|

Europe rides Wall St. gain

|

|

December 5, 2000: 1:14 p.m. ET

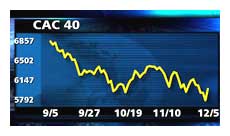

Dax, CAC rise 3% as Wall Street gets Greenspan lift, presidential picture clears

|

LONDON (CNNfn) - The wind returned to Europe's market sails Tuesday, with technology and telecom stocks rallying behind a bounce on Wall Street amid prospects for a speedy end to the U.S. presidential election saga and hints by the leading U.S. central banker that interest rates there could fall soon.

Bourses spiked upward after U.S. Federal Reserve Chairman Alan Greenspan said the U.S. central bank is starting to see signs of slower growth in the U.S. economy, which may signal an end to the era of rising interest rates. Top European markets already were up earlier in the day after a U.S. Supreme Court decision appeared to support George W. Bush's presidential ambitions, and cooling the market's uncertainty.

"It's the U.S. presidential situation ... markets don't like uncertainty," said Ben Funnell, an equity market strategist with Morgan Stanley Dean Witter, before the comments from Greenspan. "It's notable that the Nasdaq fell 15 percent in the first several days after the U.S. election."

In Paris, the blue chip CAC 40 index closed up 203.38 points, or 3.5 percent, to 5,994.89, as telecom equipment maker Alcatel (PCGE), one of the Paris's most highly valued firms, rocketed up 10.4 percent.

London's benchmark FTSE 100 index closed up 140.3 points, or 2.3 percent, at 6,299. Baltimore Technologies (BLM), a provider of Internet security software, rose 16.4 percent, leading a list of a half-dozen technology, media and telecom stocks that racked up a double-digit gain in percentage terms.

As other leading bourses closed, Frankfurt's electronically traded Xetra Dax was up 228.99 points, or 3.57 percent, to 6,637.09, led by chip maker Infineon Technologies (FIFX), which rose 10.4 percent.

Amsterdam's AEX index and Milan's MIB30 each gained 1.9 percent, while the SMI in Zurich rose 1.8 percent.

Helsinki's HEX General blasted up 7.4 percent, as Nokia rallied 9.6 percent after the world's biggest maker of mobile phone handsets said it expects the number of people owning a cellular handset to reach one billion in the first half of 2002 -- six months earlier than it previously predicted.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

The pan-European FTSE Eurotop 300, a broader index of the region's largest stocks, climbed 2.8 percent. The information technology hardware sub-index rose 9.3 percent and the computer software and service sub-index rose 8.1 percent.

As the European markets closed, the Nasdaq composite was up 7.4 percent and the Dow Jones industrial average was up 268.47 points, or 2.5 percent, to 10,828.57.

As the European markets closed, the Nasdaq composite was up 7.4 percent and the Dow Jones industrial average was up 268.47 points, or 2.5 percent, to 10,828.57.

In the currency market, the euro fell to 88 U.S. cents from 88.64 cents in late U.S. trade Monday.

click here for the biggest movers on the techMARK 100 in London click here for the biggest movers on the techMARK 100 in London

click here for the biggest movers on the Neuer Market in Frankfurt click here for the biggest movers on the Neuer Market in Frankfurt

click here for the biggest movers on the Nouveau Marché in Paris click here for the biggest movers on the Nouveau Marché in Paris

Among European technology stocks, Franco-Italian chipmaker STMicroelectronics (PSTM) climbed 10.2 percent and Epcos (FEPC), a German maker of electronic components, rose 5.6 percent. German software maker SAP (FSAP) rallied 8.9 percent and Siemens (FSIE3), an engineering powerhouse, rose 6.3 percent.

In London, fiber-optic equipment company Bookham Technology (BHM) rose 11.5 percent, broadcaster Granada Media (GME) jumped 12.5 percent, and business telecom services provider Colt Telecom (CLT) added 10.4 percent.

Information technology consulting firms that got battered after last month's profit warning by Sema Group staged a comeback. Sema (SEM) rose 6.3 percent, U.K. rival Logica (LOG) advanced 12.4 percent, and Cap Gemini (PCAP) climbed 6.7 percent in Paris.

In the telecom sector, FTSE heavyweight Vodafone (VOD), the world's most valuable mobile phone company, rose 2.6 percent, while France Telecom (PFTE) rose 4.6 percent and its rival Bouygues (PEN), a construction and telecom firm, rose 6.7 percent.

In Milan, telecom company Olivetti rose 4.5 percent, but rival Tiscali tumbled as much as 8 percent as takeover traders sold the stock ahead of the closing date for its purchase of World Online, expected Wednesday. The Dutch ISP's shares closed unchanged in Amsterdam.

Cable firm drops Excite deal

United Pan Europe Communications sank 13.7 percent. The Dutch broadband cable company said it and ExciteAtHome (ATHM: Research, Estimates) failed to agree terms to form a joint venture that would have been the largest cable-based Internet service provider outside the United States.

British television broadcaster Carlton Communications (CCM) rose 3.4 percent in London. The company said it was close to selling the half of the company that handles film imaging and processing, as it posted annual pretax profit toward the top end of the range of analysts' forecasts.

Several British banks had a rough ride. Retail bank Lloyds TSB (LLOY) shed 3.5 percent. After the close of trading, U.K. mortgage lender Abbey National (ANL), which has been in merger discussions with Bank of Scotland, said it was mulling a letter from Lloyds proposing a "combination" of the companies. Abbey rose 1 percent as Bank of Scotland fell 0.8 percent.

Standard Chartered (STAN) shed 0.7 percent, paring earlier losses after investment bank Cazenove cut its forecast for the bank's earnings per share next year to 60.6 pence from 64.7 pence, below the market forecasts.

Elsewhere in the sector, Barclays (BARC) fell 2.6 percent.

German banks fared better. Deutsche Bank (FDBK) rallied 5.9 percent while rival Dresdner Bank (FDRB) tacked on 5.6 percent.

Also taking heavy blows was brewer Scottish & Newcastle (SCTN), falling 7.3 percent and possibly jeopardizing its chance of being included in the FTSE 100 index, which was set to be recalibrated after the end of trading Tuesday. Despite an 8 percent rise in half-year profit, investors fretted over a U.K. beer market that was down 3.6 percent, the effect of British floods on its beer and pubs business, and no early sale of its smaller pubs.

Falling in sympathy, rival Bass (BASS) was the top FTSE 100 loser, down 4.3 percent. Chocolate and soft drinks producer Cadbury Schweppes (CBRY) fell 3.4 percent.

-- from staff and wire reports

|

|

|

|

|

|

|