|

Swisscom eyes 3G gift

|

|

December 1, 2000: 7:46 a.m. ET

Undersubscribed sale of Swiss mobile-phone licenses set to give winners a lift

|

LONDON (CNNfn) - Swisscom looked set Friday to be handed a third-generation mobile-phone permit on the cheap, after a shortage of bidders in the license auction left Swiss authorities with no option but to press ahead with the undersubscribed sale.

The incumbent Swiss telecom company saw its shares rise 3.6 percent after Swiss industry regulator ComCom said the delayed auction for Universal Mobile Telecommunications Standard (UMTS) licenses in Switzerland would begin next Wednesday at 9:00 a.m. local time.

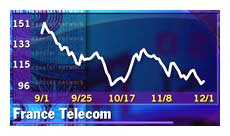

France Telecom SA (PFTE), the owner of another bidder, Orange Communications, also rose 3.6 percent, while Spain's Telefónica rose 2.6 percent and TeleDanmark, which controls merger partners Sunrise and diAx, rose 2 percent in Copenhagen.

The Swiss suspended the auction Nov. 13 after the last-minute merger between Sunrise and diAx – which had each planned to bid separately -- cut the number of companies registered to take part in the auction to four. The sale will resume with an unchanged minimum bid value of 50 million Swiss francs ($28.8 million), ComCom added.

Yves Haffenpfenneg, an analyst with UBS Warburg Dillon Read in Zurich, said he had expected the licenses to fetch about 2.2 billion Swiss francs apiece before the auction was suspended.

After the suspension, investors grew skittish that the auction rules or structure might be changed, said Kissenpfennig. "Now people are happy that it seems Swisscom is assured of winning a license," he added.

The auction is one of many that have been carried out in Europe this year as mobile-phone companies gear up to offer services such as high-speed Internet and video via cell phones. Now, though, it is unlikely to last long and seems certain to dash the hopes that the Swiss sale could yield several billions of francs.

"The minimum bid is 50 [million francs], so they're going to go in and bid 50, and then the auction's going to be over," said Kissenpfennig, who rates Swisscom shares a "strong buy". "It's turned out to be a bit of a joke ... but the companies are definitely very happy."

ComCom said it had found no proof of collusion among any of the original 10 bidders, and added the merger of Sunrise and diAx would not limit competition in UMTS services.

"For us as regulators, we are not disappointed, because we want the technology to come by 2002. The government, I think, hoped that it could bring a lot of money, but these are rules," said Roberto Rivola, a spokesman for the Federal Office of Communication, a division of ComCom.

Many mobile-phone companies have gotten a case of stock-market indigestion as a result of swallowing licenses in far larger markets, such as the United Kingdom and Germany, where similar auctions generated huge sums for government coffers. Several credit-rating agencies have cut their ratings on the debt of telecom giants as the cost of the licenses in the German and U.K. auctions soared far above initial expectations.

The Swiss postponement came hard on the heels of flopped UMTS auctions in Austria and Italy.

France is planning to sell its third-generation licenses via a so-called "beauty contest" process, selecting the winners based on the quality of the services that they promise to offer and the soundness of their business proposal, rather than how much they will pay for the licenses.

On Monday, Norway awarded its licences to four applicants – out of seven hopefuls – after a beauty contest.

The Swiss licences are to run for 15 years. Winners are expected to extend their network coverage to at least 50 percent of the country's population by the end of 2004.

-- from staff and wire reports

|

|

|

|

|

|

|