NEW YORK (CNNfn) - The Dow Jones industrial average rose for the first time in four sessions Tuesday on gains in drug, tobacco and food stocks that often hold up well as the economy slows.

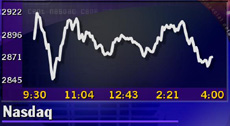

But the Nasdaq composite index edged lower and hit a new record low for the year. The losses followed an earnings disappointment from Lucent Technologies, the latest technology firm to spook investors who have been shedding technology stocks since Labor Day.

"The market's grappling with earnings slowing down," Douglas Cliggott, U.S. equity strategist at J.P. Morgan, told CNNfn's In the Money. "The market's grappling with earnings slowing down," Douglas Cliggott, U.S. equity strategist at J.P. Morgan, told CNNfn's In the Money.

A few bright spots emerged. Agilent Technologies blew past analysts' earnings expectations and Nortel Networks said it is on track to meet Wall Street's profit forecasts.

Still, Cliggott sees corporate profit growth climbing about 6 percent next year, a rate of gain much slower than this year's anticipated pace.

"It's no wonder the markets are struggling here," he said.

The Nasdaq closed below 3,000 for only the third time this year and is off 43 percent from its March high. Despite the day's gains, the Dow is essentially unchanged from where it was in May 1999.

And the S&P 500, which comprises 75 percent of the stock market's value, is down 8.3 percent this year. Those losses, if they hold for another five weeks, would be the worst for the index since 1981, when it fell 9.7 percent.

The Nasdaq shed 4.34 points to 2,871.30, its lowest close since October 27, 1999. The Dow gained 31.85 to 10,495.50 and the S&P 500 advanced 4.71 to 1,347.33. The Nasdaq shed 4.34 points to 2,871.30, its lowest close since October 27, 1999. The Dow gained 31.85 to 10,495.50 and the S&P 500 advanced 4.71 to 1,347.33.

More stocks fell than rose. Declining issues on the New York Stock Exchange beat advancing ones 1,463 to 1,385, on volume of 1.1 billion shares. Nasdaq losers topped winners 2,483 to 1,429, as more than 1.7 billion shares changed hands.

In other markets, the dollar rose against the euro and yen. Treasury securities edged higher.

Nasdaq searches for bottom

Among the day's gainers, Agilent Technologies (A: Research, Estimates), which makes testing and measurement gear, rose $4 to $48.63 after posting stronger-than expected earnings. Agilent said it earned $305 million, or 66 cents per diluted share, in its fiscal fourth quarter, well above the 53 cents per share expected by analysts surveyed by earnings tracker First Call.

Nortel (NT: Research, Estimates) gained $2.94 to $38.19 after the fiber-optic equipment maker said it is on track to meet Wall Street's fourth-quarter earnings forecast of 26 cents a share. The company, which held an analysts' meeting in Boston Tuesday, saw its shares tumble nearly 30 percent in October after reporting lower-than expected revenue.

Both stocks, like many in the tech sector, are well off their highs.

With the economy slowing, companies and the analysts who cover them have been lowering profit forecasts. Stocks have fallen accordingly.

In the latest disappointment, Lucent Technologies (LU: Research, Estimates), said questions about $125 million in revenue in its previously announced fourth-quarter results could cut earnings by 2 cents a share.

Lucent, whose series of earnings shortfalls have shaved more than 50 percent off the company's stock, continued falling Tuesday, down $3.38 to $17.56, a 2-year low.

On the Nasdaq, Oracle (ORCL: Research, Estimates) shed 88 cents to $23.88 while Yahoo! (YHOO: Research, Estimates) fell $7.19 to $41.69, a 2-year low. Influential Morgan Stanley Dean Witter analyst Mary Meeker said the Internet portal may not meet revenue targets.

Still, Patrick Boyle, head financial trader at Credit Suisse First Boston, told CNNfn's market coverage that the Nasdaq could reach 3,500 once the market gets past some of the current earnings uncertainties. (385K WAV) (385K AIFF)

In the meantime, investors moved into defensive, non-cyclical stocks, which hold up well in a slowing economy. Drug maker Merck (MRK: Research, Estimates) gained $1.63 to $92 and Philip Morris (MO: Research, Estimates), the cigarette maker that owns Kraft Foods and Miller Brewing, gained 88 cents to $37.44. In the meantime, investors moved into defensive, non-cyclical stocks, which hold up well in a slowing economy. Drug maker Merck (MRK: Research, Estimates) gained $1.63 to $92 and Philip Morris (MO: Research, Estimates), the cigarette maker that owns Kraft Foods and Miller Brewing, gained 88 cents to $37.44.

Sysco Corp. (SYS: Research, Estimates), the big food distributor, gained $1.75 to $54.94, a 52-week high.

Waiting for Florida

The presidential impasse, meanwhile, continued to cloud the market. Florida's Supreme Court could decide Wednesday whether manual recounts from three primarily Democratic counties can be used in the final tally. Republicans want the outcome to stand as of Saturday's results, which show George W. Bush ahead of Democrat Al Gore for the 25 electoral votes that will determine the winner.

The delays haven't helped the market, with the Nasdaq falling nearly 13 percent since Election Day.

"Overall, the market does not like indecision," Patrick Boyle, head financial trader at Credit Suisse First Boston, told CNNfn's market coverage.

|