|

Tyson bids $2.8B for IBP

|

|

December 4, 2000: 4:12 p.m. ET

Cash and stock offer trumps $2.6B rival proposal from Smithfield Foods

|

NEW YORK (CNNfn) - Tyson Foods Inc., the world's largest poultry producer, offered Monday to buy IBP Inc. for $2.8 billion in cash and stock, trumping two previous bids for the meatpacking company, including a $2.6 billion proposal from the world's No. 1 pork processor, Smithfield Foods Inc.

The offer, which also calls for Tyson to assume roughly $1.4 billion in IBP debt, would create an unparalleled giant in the meat and poultry industries, boasting annual revenue in excess of $21 billion.

IBP acknowledged Monday that a special committee of independent board members has received a merger offer from Tyson, and that the committee "with the help of outside counsel and its financial advisor, will examine this proposal." The Dakota Dunes, S.D.-based company gave no time frame for making its decision.

Under the proposed offer, IBP shareholders would receive the equivalent of $26 for each of their common shares, half in Class A Tyson shares and half in cash. Tyson is proposing initiating a tender offer for just more than half of IBP shares at that price, then converting the remaining shares into its stock.

Tyson's proposal represents a 42 percent premium over IBP's closing price Sept. 29, the last trading day prior to the public announcement of the management buyout. Tyson's proposal represents a 42 percent premium over IBP's closing price Sept. 29, the last trading day prior to the public announcement of the management buyout.

"This is a unique opportunity for Tyson foods, the number one company in the chicken category, and the folks at IBP, who are the number one in the beef and pork industry," Tyson Chairman John Tyson told analysts and investors during a conference call Monday. "Seldom do you get the chance to put the leaders together in an industry and then move forward."

Whether Tyson ultimately gets that opportunity, though, remains to be seen.

Tyson's overtures come amidst growing disenchantment with a $2.6 billion all-stock offer from Smithfield last month that valued IBP at $25 per share. That deal, however, has drawn harsh scrutiny from some regulators and farming organizations, who fear it would create too dominant a player in the beef and pork industry, where it would hold a greater-than-30 percent market share.

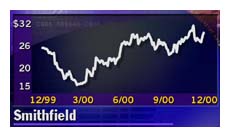

Analysts were also wary of the offer because it offered IBP no chance to walk away from the transaction if Smithfield's stock fell below $28.46 per share -- a level the stock only surpassed last Friday for the first time since it made the IBP bid.

BP also has a $22.25-per-share buyout offer sitting on the table from an investor group led by Donaldson, Lufkin & Jenrette's merchant banking arm and certain company executives. BP also has a $22.25-per-share buyout offer sitting on the table from an investor group led by Donaldson, Lufkin & Jenrette's merchant banking arm and certain company executives.

In addition to his company's higher valuation of IBP and offer to pay using both stock and cash, Tyson also noted his company's proposal has "a far higher degree of certainty for IBP shareholders" than the Smithfield offer since it offered fewer antitrust concerns.

Christine McCracken, an analyst with Midwest Research, agreed that Tyson would present fewer regulatory worries since it is primarily a poultry producer, but she said that could change if the government groups the companies as meat producers rather than pork, beef or poultry producers.

"I think that it's probably a lot less onerous from the pork-processing side unless they define it as meat processing," McCracken said. "Then it could still present a challenge."

Jeff Kanter, an analyst with Prudential Securities, also believes an IBP/Tyson grouping would face less regulatory scrutiny.

"Clearly Tyson has the sweetest offer out there," Kanter told CNNfn's Market Coverage. "I think most people would believe a Smithfield Foods/IBP merger -- would think that would be a better company, but the $26-a-share offer form Tyson is advantageous not so much on an absolute value level, but it avoids a lot of the regulatory risk that would be present in a Smithfield/IBP merger." (486K WAV) (486K AIFF)

Check Kanter's comments on the Tyson bid

Answering analysts' questions about regulatory concerns, Tyson said during the conference call he doesn't expect any challenge.

"Based on first-cut guidance from folks in Washington, we don't see it as an issue," Tyson said. "There are a lot of other competitors out there... there are a lot of folks out there servicing the great American consumer. I don't anticipate any challenge, but that's to be seen."

But in a statement released late Monday afternoon, Smithfield countered that the Tyson proposal "by no means . . . represents superior long-term value over ours," noting that its experience in the meat business and ability to generate greater synergies acquiring IBP made its offer just as attractive as Tyson's.

"We will continue moving forward with the due diligence process and evaluating our next steps, consistent with our disciplined approach to investing our shareholders' assets," the company said.

McCracken believes the Smithfield, Va.-based company will make a counteroffer by Tuesday.

"Smithfield wants to buy IBP. I think he's [Smithfield Chairman Joseph Luter III] probably going to wind up with the asset," McCracken said. "He's willing to sell off the pork operation. You're really talking about a doable deal in my view, despite the fact that everybody hates concentration in the agricultural sector."

If completed, the transaction would mark the first major acquisition for Tyson since it purchased the troubled Hudson Foods meatpacking operation in 1998. Since that time Tyson has primarily been selling off operations, including its turkey processor Willow Brook Foods and its seafood business.

Tyson's (TSN: Research, Estimates) shares fell $1.25, or nearly 9 percent, to $12.75 in late-afternoon trading Monday, while IBP shares (IBP: Research, Estimates) rose $2.06, or 9 percent, to $24.81.

Smithfield (SFD: Research, Estimates) shares rose 77 cents to $29.433 Monday.

|

|

|

|

|

|

|