|

The future or now?

|

|

November 20, 2000: 8:03 a.m. ET

The Browns have plenty of ideas. But are they sacrificing their security?

By Staff Writer Alex Frew McMillan

|

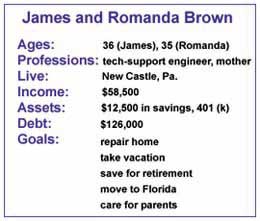

NEW YORK (CNNfn) - James Brown is looking for a financial game plan. "My wife and I have very little left over each month," he said. But they have lots of ideas.

Romanda Brown, 35, is studying to be a registered nurse. When she gets her degree in two years, they'll have $25,000 to $30,000 more coming in, they figure. "There should be lots we can do," James Brown said.

They're taking a vacation this Christmas. Then their house needs $500 in roof repairs, and they want to refinish the floors. They also have their eyes on an Ikea kitchen, furniture for their two children's rooms and a dining-room set.

They bought a place 18 months ago in Brown's hometown, and it needed work. They're fully leveraged -- they took out a second mortgage when it appreciated, to pay off debts.

Checks & Balances runs weekly. People with questions about financial planning are invited to write in. Click here to go to the Checks & Balances page, with past columns and details on how to submit your information.

Brown, 36, also wants to know how much he should be saving. He puts 5 percent of his pay in his 401(k). But he's heard there's a formula for the optimal contribution without reducing his take-home. Is that right, he wonders.

Brown was in the military for 10 years and didn't worry about his finances. He does now. "I'm 36 and I need to get something going," he said.

"Am I doing this stuff for now, and it's going to hurt my future?" he asks.

A lucky career move in the Air Force

Brown grew up in New Castle, Pa., a small steel town. After high school, he played outside linebacker at a couple of colleges. He left with his wife, whom he met at Evangel University in Missouri, but without his degree.

Brown tried out for the San Diego Chargers but didn't make the team. He had calls from a couple other NFL franchises but the travel wasn't worth it.

"I was just recently married, and I had a baby on the way," he explains. "It was going to cost too much, long shot as it was."

Instead, Brown entered the Air Force. He trained to work on F-15 fighters. Then he was asked to pick up technology experience, with circuits.

"I was fortunate and fell into it, not knowing the telecommunications world was about to explode," he said.

Aging parents to consider

Brown left after 10 years and landed a telecom-support job with Marconi near Pittsburgh. He wanted to move home -- his father had both hips replaced and his mother has diabetes.

They're fine now. They're independent and just moved into an apartment, to cut upkeep. Still, Brown may need to look after one or the other. None of his siblings lives nearby. "There's going to be complications. It's just a fact of life," Brown said.

Ultimately, the Browns would like to move to Florida. They lived there when he was in the military, they love the weather and many of Romanda Brown's relatives live in the state.

For now, they'll sate their thirst for hot weather with a Christmas trip to St. Croix, where Romanda Brown grew up. Brown figures it'll run $2,500 to $3,000. That might add to their debt – besides their mortgage, they owe $36,000 on their 1999 Volkswagen Passat and 1999 Chevrolet Malibu.

But Romanda Brown hasn't been back in over 11 years, and her family has never seen where she grew up. "It's going to put a pinch on things," Brown said. "But for our sanity it's one of those things we've got to take care of."

What the planners say:

"My initial advice is to hunker down," said Greg Zandlo, a certified financial planner with North East Asset Management in Coon Rapids, Minn. The prospect of Romanda Brown earning more money in May 2002 is great. But until then, they should focus on narrowing their wants and eliminating debt.

The Browns seem to be living like both of them are gainfully employed, said Peggy Eddy, a CFP and president of Creative Capital Management in San Diego. She reviewed their details with her husband, Bob Eddy, also a certified financial planner.

James Brown plans to pay for the St. Croix trip by working overtime over holidays. That doesn't strike the Eddys as a great idea. "The stress can't be good for his overall health and longevity," they point out.

Break down the debt load first

Thinking of the trip as necessary for "sanity" strikes the Eddys as odd, too. It's another buy-now, pay-later expense. "They are living today on tomorrow's earnings, a risky proposition overall," the Eddys write.

Thinking of the mental effects of money is important, though, said Peg Eddy.

Zandlo notes that the Browns have "a tremendous debt load that will constantly impede any major progress." He likes his clients to be flexible. High fixed costs like the Browns' mortgage and car loans prevent that.

He suggests James Brown suspend his 401(k) to knock out the debt on the Chevy Malibu, which has the highest interest. The debt isn't tax-deductible. Once Brown has taken care of that, he should concentrate on the Passat.

"Every time a fixed-expense item is paid off, reallocate that former payment against another debt," Zandlo suggested. "Combined with Mrs. Brown's employment as a nurse in 2002, you will be able to stop the interest clock from ticking forever."

Reconsidering repairs

The Browns need to reconsider their home costs, too. Obviously the roof is a priority, Zandlo said, "but after that, strongly think about what must get accomplished versus what can wait."

The Eddys agree. The roof repairs can come out of their savings. But kitchen remodeling has to wait until Romanda Brown starts working, they say, as well as any furniture purchases.

The Browns need to build their savings, which fluctuate in the range of $2,000 to $5,000, up to three months' worth of expenses, the Eddys say. The planners suggest a money market account, earning 6 percent or so interest. Any tax refunds should go to credit-card debt, then their reserves.

Click this link to read last week's Checks & Balances column.

Click the following link to read last week's Portfolio Rx, a column that runs every Tuesday in CNNfn's Retirement section. Each article reviews an investor's long-term portfolio, using financial experts to offer advice.

Brown has $45,000 in life insurance through Marconi. That means he is vastly underinsured, Zandlo said. He recommends multiyear-term insurance.

Romanda Brown is a resident alien with a "green card," though her citizenship should be a formality, James Brown said. Zandlo encourages her to sort the paperwork out.

Otherwise, the planner noted, Brown's estate would not transfer to his wife without estate taxes if he died, like it would to an American. "A potentially large estate-tax liability is lurking for anyone in this situation," Zandlo said.

The Eddys instruct them to review their wills, too. The parents should get a basic estate plan from an attorney. Picking younger, nearby guardians is a good idea, the Eddys said, since Romanda Brown's parents aren't in the country.

A sandwich generation squeeze

Once Brown has paid off debts, he can reapply money to retirement. But Brown may get caught in a classic "sandwich generation" squeeze, caring for his parents and helping with his kids' college, Zandlo said. He may need to divert retirement funds and put the move to Florida on hold.

Then again, the Eddys noted, there are good resources for seniors in Florida. His parents might prefer a nursing home, the Eddys point out. It might be more cost-effective than revamping a home, too, they note.

Peg Eddy instructs Brown to check if his parents qualify for Medicare. If Brown wants better coverage, his father should consider long-term-care insurance through the state of Pennsylvania, his former employer. Brown and his siblings could chip in for the cost, the planner said.

Click here to review your mutual-fund portfolio with CNNfn.com's Morningstar tools.

Click here to go to CNNfn.com's 401(k) and pension-plan page.

Brown needs to beef up his 401(k) once his wife starts working, the Eddys say. And there's no magic formula for 401(k) payments, Peg Eddy says.

Assuming an 8 percent return, his current 5 percent contribution and his 4 percent match will yield around $525,000 if he retires at 62, the planners calculate, allowing for 3 percent annual raises.

But he will need $2.8 million in retirement to live on $70,000 a year, if they live to 90, the Eddys note. He should step up his payments to as close to 15 percent as he can afford, they say. Romanda Brown could also cut down the shortfall by paying into a plan once she's working, they add.

Once she does, the Eddys suggest the Browns make no major expenditures for the first six months. Though she may gross around $25,000, they will see substantially less after taxes, commuting costs, day care and the like.

Instead, the Eddys suggest the Browns pay down debt and track their expenses on their computer.

The Eddys say the Browns are like a lot of Americans – spending now and paying later. "We believe that 2001 should be their year of hunkering down and postponing things while they stabilize their situation."

* Disclaimer

Got questions about financial planning? Need some advice? Click here for more on CNNfn.com's weekly feature Checks & Balances.

|

|

|

|

|

|

|