|

Gillette cuts jobs, warns

|

|

December 18, 2000: 4:20 p.m. ET

Personal grooming products maker to take 4Q charge; issues 1Q, 4Q warning

|

NEW YORK (CNNfn) - Gillette Co. warned Monday that it will take a fourth-quarter charge and slash its work force by 8 percent as part of a restructuring plan, its second in two years, aimed at rejuvenating lackluster earnings. It also cautioned that its profits for the fourth and first quarters won't meet Wall Street forecasts.

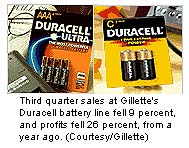

The maker of the Mach 3 shaver, Oral-B toothbrushes, Right Guard deodorant and Duracell batteries said it will take a fourth-quarter after-tax charge of $572 million, or 40 cents a share. It also said it will cut 2,700 jobs, including management positions, and close eight factories and 13 distribution centers.

In a conference call Monday, the company said it expects to earn between 18 cents and 21 cents a share in the first quarter of 2001, below the current 26-cent-a-share average forecast of analysts polled by First Call. All the same, the company refused to characterize the first-quarter guidance as a warning since it had not offered any previous guidance about its profit potential. In a conference call Monday, the company said it expects to earn between 18 cents and 21 cents a share in the first quarter of 2001, below the current 26-cent-a-share average forecast of analysts polled by First Call. All the same, the company refused to characterize the first-quarter guidance as a warning since it had not offered any previous guidance about its profit potential.

"Clearly, they've been struggling to get earnings-per-share growth, and we shouldn't be that surprised by this move," said Sally Dessloch, a consumer products analyst with J.P. Morgan.

The restructuring, to be completed over the next 12 months, comes in the wake of disappointing third-quarter earnings and the ousting of former chief executive Michael Hawley. The company's board, led by billionaire investor Warren Buffett, in October named Edward DeGraan as Gillette's acting CEO. Buffett's Berkshire Hathaway owns about 9 percent of Gillette stock.

Grappling with slowing demand

It also comes as consumer products companies such as Procter & Gamble Co. (PG: Research, Estimates) and Colgate-Palmolive Co. (CL: Research, Estimates) grapple with a slowing world economy, where an already-strong global presence and a lack of new in-demand products has made it increasingly difficult to maintain the 10- to 15-percent profit growth that investors have come to expect. Unfavorable exchange rates have also put a dent in many of those companies' bottom lines.

"It is a much more difficult global environment for companies like Gillette," said Bill Steele, an analyst with Banc of America Securities in San Francisco. "With more than 200 markets worldwide, there are no real places to pick up volume, particularly with no new products. "It is a much more difficult global environment for companies like Gillette," said Bill Steele, an analyst with Banc of America Securities in San Francisco. "With more than 200 markets worldwide, there are no real places to pick up volume, particularly with no new products.

"I think the company clearly has had a tough time driving their top-line growth, and I think they are cutting costs now in anticipation of boosting their market share." Steele has a "market performer" rating on the company's stock, and expects it to trade near its current range of $34 during the next 12 months.

Gillette said it expects sales to gain between 4 percent and 6 percent in 2001, with earnings per share gaining between 8 percent and 10 percent.

Gillette has been posting disappointing results all year amid currency-exchange woes and restructuring moves. On Sept. 18, Gillette warned that lower sales from the weak euro would cause a 6 percent revenue drop in the third quarter. A lower euro hurts multinational companies when they have to translate sales in Europe back into dollars.

Flat 4Q earnings expected

For the current quarter, Gillette said it now expects earnings to be "flat to slightly up" from the year-earlier quarter with earnings of 32 cents a share. Analysts polled by First Call had expected the company to post fourth-quarter earnings of 34 cents a share.

Gillette also said it will post full-year 2000 earnings of $1.17 to $1.18 a share, a penny shy of the current $1.19 a share forecast. The company earned $1.14 a share for the full year 1999.

"These actions will significantly improve the company's operating efficiency, streamline the supply chain and further decrease our costs," DeGraan said. "This is about restoring investor confidence. Though I see many strengths, I also recognize that we have not exercised against these strengths as well as we could. This is a plan designed to accelerate earnings growth."

Gillette said the restructuring is expected to cost approximately $250 million on a pretax basis in order to generate savings of more than $125 million annually. The company did not disclose what divisions the job cuts will take place in, or which factories and distribution centers will be shuttered.

The restructuring is Gillette's second in a little more than two years. In September 1998, the company said it was cutting 4,700 jobs, or 11 percent of its work force, and taking a $350 million charge.

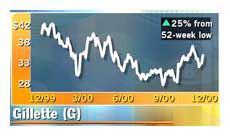

Shares of Gillette (G: Research, Estimates) rose $1 Monday to $34.81 on the New York Stock Exchange.

|

|

|

|

|

|

Gillette

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|