got hurt as its business shifted more towards low-end products and the commissions it pays its sales force increased.

"We are pleased that revenue growth is accelerating, but very disappointed that we missed our EPS growth target this quarter due to the confluence of a number of issues that we now understand and are urgently addressing," Chief Executive Carly Fiorina said in a statement. "I accept full responsibility for the shortfall." "We are pleased that revenue growth is accelerating, but very disappointed that we missed our EPS growth target this quarter due to the confluence of a number of issues that we now understand and are urgently addressing," Chief Executive Carly Fiorina said in a statement. "I accept full responsibility for the shortfall."

Fiorina cited currency fluctuations and higher expenses as well as the shift it the company's business mix.

HP also walked away from its negotiations to acquire the consulting division of PricewaterhouseCoopers, after apparently failing to reach agreement on a price for the unit and in response to concerns about its ability to retain PwC consultants after the transaction.

"While it's true that when we confirmed negotiations were under way we were discussing a valuation in the $17 billion to $18 billion range, given the current market environment we're re-examining every aspect of the transaction, including price," Fiorina said in a speech earlier this month in New York.

"Given the current market environment, we are no longer confident that we can satisfy our value creation and employee retention objectives -- and I am unwilling to subject the HP organization to the continuing distraction of pursuing this acquisition any further," Fiorina said in a statement Monday.

Industry analysts were pleased to see HP abandon the PwC transaction. "PwC was such a big chunk. It was too large, too unwieldy, and too much of a distraction for HP to take on," Daniel Kunstler, an analyst at J.P. Morgan, told CNNfn. [397KB WAV][397KB AIFF]

PwC said it will go forward with its previously stated plans to restructure its business "to respond to the evolving needs of its clients in the networked economy."

"We remain committed to developing a structure that will allow all our businesses to flourish while maintaining the professional independence and objectivity necessary to ensure healthy capital markets," PwC CEO James Schiro said.

A mix of forces spoiled the quarter

In a conference call with analysts, Fiorina said that six or seven forces "combined to spoil what could have been a very good quarter."

The company's overall cost of goods sold rose because it boosted commissions and added more sales and consulting employees. The company's 17 percent revenue growth came mostly from lower-end products, which hurt margins.

"Given the weakness in HP shares this morning following their pre-announcement and our belief that the printer business is worth approximately $25 per share, we do not think it makes sense to downgrade the stock at this time," said Merrill Lynch analyst Tom Kraemer in a research note. "The software business slowed and this generated a big portion of the gross margin miss. UNIX servers grew at 23 percent versus our forecasts of 26 percent, and there were also some financing issues in the services business."

Revenue from sales of home personal computers rose 62 percent from the same period last year, while notebook sales rose 164 percent. UNIX server revenues rose 23 percent year-to-year, with orders up 43 percent, driven by strong demand for low- and mid-range servers. HP hasn't yet booked any revenue for Superdome, the very high-end server introduced in September. The company expects to make its first volume Superdome shipments in January.

Revenue from HP's imaging and printing systems segment rose 6 percent over the same period last year, with nearly 12 million printing and scanning devices shipped during the quarter. However, sales of laserjet printers, hit by softness in the corporate market, fell 7 percent.

Looking forward

For its fiscal year ending next October, HP said it expects revenue to grow 15-17 percent, compared with the 15 percent in fiscal 2000, just completed. The company expects its gross margin in fiscal 2001 to be in the range of 27.5-28.5 percent, compared with 28.5 percent in the fiscal year just completed. Total operating expenses are expected to be about 10-12 percent above fiscal 2000.

J.P. Morgan's Kunstler called that revenue growth target "ambitious, but nonetheless achievable."

Separately, HP's results in the fiscal fourth quarter were hurt by its VeriFone division, which provides secure electronic-payment solutions for financial institutions, merchants and consumers. HP said it is considering selling that division. HP had to write off $48 million from its venture capital investments because of financial turmoil among dot.coms. In response, the company lowered the average transaction size for its venture investments and replaced management within its venture arm.

|

|

|

|

|

|

Hewlett-Packard

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|