|

Northrop in $3.8B buy

|

|

December 21, 2000: 7:31 p.m. ET

Defense company purchases U.S. naval ship supplier Litton for $80 per share

|

NEW YORK (CNNfn) - Northrop Grumman Corp. agreed Thursday to acquire Litton Industries Inc., the No. 1 builder of non-nuclear ships for the U.S. Navy, for $3.8 billion in cash, a move that will solidify Northrop's place among the world's leading defense companies.

The transaction, announced after the financial markets closed, significantly enhances Northrop's ties with the U.S. Navy, where it will now serve as a primary contractor and systems integrator of surface ships. It also allows the Los Angeles-based company to broaden its portfolio to include the production of navigation and guidance systems for airborne platforms and other military avionics systems.

"Today's acquisition creates a $15 billion top tier defense company with 79,000 employees," said Northrop Grumman's CEO Kent Kresa in a conference call open to analysts. "Northrop has had a fantastic 2000. These are two companies with a rich history and a wealth of talent." "Today's acquisition creates a $15 billion top tier defense company with 79,000 employees," said Northrop Grumman's CEO Kent Kresa in a conference call open to analysts. "Northrop has had a fantastic 2000. These are two companies with a rich history and a wealth of talent."

Terms of the agreement call for Northrop to pay $80 in cash for each outstanding Litton Class A share, a 28 percent premium above Litton's closing price of $62.62 Thursday. Northrop also agreed to pay $35 for each Class B share. Northrop will also assume approximately $1.3 billion in Litton debt.

Credit Suisse First Boston and The Chase Manhattan Bank agreed to provide $6 billion in financing to Northrop Grumman to complete the transaction.

Litton will be operated as a wholly owned subsidiary of Northrop. Michael Brown, Litton's CEO, plans to retire and will be replaced by Ronald Sugar, Litton's current chief operating officer. Sugar has also been nominated to serve on Northrop's board of directors following the close of the deal.

"We expect revenue to grow to $18 billion by 2003," Kresa said on the conference call.

Northrop expects the Litton purchase to close in first quarter of 2001 and will be subject to regulatory review in the U.S. The transaction could also come under scrutiny in Europe, Northrop executives said on the call.

Add to EPS

Northrop said the transaction will have no impact on GAAP (Generally Accepted Accounting Principle) earnings per share, which are typically tracked by Wall Street, next year, but will account for double-digit gains in GAAP earnings in 2002 and beyond.

The acquisition will add to Northrop's 2001 earnings excluding pension income and amortization by 7-to-10 percent, before contributing to double-digit earnings growth in 2002.

The company also expects to realize $250 million in cost savings over the next few years as a result of the transaction, including $100 million in savings in the first year after the transaction is closed. It is expected to close during the first quarter of next year.

To help fund the transaction, Northrop said it intends to raise additional capital through a secondary stock offering after the close of the transaction. Northrop used the same method, a cash tender offer followed by a secondary offering, when it bought the former Westinghouse. Northrop declined to give further details on the size of the offering.

Northrop executives expressed confidence that the purchase will pass regulatory scrutiny by the first quarter and does not expect the change in Presidential administrations to hamper the deal.

"We will file all necessary paperwork shortly after the holiday," executives on the call said. "Obviously there will be a transition in January that will create new things. But many people working there will be the same."

Divestiture?

The merger comes amidst an ongoing effort at Litton (LIT: Research, Estimates) to gradually divest itself of several non-core businesses.

Just last month, the Woodland Hills, Calif.-based company unveiled plans to sell its $1.6 billion Advanced Electronics Group to focus more closely on its higher-growth telecommunications, wireless and shipbuilding businesses.

Northrop executives downplayed any plans for divestiture.

"All our [businesses] have great value. Right now everything is part of Northrop Grumman," executives said.

The purchase vaults Northrop to fifth place among defense contractors, said analyst Thomas Meagher, of BB&T Capital Market. Before the transaction, Litton ranked as the 11th largest defense contractor, with $3 billion in 1999 revenue, while Northrop was seventh.

The combined Northrop/Litton firm will have more than $9 billion in defense contracting revenue, pushing the combined firm ahead of General Dynamics which has nearly $9 billion in revenue. The combined Northrop/Litton firm will have more than $9 billion in defense contracting revenue, pushing the combined firm ahead of General Dynamics which has nearly $9 billion in revenue.

"Mass is becoming critically important in the defense marketplace," Meagher said.

However, Northrop still trails the four major players – Lockheed Martin, Boeing, BAE Systems and Raytheon -- in the defense market, he said.

Northrop also gains a shipbuilding presence, where it had nothing before, and electronics components unit, Meagher said. The only overlap could occur in its defense electronics services unit.

"This is good for Northrop because it gets them into a new business such as ship building where Litton was a dominant player, " Meagher said. "This is an excellent deal for Litton shareholders."

Litton posted revenue of $5.6 billion during its latest fiscal year ended July 31 and employs more than 40,000 people worldwide.

Salomon Smith Barney principally advised Northrop Grumman while Merrill Lynch & Co. advised Litton.

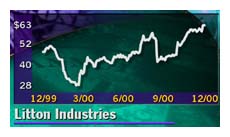

Litton shares closed Thursday up 94 cents to $62.64, but soared $14.13 to $76.87 in after-hours trading. Northrop (NOC: Research, Estimates) shed 19 cents to $81.94 Thursday and was held for trading in the after-market at 5:55 p.m.

|

|

|

|

|

|

Litton Industries

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|