|

Agere IPO to be revised

|

|

March 19, 2001: 12:43 p.m. ET

$7 billion IPO from Lucent unit to be revised, price Thursday or next Monday

|

NEW YORK (CNNfn) - The highly anticipated $7 billion IPO from Agere Systems Inc., a unit of Lucent Technologies, will be revised again this week, underwriters on the deal said.

New terms will be announced on Wednesday and the deal could be priced as early as Thursday, but more likely next Monday, the underwriters said.

The $7 billion initial public offering could have ranked as the second largest U.S.-based IPO since AT&T Wireless Group's (AWE: Research, Estimates) $10.6 billion offering last year.

On Feb. 26, Agere revised its planned offering and said it expected to sell 500 million shares at $12-to-$14 each via Morgan Stanley Dean Witter. The microelectronics unit of Lucent Technologies (LU: Research, Estimates) expects to trade under the New York Stock Exchange symbol "AGR.A."

Press reports had speculated that Agere could slice its offering to the $8-to -$10 range, while some analysts believe the new terms could be in the $10-to-$12 price range. Press reports had speculated that Agere could slice its offering to the $8-to -$10 range, while some analysts believe the new terms could be in the $10-to-$12 price range.

Agere declined to comment on anything specific. "We can't comment on anything not already in the S-1 [filing]," a company spokeswoman said.

Allentown, Pa.-based Agere makes and designs optoelectronic components for communications networks and integrated circuits for computer equipment. Agere is a leader in the sales of communications semiconductors.

Agere Systems is offering 300 million shares while Morgan Stanley plans to sell 200 million. Agere initially filed with the Securities and Exchange Commission in December.

The change in Agere's IPO terms was expected by analysts. Lucent is compelled to launch the Agere IPO despite a poor broad market and will receive about 60 percent of IPO proceeds. Morgan Stanley will receive a profit from the 200 million shares it holds, analysts said, return for taking on $2 billion in Lucent debt .

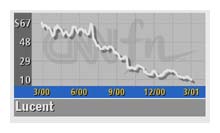

Lucent has fallen behind rivals in the key optical networking market, struggling with manufacturing constraints and declining demand for its core telephone equipment products. The company trimmed its growth outlook several times last year and in January announced plans to cut 8 percent of its work force, as well as take a charge of up to $1.6 billion.

Lucent, which some analysts estimate has about $6.5 billion in debt, is also considering selling its Atlanta-based Optical Fiber unit and the business could fetch between $8 billion and $10 billion.

Nextel International, the wireless unit of Nextel Communications, pulled its planned offering last week due to poor market conditions.

Last Friday, Kraft Foods Inc., a unit of Philip Morris Co. Inc., filed for an initial public offering that could raise $5 billion, ranking it among the top 10 of U.S.-based offerings.

The much anticipated IPO from Kraft will be co-led by Credit Suisse First Boston and Salomon Smith Barney, the company said in a filing with the Securities and Exchange Commission. The company plans to trade on the New York Stock Exchange, under the symbol "KFT."

Shares for Philip Morris (MO: Research, Estimates) dropped 77 cents to $47.38 in mid-day trading while Lucent gained $1.01 to $11.

|

|

|

|

|

|

|