|

New way home for e-buyers

|

|

November 24, 2000: 4:28 p.m. ET

UPS still leads, but new competitors and new methods could narrow the gap

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - Delivery of online purchases to consumers isn't that much different than the delivery of catalog purchases for much of the last century -- namely United Parcel Service trucks pulling up outside most buyers' homes.

But as with other parts of the world of Internet commerce, that is changing.

The last year has seen a major new initiative in the field by express carrier FedEx, which started a new low-cost offering geared to making residential deliveries in the evenings and on Saturdays.

Airborne Express, the nation's third largest express delivery service, has expanded its new joint effort with the U.S. Postal Service to have letter carriers deliver its packages to homes, and FedEx and the Postal Service have entered into talks about a possible alliance between the two services.

And a growing number of online retailers are now offering customers something that wasn't' available in the past -- a choice of delivery services.

While a majority of sites still use only a single carrier, or a choice of carriers that only corresponds to customers' shipping needs -- such as standard, express or overseas delivery -- a bit more than a quarter of online retailers now offer consumers the choice of who delivers the goods at what price. While a majority of sites still use only a single carrier, or a choice of carriers that only corresponds to customers' shipping needs -- such as standard, express or overseas delivery -- a bit more than a quarter of online retailers now offer consumers the choice of who delivers the goods at what price.

That choice is up from less than one in six who offered a choice a year ago, according to research by Goldman Sachs.

Online services such as Kozmo.com and Urban Fetch, which specialize in on-demand deliveries of items like movie rentals, food or other goods in specific urban markets, are further changing the online consumer's delivery expectations, and make a new model of delivering online purchases likely in the future, according to experts such as Forrester Research and Shop.org, the trade group of online retailers.

"I'd say the delivery picture right now is roughly the same as last year, although somewhat more competitive," said Elaine Rubin, chairman of Shop.org. "But in the future we'll see greater service selection. And offering multiple shipping options means there's clearly not a winner in (delivery) category yet."

Analysts point out delivery of goods purchased online still make up only a fraction of the business of the major delivery companies, and an even smaller fraction of their profits. But they say that with estimates of a growth in those shipments in coming years, it will become a major part of their business soon.

"It still doesn't carry the day," said Doug Rockel, analyst with ING Barings. "But as e-commerce grows, it's becoming more significant. I'll end up eating those words one day."

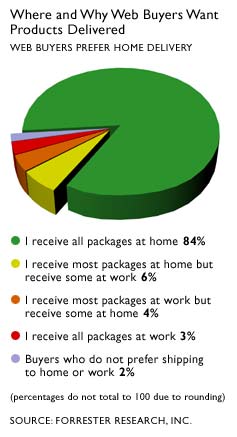

The business of delivering consumers' online purchases is still primarily a matter of getting it to their homes. A Forrester survey earlier this year found about 90 percent of online shoppers receive most of their purchases at home, with only about 7 percent generally having deliveries to the office.

New model for delivering online purchases

But Rubin and Forrester researchers see many shipments of goods in the future going not to a consumers' home or work but to central locations close to their homes, such as supermarkets or other business where the goods could be picked up later by consumer or delivered by a local service at a pre-arranged time once the consumer gets home, along with items such as dry-cleaning, groceries or pizza.

That delivery model would open the door to many new companies to deliver many e-commerce purchases, moving such traditional items as books, toys or music and clothing. Traditional trucking firms that aren't now positioned to handle residential delivery could handle the deliveries from the online retailer to the local delivery hub instead.

"While this shipping model has worked fine so far, things will change between now and 2004," predicts a report from Forrester. "While this shipping model has worked fine so far, things will change between now and 2004," predicts a report from Forrester.

All of these changes could put tremendous pressure in the future on the company that is still the clear leader in delivery of consumers' online purchases -- UPS (UPS: Research, Estimates).

UPS is still the service used by about 49 percent of online retailers, according to the Goldman survey. That compares to 17 percent who use the postal service and only 7 percent who exclusively use FedEx.

But UPS officials say they recognize the changes taking place in the market and they are well positioned to compete in a world where the customer, not the retailer, is making more of the choices about shipping options.

"That's something we assumed would happen, that the buyers in the e-commerce equation would gain more power," said Alan Amling, director of electronic commerce for UPS. "Undoubtedly we see constant competitive threats, not just from FedEx and USPS and Airborne, but from the new carriers that weren't on horizon a year or two ago.

"Here's the acid test. When our competitors offer new choices we don't offer that customers are choosing and paying for, that's something we'll react on fairly quickly," said Amling. "We're not going to offer a service just to offer it and price at a cost no one would use it. That's not service."

FedEx's new aim at home delivery

The new delivery options have yet to make a profit handling the costly last mile of the delivery of the goods. But officials from FedEx (FDX: Research, Estimates) insist that their new effort at home delivery is making its goals and will be well-positioned to make money and capture market share in the future.

FedEx Home Delivery is the company's new lower cost service that generally moves the goods by truck in three-to-four business days, rather than by plane overnight. While it now serves only about half the nation's population with the low-cost service, it expects to reach 80 percent by September, 2001 and all of the nation a year later, which is a year quicker than originally planned.

In the meantime it can compete for some national delivery contracts immediately by supplementing it with the company's express delivery drivers or its ground service drivers who normally handle business-to-business deliveries. In the meantime it can compete for some national delivery contracts immediately by supplementing it with the company's express delivery drivers or its ground service drivers who normally handle business-to-business deliveries.

UPS has a tremendous cost advantage for residential deliveries, despite paying higher union wages than FedEx, because its strong market share gives it the density to lower the costs of each delivery. But FedEx officials insist that the new service's focus on residential deliveries will allows it to be competitive in the future.

Its standard hours of operations, from 11 a.m. to 8 p.m. Tuesday through Saturday, rather than a traditional business week, will allow the off-hours deliveries customers want without additional costs.

"We've combated that (the extra costs of off-hours deliveries) in how we designed the service," said Henry Maier, FedEx's vice president of customer automation. "This will be a better business model."

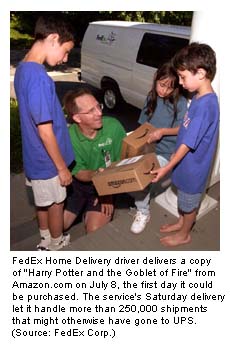

The Saturday delivery is an important distinction for many customers, and it allowed the company to get the contract to deliver more than 250,000 copies of the best-selling children's book "Harry Potter and the Goblet of Fire," which Amazon needed to have delivered the first day they were available -- July 8, which was a Saturday.

But Amazon.com still does not use FedEx for its deliveries, depending upon the Postal Service for standard delivery, UPS for time-definite deliveries and DHL for overseas shipments.

Bill Curry, a spokesman for Amazon.com, says the company is pleased with FedEx Home Delivery's performance of that contract, but that doesn't mean the company is about to make it one of its delivery options or give customers a direct choice of delivery companies.

"We have our systems set up so that the customer gets the best, lowest cost service," Curry said. "We have arrangements with these carrier companies that seems to work quite well for customer. Our customers are more concerned with getting delivery on time than what uniform the delivery person is wearing."

FedEx officials won't comment much about a possible alliance with the Postal Service that could see letter carriers making some of the rural residential deliveries of the non-express packages, while FedEx handles some of the Postal Service's express mail needs. Such an alliance is only in negotiations at this point, and even if a deal is announced, UPS has vowed to challenge any alliance on anti-trust grounds.

| |

|

|

| |

|

|

| |

"Our customers are more concerned with getting delivery on time than what uniform the delivery person is wearing."

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Bill Curry

Spokesman, Amazon.com |

|

But one alliance that already is up and running is Airborne Express, which during the last 13 months has moved into the residential delivery market for the first time by making deliveries of packages to Post Offices around the country and letting the letter carriers handle the final delivery.

This has been a difficult year for profits at Airborne Express' corporate parent, Airborne Freight Corp. (ABF: Research, Estimates). It missed third-quarter earnings expectations and lowered profit guidance for the fourth quarter. The company blamed rising fuel costs and weakness in its core business-to-business deliveries for its problems.

But its new home delivery service has been a bright spot, according to Lanny Michael, its chief financial officer.

"When it debuted in the fourth quarter last year, companies already were locked in for their shipping needs for that holiday," Michael said. "We really saw product ramping up this year. It's a profitable product, and critical mass will help profitability."

The company handled an average of 28,000 home delivery shipments a day in the third quarter, a 48 percent increase over the second quarter. But the end of October the average volume had built to 55,000 shipments a day, with the company projecting an average of 60,000 to 65,000 shipments a day for the current period.

Delivery companies helping fill orders

Both FedEx and UPS are offering customers greater technical support in making sure their shipping, order tracking and order fulfillment processes work smoothly in an integrated manner, even if the site uses more than one delivery service. Officials from both companies said that kind of technical support is a key to gather their share of online deliveries going forward.

"The real value we can offer e-tailers is not giving them a rate they can afford to eat, it's helping them manage the supply or fulfillment piece of their business," Maier said. He said that fulfillment is a far greater issue for online retailers this year, given the problems of the past.

One study by Boston Consulting Group and Harris Interactive found a bit more than half of online shoppers had service problems during last year's holiday season, with 28 percent finding the item ordered not in stock, 11 percent having an item delivered after the holiday and 4 percent reporting the wrong item was delivered.

But UPS says it is also ready to offer the technical support needed to help online retailers fill orders. Both companies have operations that manage the warehouses and fill the orders themselves, in addition to handling the shipping.

"A lot of the dot.coms and e-tailers were not as concerned about the back end at this time last year," said UPS's Amling. "They were concerned about attracting customers to site and having sticky sites. They felt a lot of pain, and because of that pain, they're searching for relief."

Click here to send mail to Chris Isidore

|

|

|

|

|

|

|