|

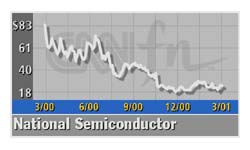

National Semi beats, warns

|

|

March 8, 2001: 2:06 p.m. ET

Chipmaker beats reduced 3Q estimate but warns about fourth-quarter results

|

NEW YORK (CNNfn) - National Semiconductor reported a fiscal third-quarter operating profit Thursday that was ahead of analysts' recently reduced expectations, but executives lowered their financial targets for the current quarter and fiscal year ending in May.

National Semi said it earned $48.9 million, or 27 cents per share, in the quarter ended Feb. 25. Analysts polled by earnings tracker First Call generally had expected the company to log a profit of 20 cents per share during the quarter.

During the same period a year earlier, National Semi (NSM: Research, Estimates) earned $99.8 million, or 51 cents per share.

Revenue fell 13.5 percent to $475.6 million, the low end of the range executives had targeted when they warned of a quarterly shortfall last month.

On Feb. 1, executives reduced their profit target to a range of 20 cents-to-22 cents per share and said they expected revenue to come in between $475 million and $480 million.

For the fourth quarter, National Semi said it now expects a sequential decline of as much as 10 percent. Analysts had expected the company's fourth-quarter sales to come in about $490.2 million, suggesting a 3 percent increase over the revenue it reported in the most recent quarter.

Gross margins also may decline around 5 percentage points, due to lower factory utilization, which may result in earnings of 3 cents-to-5 cents per share, the company said. The most recent consensus estimate of analysts was for National to earn 23 cents per share in the current quarter.

When National Semi warned of the third-quarter shortfall, executives had said the company's "turns orders," which are orders that are taken and shipped in the same quarter, were running significantly below those taken in the fiscal second quarter.

That, they said, indicated that its customers were working through a glut of inventory that had built up in the distribution channel amid weak demand for semiconductors, especially those used in mobile phones and personal computers.

National Semi said its third-quarter worldwide bookings declined 30 percent from the second quarter of fiscal 2001, and 38 percent compared with the previous year's third quarter. But after three months of sequential declines through January, the company said bookings grew in February.

Click here to check on chip stocks

"As it turns out, the February month was actually the best in an overall underwhelming quarter," Brian Halla, National Semi's president and chief executive, said in a teleconference with analysts Thursday afternoon.

In spite of the strength in bookings in February, Halla said the company is still maintaining a cautious outlook for the months ahead.

"We still believe that it is not over," he said, referring to the inventory correction which has dogged the entire semiconductor industry. "There are more corrections to go, and, quite frankly, it's too soon to call a turn."

Halla said National's goal moving forward is to maintain profitability, control costs and continue investing in targeted high growth markets.

As a result of the fourth-quarter shortfall, National Semi said it expects its total revenue for the fiscal year ending in May to "marginally exceed" the $2.14 billion in sales it logged during the previous year. Analysts generally had been expecting the company's sales this year to be about $2.22 billion in revenue for the year, suggesting an 8 percent increase from the previous year.

Shares of National Semiconductor were down 98 cents at $23.86 in afternoon trade on the New York Stock Exchange Thursday.

|

|

|

|

|

|

|