|

Europe back to basics

|

|

November 21, 2000: 12:36 p.m. ET

Investors switch to defensive stocks though techs share broad-based gains

|

LONDON (CNNfn) - Europe's main markets closed higher Tuesday, with some battered tech shares leading broad-based gains among pharmaceutical and retail stocks, while better-than-expected earnings reports from utility companies lifted that sector.

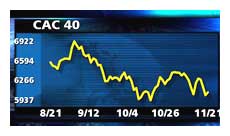

The blue-chip CAC 40 in Paris climbed 59.23 points, or 1 percent, to 6,081.02, led by Dutch-based network operator Equant (PEQU) and automaker Renault (PRNO).

Frankfurt's late trading Xetra Dax added, 68.59 points, or 1.04 percent, to reach 6,678.07, with power utility RWE (FRWE) and telecom and engineering powerhouse Siemens (FIFX) among the leading gainers. Frankfurt's late trading Xetra Dax added, 68.59 points, or 1.04 percent, to reach 6,678.07, with power utility RWE (FRWE) and telecom and engineering powerhouse Siemens (FIFX) among the leading gainers.

London's benchmark FTSE 100 index rose 35.9 points, or 0.6 percent, to 6,380.9, with strong performances by British American Tobacco (BATS) and drug retailer Boots (BOOTS).

Amsterdam's AEX index and Zurich's SMI gained 0.3 percent each, and Milan's MIB30 climbed 0.4 percent.

Amsterdam's AEX index and Zurich's SMI gained 0.3 percent each, and Milan's MIB30 climbed 0.4 percent.

The broader FTSE Eurotop 300 index, a basket of Europe's largest companies, was up 0.6 percent at 1,605.36, led by its tobacco sub-index, up 4.2 percent.

British American Tobacco, its biggest component, jumped 5.5 percent to a 13-month high as investors switched to defensives stocks. The tech-heavy Nasdaq market tumbled 5 percent to 2,875.64 Monday , its lowest close in more than a year, after investment banks Morgan Stanley Dean Witter and Lehman Brothers lowered their recommendations on some key technology stocks..

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

U.S. markets rose Tuesday. The Nasdaq composite climbed 0.2 percent to 2,880.81, and the blue-chip Dow Jones industrial average edged up 0.1 percent to 10,475.16.

In the currency market, the euro slipped to 84.59 U.S. cents from 85.10 cents in late New York trading Monday.

Techs rally

European technology shares rebounded after recent losses, led by Equant's 8 percent charge. The network company extended the previous day's gain, following France Telecom's (PFTE) agreement to buy a controlling stake in the firm and merge it with its own business telecom subsidiary. France Telecom climbed 1.2 percent.

French telecom network equipment maker Alcatel (PCGE) gained 2.3 percent.

Franco-Italian chipmaker STMicroelectronics (PSTM) rose 3.1 percent while Europe's largest software firm SAP (FSAP) rose 2.2 percent in Frankfurt. Engineering and electronics firm Siemens (FSIE) rose 1.8 percent.

Britain's largest power utility, National Grid (NGG), rose 1.25 percent after promising five years of dividend growth at 5 percent a year and saying half-year pretax profit rose more than expected to £259.9 million before exceptional items and goodwill, from £250.7 million a year earlier. United Utilities (UU-) rose 1.4 percent and Scottish & Southern Energy (SSE) added 4.1 percent. Britain's largest power utility, National Grid (NGG), rose 1.25 percent after promising five years of dividend growth at 5 percent a year and saying half-year pretax profit rose more than expected to £259.9 million before exceptional items and goodwill, from £250.7 million a year earlier. United Utilities (UU-) rose 1.4 percent and Scottish & Southern Energy (SSE) added 4.1 percent.

Diversified German utility RWE (FRWE) climbed 3.1 percent. The company posted a better-than-expected 6.7 percent rise in first-quarter operating profit, boosted by a strong performance in its oil and chemicals division. Rival E.ON (FEOA) added 4.5 percent and Italy's ENI gained 1.9 percent.

Shares in Glaxo Wellcome (GLXO) rose 1.2 percent after Britain's health service watchdog reversed an earlier decision to deny state-financed patients access to Glaxo Wellcome PLC's flu drug Relenza, ruling it could be given to the elderly and other high risk groups.

German personal care products maker Henkel (FHEN) added 2 percent and drug maker Bayer (FBAY) rose 2.6 percent and chemicals company BASF (FBAS) climbed 1.9 percent.

Drug retailer Boots (BOOTS) jumped 3.1 percent. SG Securities analyst Nick Bubb raised his price target for the stock and reiterated his "buy" rating on the company.

Among other retailers showing strong gains. Tesco (TSCO), Britain's biggest supermarket chain, climbed 3.4 percent and close rival J. Sainsbury (SBRY) added 2.7 percent.

In Paris, luxury goods maker and retailer LVMH Moet Hennessey Louis Vuitton was up 2.3 percent after French daily Le Figaro reported the company was interested in buying landmark Parisian department store Samaritaine, valued at $378 million by analysts.

Renault (PRNO) rose 6.1 percent after the French carmaker said its investment in Japan's Nissan Motor would reap its first financial reward by contributing Renault (PRNO) rose 6.1 percent after the French carmaker said its investment in Japan's Nissan Motor would reap its first financial reward by contributing  453 million ($385 million) in its second-half results. 453 million ($385 million) in its second-half results.

Germany's DaimlerChrysler (FDCX) retreated 2.2 percent as investors continued to fret over its troubled U.S. Chrysler division. Volkswagen (FVOW) fell 0.9 percent.

In London, EMI Group (EMI) fell 1.5 percent after reporting that half-year pretax profit before exceptional items fell 30 percent to £59.1 million ($82.7 million), in line with analysts' expectations of £57.5 million. EMI said it was continuing to talk to Bertelsmann about a possible merger with the privately owned German media company's music division, but that there still is a long way to go before any deal.

Dutch cable company UPC shed 1.4 percent, extending the previous day's 24 percent tumble, amid rumors it had problems with a loan. The company and its bankers jointly issued a statement late Monday to deny the speculation.

-- from staff and wire reports

|

|

|

|

|

|

|