NEW YORK (CNNfn) - The Nasdaq composite index plunged to its lowest level in 20 months Wednesday after a flurry of analyst downgrades and corporate results warnings propelled U.S. technology stocks sharply lower.

Renewed concern erupted about corporate profit growth after the Federal Reserve's decision to leave interest rates unchanged at its policy-making meeting Tuesday. The Fed's decision did little to inspire investor confidence, despite moving to an easing bias.

The Nasdaq composite index fell for the seventh straight session, losing more than 7 percent to levels last seen in April 1999. The index is now down more than 42 percent from the start of the year, setting itself up for its worst year ever. The Nasdaq composite index fell for the seventh straight session, losing more than 7 percent to levels last seen in April 1999. The index is now down more than 42 percent from the start of the year, setting itself up for its worst year ever.

"We continue to go down in full force and technology stocks are one total disaster," said Peter Cardillo, director of research at Westfalia Investments. "Fear of pockets of recession continue to grow in the market and, while disappointment over the Fed didn't help, that's just an excuse [to sell]."

The Nasdaq fell 178.93 points to 2,332.78, hitting its lowest close for the year. The Dow Jones industrial average tumbled 265.44, or more than 2 percent, to 10,318.93, while the S&P 500 slid 40.86, more than 3 percent, to 1,264.74. The Nasdaq fell 178.93 points to 2,332.78, hitting its lowest close for the year. The Dow Jones industrial average tumbled 265.44, or more than 2 percent, to 10,318.93, while the S&P 500 slid 40.86, more than 3 percent, to 1,264.74.

Investors keep looking for signs that it's safe to step back into the water but fear and a lack of positive news is keeping cash on the sidelines.

"I think it's still emotional and we've seen a manic depressive market," Phil Dow, stock market strategist with Dain Rauscher Wessels, told CNNfn's Street Sweep. "It has very little to do with the economy and my guess is it will wash out at some point – I think we're getting close here."

But the negative sentiment is leaving little room for any significant recovery with only six trading days left in the year.

"The sentiment is very negative and it's exactly the mirror image of this time last year when people couldn't buy enough tech and telecom," Jeff Davis, chief investment strategist with State Street Global Advisors, told CNNfn's In the Money. In December 1999, the Nasdaq was trading more than 1,300 points higher than current levels.

Market breadth was negative on heavy volume with the Nasdaq setting its second heaviest trading day ever with losers outpacing winners 3,300 to 824, as more than 2.82 billion shares changed hands. Decliners beat advancers on the New York Stock Exchange 1,945 to 999, as more than 1.42 billion shares were traded.

In other markets, U.S. Treasury securities edged higher. The dollar fell against the euro but strengthened versus the yen.

Techs trample Wall Street

Skittish investors lost further confidence in the severely eroded technology sector after Merrill Lynch issued a slew of downgrades and two tech firms said results would fall short of expectations.

"The public is in a semi-shocked state and cash remains on the sidelines on Wall Street despite everything being on sale," said Alan Ackerman, senior vice president with Fahnestock & Co. "The main downside pressure seems to be continued earnings disappointments in the tech sector and we had downgrades today that were troublesome."

Brian Finnerty, head of Nasdaq trading at C.E. Unterberg Towbin, told CNNfn's market coverage that even large institutions were opting to keep their cash on the sidelines. (351 WAV) (351 AIFF)

| |

UP-TO-DATE ANALYST CALLS UP-TO-DATE ANALYST CALLS

|

|

| |

|

Click below to see the latest analyst ratings

Street Talk

|

|

|

Cisco Systems (CSCO: Research, Estimates) tumbled to a new 52-week low, losing $5.25 to $36.50, after Merrill Lynch cut its rating to "accumulate" from "buy." IBM (IBM: Research, Estimates) fell $4.13 to $86 and Hewlett-Packard (HWP: Research, Estimates) shed 88 cents to $30.44 after Merrill downgraded both firms to "neutral" from "short-term accumulate."

Foundry Networks (FDRY: Research, Estimates) also weighed on the Nasdaq, plunging $17.63 to $13 after it warned its fourth-quarter results would fall short of expectations.

Jabil Circuit (JBL: Research, Estimates), a leading contract electronics manufacturer, tumbled $6.81 to $21, blaming parts shortages for first-quarter 2001 earnings that failed to meet Wall Street expectations, and lowered its forecasts for fiscal year 2001 due to slowing demand for personal computers.

| |

WEDNESDAY'S MOVERS AND SHAKERS WEDNESDAY'S MOVERS AND SHAKERS

|

|

| |

|

Click below to see how other active stocks are faring

Hot Stocks

|

|

|

AT&T (T: Research, Estimates) slipped $1.63 to $18.94 after its board was expected to slash the company's dividend as much as 77 percent when it meets Wednesday, the first reduction in the payout to shareholders in the telephone company's history, according to the Wall Street Journal's interactive edition.

The pain spread into all technology sectors. Microsoft (MSFT: Research, Estimates) fell for a fourth day and hit a two-year low, losing $3.31 to $41.50, Oracle (ORCL: Research, Estimates) shed $2.13 to $28.50, and Dell (DELL: Research, Estimates) fell $1.63 to $16.63.

Warnings from sectors outside technology managed to stave off the brunt of the selling, largely due to the fact that these companies at least met expectations, despite some negative guidance.

FedEx Corp. (FDX: Research, Estimates) slid 50 cents to $37.25 after reporting a profit of 67 cents a share for its second quarter, meeting Wall Street forecasts, and rising from the 57 cents earned in the year-earlier period. The results came in less than a week after the package delivery company warned about results in the second half of its fiscal year. FedEx Corp. (FDX: Research, Estimates) slid 50 cents to $37.25 after reporting a profit of 67 cents a share for its second quarter, meeting Wall Street forecasts, and rising from the 57 cents earned in the year-earlier period. The results came in less than a week after the package delivery company warned about results in the second half of its fiscal year.

Nike (NKE: Research, Estimates), the world's largest seller of athletic footwear and apparel, rose $1.56 to $49.13 after it met second-quarter estimates, but warned that continued sluggishness in the U.S. footwear business combined with weak overseas currencies would hurt third-quarter earnings.

Failure to cut rate sours mood

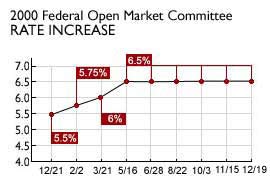

Investors had hoped that the Federal Reserve might move so far as to cut rates when its policy-making arm, the Federal Open Market Committee, met Tuesday, but the FOMC left the central bank's target for overnight loans between banks at 6.5 percent.

"Clearly, confidence is being impacted by the fact that many feel the Fed has strangled the economy and inflation remains low," said Fahnestock's Ackerman. "[Fed Chairman Alan] Greenspan will be in office until 2004 and, at the moment, he seems to be the man who makes or breaks the market based upon the Fed's policy." "Clearly, confidence is being impacted by the fact that many feel the Fed has strangled the economy and inflation remains low," said Fahnestock's Ackerman. "[Fed Chairman Alan] Greenspan will be in office until 2004 and, at the moment, he seems to be the man who makes or breaks the market based upon the Fed's policy."

At the same time, the Fed's statement acknowledged that the cooling U.S. economy has hurt corporate profitability, consumer confidence and even the stock market. In its so-called policy bias, or inclination, the central bank changed to an "easing bias" from a "tightening bias."

This opens the door for a possible rate cut early in 2001.

"The drag on demand and profits from rising energy costs, as well as eroding consumer confidence, reports of substantial shortfalls in sales and earnings, and stress in some segments of the financial markets suggest that economic growth may be slowing further," the central bank said. Unlike past statements, the bank made no mention of tight labor markets and downplayed any risk of inflation. Still, the Fed decided to wait before lowering the costs of borrowing, which aims to spur growth. "The drag on demand and profits from rising energy costs, as well as eroding consumer confidence, reports of substantial shortfalls in sales and earnings, and stress in some segments of the financial markets suggest that economic growth may be slowing further," the central bank said. Unlike past statements, the bank made no mention of tight labor markets and downplayed any risk of inflation. Still, the Fed decided to wait before lowering the costs of borrowing, which aims to spur growth.

"The market just fell apart. It seemed like the buyers just walked away; now we've got more uncertainty about what the Fed is going to do," Michael Murphy, head of equity trading at First Union Securities, told CNNfn's market coverage. "Technology is the name of the game. It continues to underperform. The Nasdaq has just been decimated and sentiment is very, very negative."

In Wednesday's economic data, starts on new homes and apartments jumped last month in the United States as mortgage rates fell, according to the Commerce Department. Housing starts rose 2.2 percent to an annual rate of 1.56 million, above Wall Street forecasts, after falling 0.6 percent in October.

|