|

No. 1 bank defends loans

|

|

January 5, 2001: 1:44 p.m. ET

Bank of America says it has incurred no significant trading activity losses

|

NEW YORK (CNNfn) - Shares of Bank of America Corp., the nation's largest bank, on Friday tumbled even as the company refuted market speculation that it has experienced significant losses from bad loans or other trading activities.

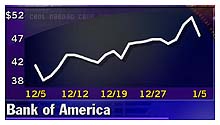

Bank of America (BAC: Research, Estimates) shares fell more than 7 percent in heavier-than-usual trade on Friday, sliding $3.75 to $47.75. Other stocks in the financial sector were also weak, amid a strong sell-off in blue chip stocks.

Other banks with possible utility loan exposure also fell with J.P. Morgan Chase (JPM: Research, Estimates) off $3.06 to $48.94 and Citigroup (C: Research, Estimates) down $2 to $53.69.

The Charlotte, N.C.-based Bank of America's defiant comment comes amid rumors that troubled California utilities had drawn down a line of credit. The Charlotte, N.C.-based Bank of America's defiant comment comes amid rumors that troubled California utilities had drawn down a line of credit.

In a four-sentence statement, the Charlotte, N.C.-based bank said it knew "of no basis to support speculative rumors about our operations. We are conducting business as usual. The company has not experienced any significant losses in derivatives or other trading activities."

Moreover, it said it remains comfortable with its 2001 credit quality guidance provided to investors last month.

Speculation swirled on Friday that one of the largest California utilities had drawn down a line of credit at Bank of America, the parent of the country's largest bank, and that the bank had large losses in derivatives trading.

A Bank of America spokesman said it was against the bank's policy to comment on customer relationships.

"There were a bunch of rumors," Lawrence Cohn, an analyst at Ryan Beck & Co., said. "One was that the bank had a lot of exposure, unspecified, to the California utility industry. The other one had to do with some kind of exposure to credits in Europe on the derivative side. As soon as I heard it, I thought it sounded like someone who was short and needed to cover and didn't want to get hurt. It was so weird and vague."

Jitters about California utilities

Wall Street is jittery about U.S. banks' exposure to two California utilities -- Pacific Gas and Electric, a unit of PG&E Corp, and Southern California Edison, part of Edison International -- which are in financial crisis because they may not have enough cash to continue operations.

Standard & Poor's, Moody's, and Fitch Inc., all major credit rating agencies, expressed disappointment with emergency rate increases ranging from 7 percent to 15 percent by downgrading PG&E Corp. and Edison International on Thursday.

California's state Public Utilities Commission, which issued a unanimous vote for the rate hikes, also urged the state legislature to consider some form of state backing of new bonds issued by the utilities.

The companies are the corporate parents of San Francisco-based Pacific Gas and Electric Co. (PCG: Research, Estimates) and Rosemead, Calif.-based Southern California Edison (EIX: Research, Estimates).

Bank of America warned last month that it would miss analysts' fourth-quarter earnings expectations by a wide margin because of $1.2 billion in bad loans, as well as lower trading and investment banking fees. The warning triggered fears of an industry-wide slowdown in profitability.

|

|

|

|

|

|

|