|

BT: We blew $14bn

|

|

February 19, 2001: 10:03 a.m. ET

BT boss admits the firm overspent hugely on new cellular permits

|

LONDON (CNN) - British Telecom admitted it squandered £10 billion ($14 billion) in acquiring third-generation mobile phone licences.

Peter Bonfield, BT's chief executive, said the firm had spent more than it should have on new mobile phone licences, which give it the right to broadcast video, data and web services to cellular handsets.

A BT official confirmed Bonfield's comments, first made to the Sunday Times. "BT paid £10 billion more than it should have... especially in auctions in the UK and Germany," spokesman David Orr told CNN.com on Monday. A BT official confirmed Bonfield's comments, first made to the Sunday Times. "BT paid £10 billion more than it should have... especially in auctions in the UK and Germany," spokesman David Orr told CNN.com on Monday.

"That spending had a huge impact on the industry," landing BT with "debts of £30 billion," Orr added. The British and German auctions raised some $78 billion from the sale of permits, money which should have been spent developing services, BT said.

BT paid £5.1 billion to acquire a permit in Germany and about £4.5 billion in the UK. The company also spent another $6 billion on increasing its stake in German mobile phone operator Viag Interkom to 90 percent.

The auctions in Britain and Germany generated enormous excitement, but subsequent sell-offs haven't been anywhere near as successful, with telecom companies baulking at the huge cost of acquiring licences.

Auctions in France, Italy and Switzerland virtually collapsed, as investors took a dim view of the cash being poured into the business. Operators hope the new technology will open up new revenue streams, although some experts have expressed doubts they will be able to recoup the cost of their substantial outlay.

Europe's telecom companies have taken on heavy debt – about  128 billion, according to some estimates -- and seen credit weightings come under pressure in their attempt to build a European foothold. 128 billion, according to some estimates -- and seen credit weightings come under pressure in their attempt to build a European foothold.

Paul Mount, an analyst at Nomura, told CNN.com: "BT would have been damned if it did (buy 3G licences), and damned if it didn't."

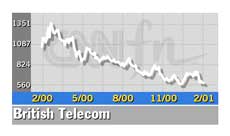

Bonfield's position is under pressure, according to several media reports of recent months. His admission of overpaying does not hide the fact he "presided over the company's stock price which has fallen from 1,600 pence to 600 pence," according to Mount.

Shares in BT (BT-A) fell 0.3 percent to 598 pence in afternoon trade on Monday. Shares in BT (BT-A) fell 0.3 percent to 598 pence in afternoon trade on Monday.

Credit rating agency Standard & Poor's said on Friday it was studying whether to downgrade the firm's debt-rating. Such a move would result in BT paying extra interest on its borrowings. The company's third-quarter earnings were blighted by a tripling of interest payments.

The company had hoped to reduce debt by floating 25 percent of its mobile phone division but BT has been forced to reconsider its options in the wake of the dismal Orange flotation.

BT's Orr said the company was not ruling out plans to demerge BT Wireless. "We're looking at an innovative non-standard way to float the company, that may involve giving existing shareholders priority in any offering. We're not ruling anything out."

Nomura's Mount said BT needs to strengthen the board of BT Wireless to prove to investors that the company means business. "BT needs to bring on a new chief executive and come up with a strategy that will help improve its position in Europe."

BT Wireless "is starting from a weak position, its mobile phone unit in Germany is the smallest and it could lose its No. 2 slot to Orange in the UK."

Mount said BT should be more radical and consider merging "with the likes of Telefonica Moviles (of Spain) and KPM Mobile (of the Netherlands)."

|

|

|

|

|

|

|